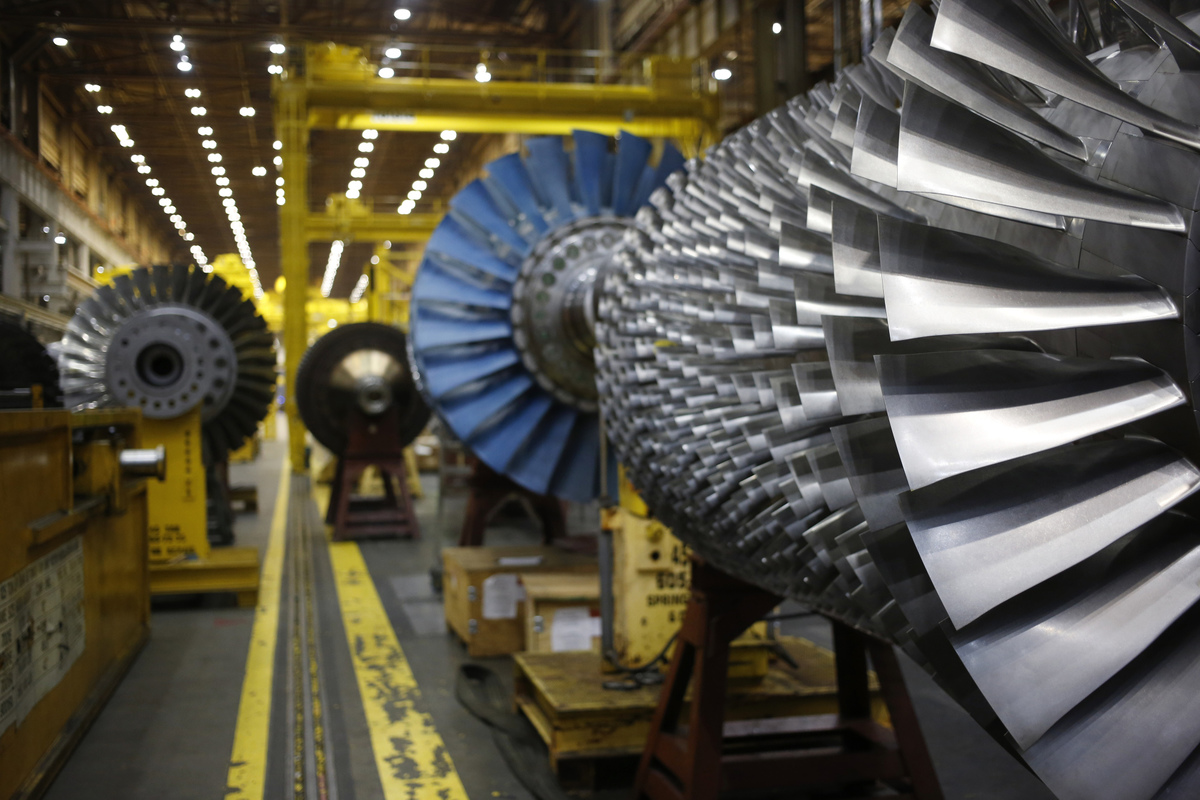

General Electric’s power unit may be facing “more serious technology issues with the new flagship product” than previously thought, with customers citing problems with H-frame turbines such as blade and other component failures, excess vibrations and delayed deliveries, JPMorgan analyst Steve Tusa wrote in a note.

- Tusa, who rates GE underweight, cites commentary from a user group event -- a forum for turbine customers to share information to improve the product’s operation and maintenance -- hosted by Exelon about a week after it reported issues with their turbine blades

- The issues pose a risk to GE’s long-term outlook as “these are engineering feats that need to be validated, typically taking time measured in years, not months, and in long-cycle technology businesses where a new product gets introduced every couple of decades, missing a cycle has long-term implications,” Tusa wrote

- Also suggests GE’s $71 billion services backlog may be a measure of exposure as opposed to the positive some bulls take it to be

- GE has 8 buys, 12 holds, 3 sells, average price target $15, according to data compiled by Bloomberg

- NOTE: Oct. 5, GE Jumps After Tying CEO’s $237 Million Pay Goal to Share Gains

To contact the reporter on this story: Courtney Dentch in New York at cdentch1@bloomberg.net

To contact the editors responsible for this story: Chris Nagi at chrisnagi@bloomberg.net, Steven Fromm

©2018 Bloomberg L.P.