/Gen%20Digital%20Inc%20logo%20on%20building-by%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Gen Digital Inc. (GEN), headquartered in Tempe, Arizona, provides cybersecurity solutions for consumers. Valued at $16.7 billion by market cap, the company offers solutions that enable consumers to protect their devices, online privacy, identity, and home networks. The multinational software company is expected to announce its fiscal second-quarter earnings for 2026 after the market closes on Thursday, Nov. 6.

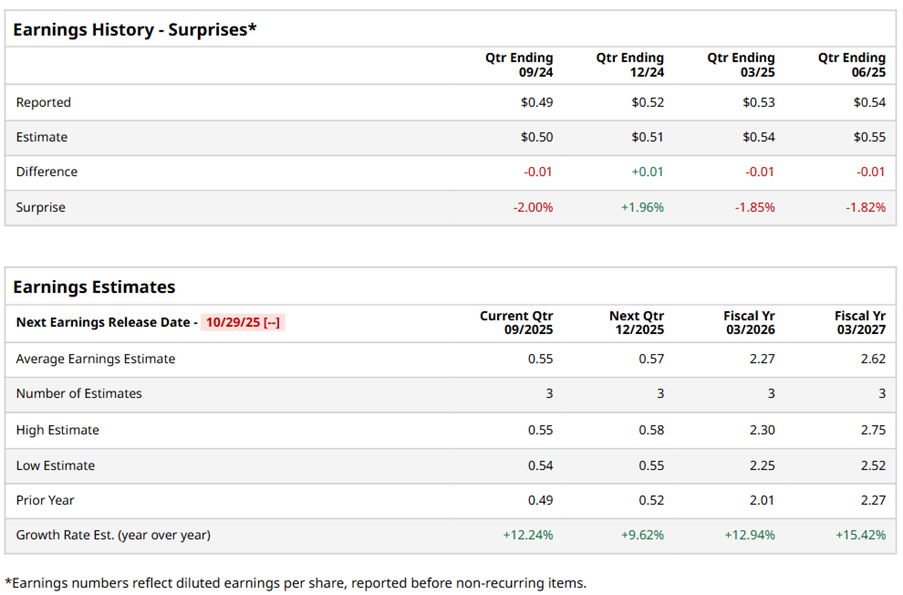

Ahead of the event, analysts expect GEN to report a profit of $0.55 per share on a diluted basis, up 12.2% from $0.49 per share in the year-ago quarter. The company missed the consensus estimates in three of the last four quarters while surpassing the forecast on another occasion.

For the full year, analysts expect GEN to report EPS of $2.27, up 12.9% from $2.01 in fiscal 2025. Its EPS is expected to rise 15.4% year over year to $2.62 in fiscal 2027.

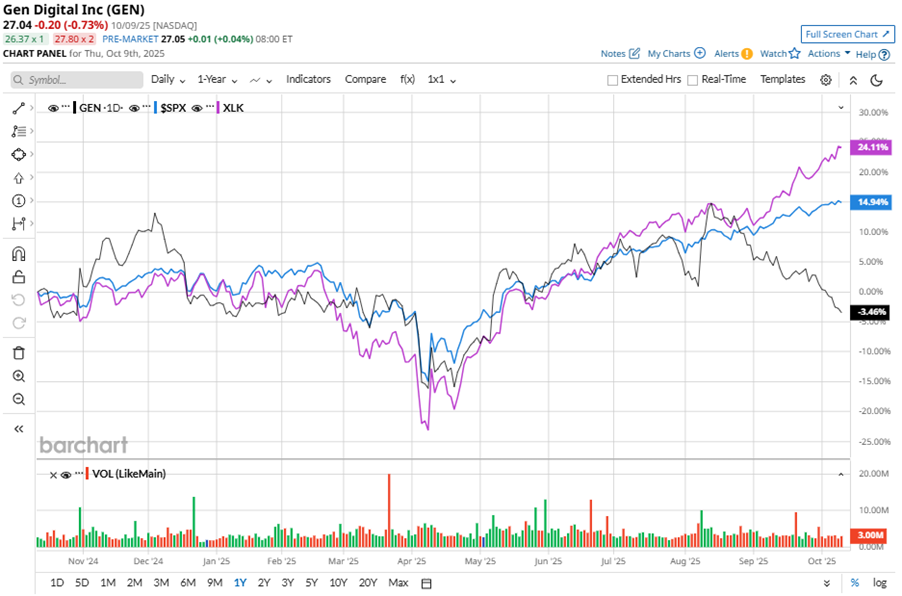

GEN stock has underperformed the S&P 500 Index’s ($SPX) 16.3% gains over the past 52 weeks, with shares down 2% during this period. Similarly, it underperformed the Technology Select Sector SPDR Fund’s (XLK) 25.9% gains over the same time frame.

GEN's strong Q1 results on Aug. 7 led to a 7.7% surge in its shares in the following trading session. Revenue jumped 30.3% year-over-year to $1.3 billion, with adjusted EPS rising 20.8% to $0.64. Growing demand for protection, trust, and financial services drove the company's growth. GEN also boosted investor confidence by raising its fiscal 2026 guidance, forecasting revenue of $4.8 billion to $4.9 billion, and adjusted EPS of $2.49 to $2.56.

Analysts’ consensus opinion on GEN stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 10 analysts covering the stock, five advise a “Strong Buy” rating, and five give a “Hold.” GEN’s average analyst price target is $35.44, indicating an ambitious potential upside of 31.1% from the current levels.