A handful stocks have been able to outperform as the stock market remains volatile and under pressure.

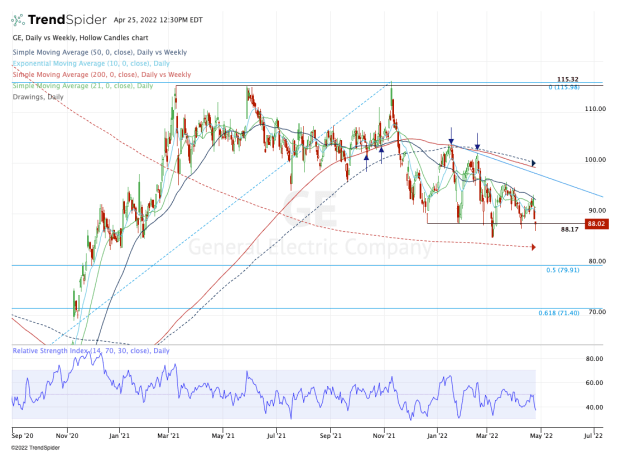

General Electric (GE) is not one of them. In fact, GE stock has been making a series of lower highs for most of 2022, even as it continues to hold support around $88.

Dating back to December, this level has been a significant support zone for the industrial giant, as the stock has been looking to make a comeback.

Under Chief Executive Larry Kulp, General Electric has been trying to turn things around. While cash flows have started to move in the right direction, his job has been anything but easy over the past few years.

Company-specific issues regarding Boeing (BA) have weighed on GE’s business, but so has the company's ability to meet resurgent demand as the pandemic has waned.

The bulls are hopeful but understandably cautious ahead of the April 26 earnings report before the opening bell. The stock has fallen in four of the past five weeks.

Can GE stock turn things around this week?

Trading GE Stock

Chart courtesy of TrendSpider.com

Looking at the charts, the $87 to $88 area is glaring. This level has temporarily failed in the past, in March and again in April.

Each time, however, it has resulted in a bounce. The problem is that those bounces keep getting weaker.

If General Electric stock has a bearish post-earnings reaction, I will be watching $85.30 and $83.50. There, the bulls find the first-quarter low, then the 200-week moving average.

If both levels fail, then we have to start looking at some potentially larger retracement levels, starting with the 50% retracement near $80. This retracement measures from the recent high in November to the March 2020 covid low.

Not long ago, in November, GE stock was trying to break out to new highs, before resistance near $115 stopped it in its tracks. It’s been downhill since, a point that can be made for many companies.

On the upside, it’s pretty simple. GE has to reclaim the 50-day moving average to see any meaningful upside traction. This measure has been active resistance for several months now.

A close above the 50-day could trigger a run to the 200-day and 50-week moving averages, which have been significant support and resistance measures for several quarters now — most recently serving as resistance.