General Electric (GE) stock is in a full-blown breakout right now and investors are anxious to see the gains hold up.

The breakout came over the $90 mark, which has been stiff resistance for two years. The shares at last check were up nearly 9% on the day and trading past $94, well above that mark.

Powering the move is management’s affirmation of its full-year outlook.

Ahead of the annual meeting today, GE reiterated its full-year outlook of earnings of $1.60 to $2 a share and free cash flow of $3.4 billion to $4.2 billion.

While the profit number is a bit below the consensus estimate of $1.90 a share, investors seem to be relieved by the fact that business hasn't taken a turn south.

That appears to be giving a lift to 3M (MMM) and Honeywell (HON), which at last check were trading gently in the green.

Let’s get back to that breakout in GE stock.

Trading the Breakout in GE Stock

Chart courtesy of TrendSpider.com

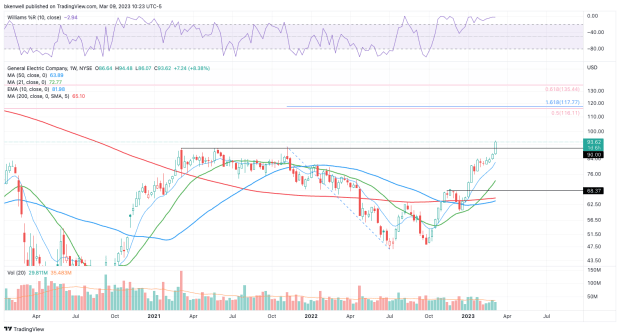

Beginning in March 2021 General Electric stock tried several times to break out over $90. Two years later we have that breakout.

For weeks — and in some cases, for months — traders have been waiting for a dip in GE stock. That dip never materialized into anything meaningful, as investors have continued to accumulate the name.

It’s not as if the bullish trend is beginning today; it’s been in play all year -- basically since the stock broke out over $68 after GE spun off its health-care unit.

Both breakouts were incredibly clean. The bulls will need to see a strong close over $90, today and this week.

If the stock can do so, the stage is set for a rally up to $100, which would be General Electric stock's highest level since January 2018.

Zooming out even more, the $116 to $118 area would be the next major upside target. There we find the 50% retracement from the 2020 low to the 2016 high. It’s also the 161.8% extension from the 2022 low to the 2021 high.

What happens if the breakout fails?

In that case, I wouldn’t consider buying the dip in GE stock until it tags the 10-week moving average.