Long-time Tesla Inc. (NASDAQ:TSLA) bull and managing partner at the Future Fund LLC, Gary Black, is sounding the alarm on what he sees as an overlooked blind spot in Tesla's robotaxi narrative: a growing list of competitors.

What Happened: On Sunday, in a post on X, Black pushed back against a commonly held notion regarding Tesla’s much-touted robotaxi launch. Black does not believe that the EV giant is guaranteed a dominant position in the autonomous ride-hailing market.

While he acknowledged that Tesla's self-driving tech will “of course” work, citing CEO Elon Musk's confidence in the Austin robotaxi rollout, Black emphasized that the real debate isn't about capability. It's about valuation.

Black is referring to the company’s $1 trillion market cap, which rides on Tesla’s dominance in the ridesharing market, with its robotaxis leading the charge.

He, however, believes that these valuations warrant a discount, now that there are several well-funded competitors in the fray, citing the example of Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon.com Inc. (NASDAQ:AMZN), Baidu Inc. (NASDAQ:BIDU), and even Nvidia Corp. (NASDAQ:NVDA), among others.

“The question, which bulls painfully avoid, is when others master general unsupervised autonomy, what valuation will be attached to TSLA autonomy when it has to split the autonomous ride-hailing market with others?” he asks.

Black’s comments directly challenge Musk’s assertion of dominating this space with a “99% market share or something ridiculous,” which the former now questions with a simple “Really?”

He then drew parallels between the current bullish sentiment to that of 2021, when the company’s supporters predicted 20 million EVs produced annually by 2030, leading the stock to hit an all-time high, before falling 73% by early 2023.

Black believes something similar is afoot right now, as he concludes by saying that “history doesn't repeat but it often rhymes.”

Why It Matters: Tesla does, however, hold significant advantages over competitors in the autonomous ride-hailing segment, with recent reports by analysts stating that the company can produce its cars at one-seventh the cost of a Waymo, along with access to over 3 billion miles of data.

Last week, Black himself warned Tesla bears and short-sellers against “slapping” traditional auto industry valuations on Tesla’s business.

“The biggest mistake $TSLA bears make is slapping an auto industry P/E on TSLA’s EV business,” said Black, noting that EVs, unlike internal combustion engine (ICE) vehicles, are growing at 25% to 30% each year, while the latter remains “in a state of permanent decline.”

Price Action: Tesla shares were up 0.03% on Friday, trading at $322.16, and were up 0.17% after hours.

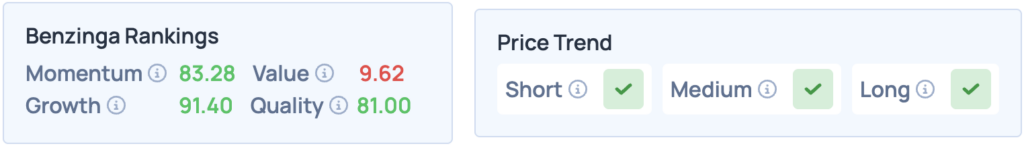

Tesla’s shares score well across the board in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium, and long terms. Click here for deeper insights into the stock.

Read More:

Photo courtesy: Tada Images / Shutterstock.com