GE Vernova (GEV) is one of the top-performing stocks this year, rising 79% year-to-date and 113% over the past 12 months. The momentum in GEV stock is supported by a broader shift toward electrification. As industries and utilities accelerate investments in grid infrastructure and decarbonization solutions, GE Vernova is witnessing strong demand for its products, technology, and services.

Yet, despite the secular demand environment, GEV stock has largely plateaued over the past three months. Attention now turns to the company’s upcoming Q3 earnings report, set for Oct. 22. The results could provide the catalyst the stock needs to reignite its rally.

GE Vernova supplies the technologies and services necessary for generating, transferring, and storing electricity. As energy demand continues to rise, the company stands to benefit from increased investments in electrification and decarbonization infrastructure projects.

GE Vernova’s fundamentals look healthy heading into the report. The stock’s 14-day Relative Strength Index (RSI) sits at 43.98, comfortably below the 70 level that typically signals overbought conditions. In other words, there may still be room for the stock to climb if results beat expectations and management delivers an upbeat outlook.

Power and Electrification Segments to Lift GEV’s Q3

GE Vernova could deliver strong quarterly numbers again, powered by the ongoing momentum in its Power and Electrification segments. The company’s robust order trends and expanding backlog suggest that demand remains resilient. In the previous quarter, GE Vernova recorded $12.4 billion in new orders, equivalent to roughly 1.4 times its quarterly revenue.

The company’s backlog has continued to climb, reaching $129 billion in the second quarter, with both Power and Electrification contributing to the growth. Notably, the quality of that backlog remains solid, as equipment margins reflect higher pricing and the company’s disciplined approach to contract underwriting.

Within the Power segment, orders surged 44% in the second quarter, primarily driven by Gas Power equipment, which nearly tripled compared with the previous year. This momentum is expected to have persisted in Q3 as GE Vernova benefits from growing demand for its aeroderivative technology to support data center operations. Power Services is positioned for continued strength, particularly in Steam Power, where life extensions and upgrades for existing nuclear facilities are boosting activity. Additionally, Hydro could again see higher orders as customers invest in upgrades to enhance capacity and efficiency.

Management expects Gas Power equipment orders to continue the year-over-year climb in Q3, alongside mid-single-digit organic revenue growth supported by higher equipment deliveries and a steady increase in services activity. EBITDA margins are projected to remain healthy, driven by strong pricing, productivity gains, and higher volume.

The Electrification segment is also expected to deliver another quarter of impressive performance. With the global push to modernize and expand electrical grids, GE Vernova benefits from heightened demand for grid infrastructure and related technologies. Management anticipates significant equipment orders at attractive margins in the third quarter, with revenue projected to grow around 20% yearly. This expansion will likely be driven by continued strength in Grid Solutions, Power Conversion, and Storage. EBITDA margins are expected to improve further, exceeding second-quarter levels, supported by higher volume, strong execution, and favorable pricing dynamics.

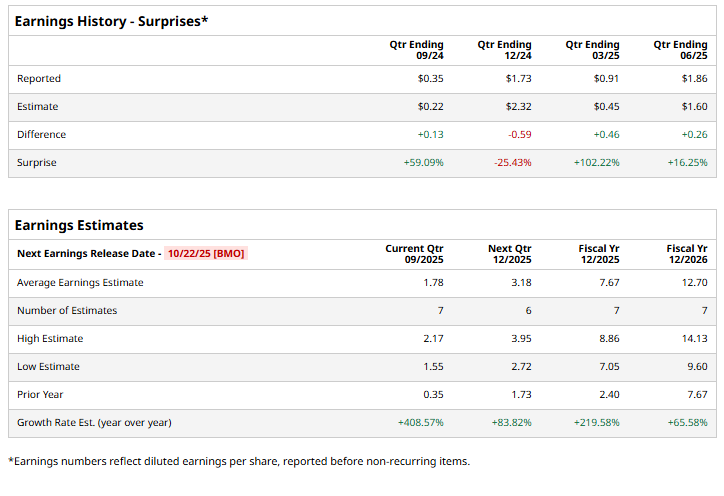

While GE Vernova’s revenue is expected to show steady year-over-year growth, analysts are optimistic about its earnings trajectory. Wall Street forecasts earnings of $1.78 per share for the third quarter, an impressive jump from $0.35 in the same period last year. Notably, GEV has beaten Wall Street’s earnings estimates in three out of the previous four quarters, including a 16.3% earnings surprise in the second quarter.

Altogether, GE Vernova’s outlook remains upbeat for Q3. As demand for reliable power generation and grid modernization accelerates worldwide, the company’s Power and Electrification segments are well-positioned to sustain growth momentum and expand margins.

Analysts’ Forecast for GE Vernova Stock Ahead of Q3

Analysts have a “Moderate Buy” consensus rating on GE Vernova stock ahead of earnings. The company continues to benefit from global electrification and decarbonization efforts. However, valuation remains a concern.

GEV stock currently trades at a forward price-earnings ratio of about 78 times, which suggests much of the company’s expected earnings growth is already reflected in the share price. While GE Vernova will benefit from secular tailwinds, its premium valuation warrants caution ahead of the Q3 earnings release.