/GE%20Aerospace%20phone%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

General Aerospace (GE) has captured market attention again as its stock recently soared to a high of $272.80, its highest price in 25 years.

The latest catalyst came when GE posted a standout second quarter, driving company-wide revenue to $11 billion, a 21% increase compared to last year. Management raised its full-year guidance, fueling renewed investor optimism as commercial aviation demand accelerates worldwide.

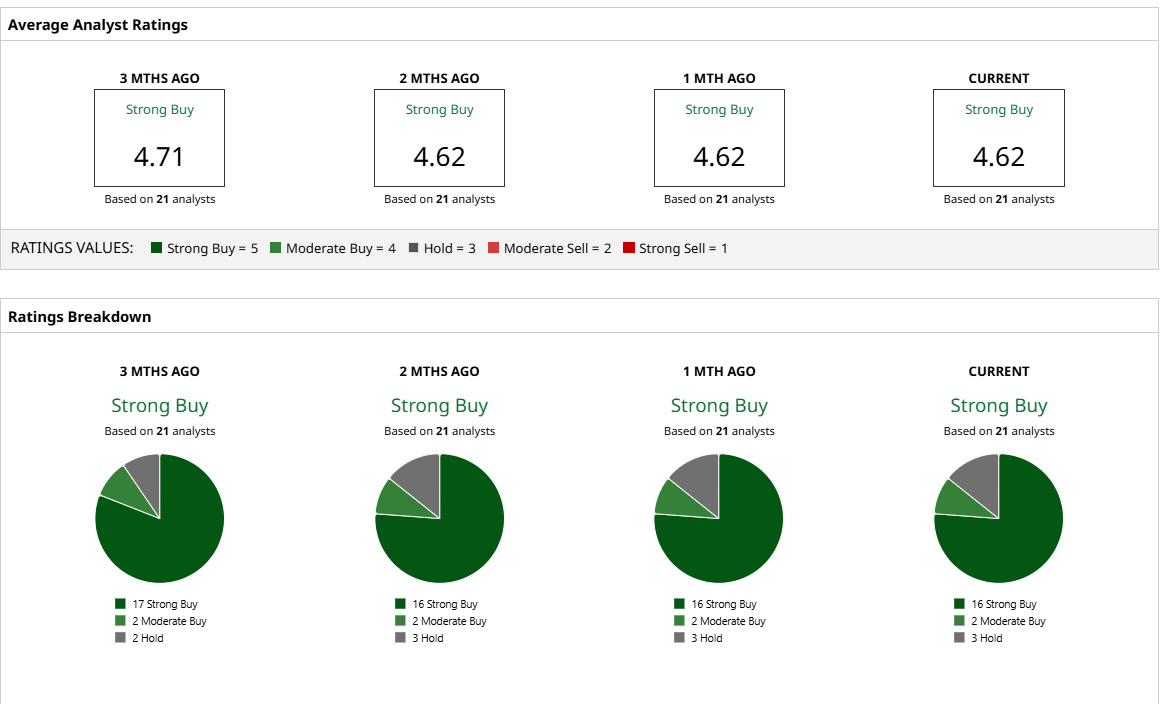

Adding to the bullish mood, analysts widely endorse GE’s trajectory, with “Strong Buy” ratings dominating. With shares cruising at record altitudes and fresh money eyeing the runway, is there more upside from here, or is turbulence ahead? Let’s find out what else GE has to offer.

GE’s Standout Financial Quarter

GE Aerospace shares are up 55.9% in the year to date and nearly 40% in just the last three months.

GE Aerospace trades at nearly 46x forward earnings, a premium valuation, highlighting how investors are willing to pay for earnings and cash flow growth.

The real story unfolds with GE’s bombshell Q2 2025 results, released July 17. Total company revenue climbed 21% to $11 billion, while adjusted revenue came in at $10.2 billion, up 23% year-over-year. Continuing EPS surged to $1.87 (+56%) and adjusted EPS hit $1.66 (+38%). Free cash flow, critical for both reinvestment and returning capital, jumped 92% to $2.1 billion.

This performance enabled management to announce a 20% hike in shareholder returns between 2024 and 2026, targeting $24 billion via dividends and buybacks, with a commitment to distribute at least 70% of free cash flow to investors beyond 2026. GE’s near-$175 billion aerospace backlog anchors this momentum, giving an unusual degree of revenue visibility for years to come.

What’s Fueling the Ascent

Airlines are leaning heavily into GE technology, as seen in Malaysia Aviation Group’s recent commitment for 60 LEAP engines to power their upcoming fleet of Boeing 737 MAX aircraft. Meanwhile, in the widebody arena, Korean Air made its move by ordering up to 30 Boeing 787-10s and 20 777-9s, specifying that all jets will run on GE’s latest GEnx and GE9X engines.

GE Aerospace is also signaling its intent to move beyond traditional markets. The company recently teamed up with Kratos Defense and Security Solutions (KTOS), to develop propulsion systems for affordable unmanned aerial vehicles, a venture that targets the fast-rising market for military drone fighters. It’s a timely pivot, tapping into growing defense budgets.

But it’s the mega-deals that are really turning heads. The company recently secured an expanded partnership with Qatar Airways, covering more than 400 engines. This order includes 60 of its flagship GE9X models and 260 GEnx units, with additional options and spares. The deal, the largest widebody engine commitment in GE Aerospace’s history, will power Qatar’s next-generation Boeing 777-9 and 787 fleets.

How Analysts View GE’s Path Forward

Looking ahead to the next earnings release, analysts expect the company to report quarterly earnings of $1.42 per share, a nearly 24% jump from $1.15 in the same period last year. For the fiscal year, consensus estimates call for EPS of $5.73, marking healthy 24.6% growth versus 2024 levels. This outlook is underpinned by robust demand and a packed order book.

GE management has also raised the bar once again, boosting guidance following its strong Q2 report. The company now targets approximately $11.5 billion in operating profit and about $8.5 billion in free cash flow by 2028, figures each $1.5 billion above its prior Investor Day forecast. That’s all in addition to mid-teens adjusted revenue growth projected for 2025.

Analyst sentiment is nearly unanimous as 16 of 21 analysts surveyed rate GE as a “Strong Buy,” which is a rare Wall Street consensus at these price levels. The mean 12-month price target sits at $258.84, below its current trading price.

Conclusion

GE Aerospace’s run to a 25-year high is well-earned, but with shares now above most analyst targets, buyers should expect the pace to cool off or see more volatility ahead. Fundamentals are solid and long-term growth looks likely, but near-term upside is limited unless earnings keep beating forecasts. At these levels, holding or waiting for a better entry point looks smarter than chasing.