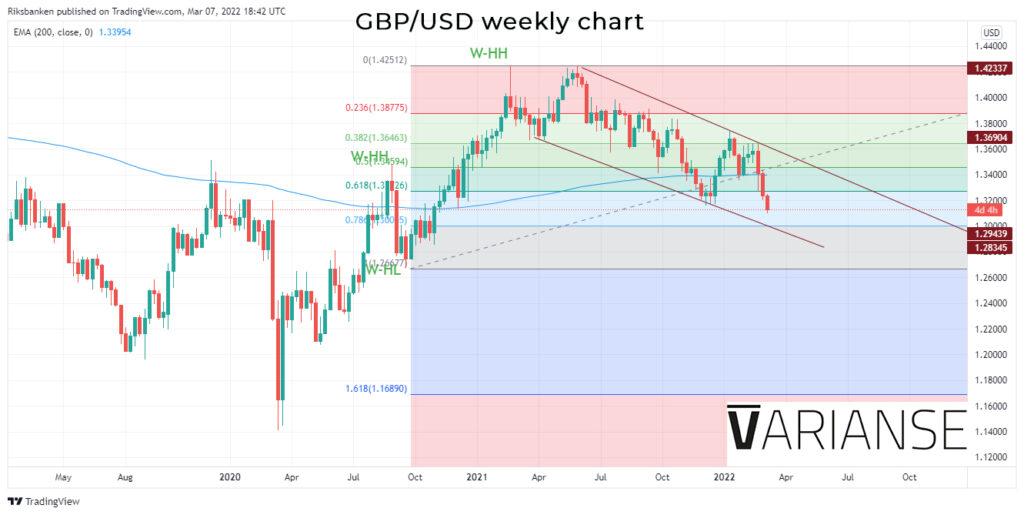

War in Ukraine led GBP/USD to sell off for a third consecutive day on Monday. The pair has dropped by c. 3.26% since the conflict in the Ukraine began on 24 September to recently trade near 1.3106. No doubt exists that price could drop even more substantially in coming days, but a key question is whether GBP/USD can withstand falling below, or potentially completely avoid the 1.30065 price region.

If it does, market confidence in GBP/USD could easily be restored as continuation of the August 2020 trend upwards would look more promising. The 1.30065 region is at the bottom of a downward flag pattern, the type associated with a bullish reversal.

Should GBP/USD fail to hold close to the 1.30065 region, the prospects of a further drop to the 1.2700 region become closer to a reality. Further below, serious support doesn’t appear until the 1.2500 level. Therefore, keep in mind that 1.30065 acts as just an important barometer of future market sentiment. Traders could be swayed on which side GBP/USD ends up.

For the moment, however, the potential for an upside for GBP/USD should give traders food for though that at somewhere at some point will view GBP/USD as cheap and that market isn’t all that far off those levels. That is certainly different than having no hope of a respite in recent selling.