The Future Fund LLC's managing director, Gary Black, thinks that Elon Musk's ambitious goal to remove the onboard safety monitor on all Tesla Inc. (NASDAQ:TSLA) Robotaxis by the end of the year is the main catalyst for the company's stock amid proposed regulatory ease.

Scaling Tesla's Robotaxi Operations

Taking to the social media platform X on Sunday, the investor shared his insights into the recent stock surge experienced by the EV giant following news that the company would beat analysts’ delivery expectations for the third quarter. Black said that he expects Tesla stock to remain strong throughout Q3 before "hedge funds unwind their bullish bets" in the fourth quarter.

He then added that the catalyst for the stock remains whether or not Tesla can remove the onboard safety monitors by the end of the year from the Robotaxis. Doing so "would allow TSLA robotaxi to expand from 150 cars now in Austin/SFO to potentially thousands as TSLA scales up its autonomous ride hailing business," the investor said.

However, even a 5000-strong Robotaxi fleet would have "little" earnings impact in 2026 at 8-10 cents per share, Black said. He also said that a new affordable model wouldn't impact Tesla's stock as a catalyst unless it "turns out to be a new form factor sufficiently differentiated from Model Y."

Dan Ives' $1 Trillion Prediction, Tesla's Gigafactory Boost

Wedbush Securities' investor Dan Ives recently released an investor's note, outlining his prediction that autonomous driving and AI present a $1 trillion opportunity for Tesla, reiterating that Musk's "Wartime CEO" mode would help boost the company's credentials in the "AI Arms Race."

Tesla, meanwhile, will ramp up its production activities at the company's Gigafactory near Berlin, citing stronger demand and positive sales figures from several of the 37 markets the factory currently serves, including multiple regions in Europe, the Middle East and Taiwan.

Interestingly, despite the production surge for Q3 and Q4, Tesla's European sales earlier fell 40.2%, according to the latest figures released by experts. The decline coincided with BYD Co. Ltd.'s (OTC:BYDDY) (OTC:BYDDF) surge in the region.

Ross Gerber Braces For Long Winter, Tesla Cuts Cybertruck RWD

However, not everyone shares Ives's optimism as Gerber Kawasaki's co-founder Ross Gerber said that the good news around the company's stock surge could end in two weeks as the IRA $7,500 Federal EV credit ends, which could affect the sales rush. "The good sales news will end in 2 weeks… followed by a long winter," Gerber said in a recent post on the social media platform X.

Elsewhere, Tesla has reportedly discontinued the most affordable Cybertruck trim as the EV giant's market share fell below 40% for the first time in eight years.

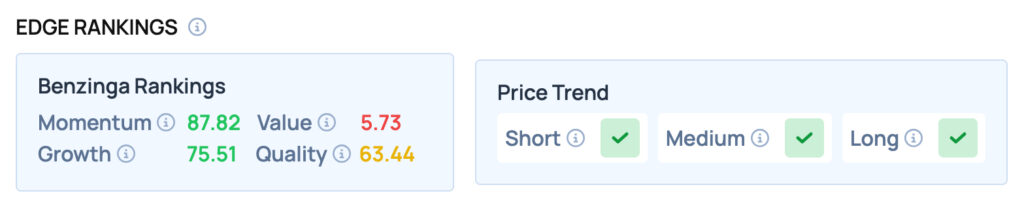

Tesla scores well on Momentum and Growth metrics, while offering satisfactory Quality, but poor Value. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Around the World Photos On Shutterstock.com