GameStop Corp (NYSE:GME) shares are trading higher Monday afternoon, gaining over 19% in the past month. The momentum follows the video game retailer's second-quarter earnings report, which surpassed Wall Street expectations.

What To Know: The company earlier this month posted earnings of 25 cents per share on revenue of $972.2 million, easily beating consensus estimates and signaling positive traction in its turnaround efforts.

Further fueling investor enthusiasm was GameStop’s declaration of a special dividend of tradable warrants. Shareholders of record as of October 3, will receive one warrant for every ten shares held. Each warrant will allow the holder to purchase one share of GME at an exercise price of $32.

The move, which could potentially raise up to $1.9 billion for corporate purposes and potential acquisitions, has been received as a bullish signal by the market as the company looks to build value for shareholders.

GME Price Action: GameStop shares were up 4.49% at $27.25 at the time of publication Monday, according to Benzinga Pro. The stock is trading within its 52-week range of $19.47 to $35.81.

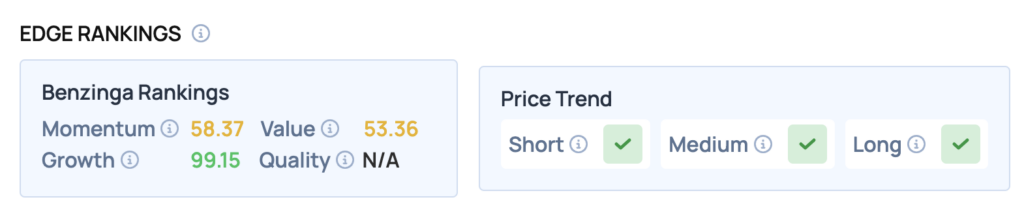

Technical Momentum: GME is currently trading at $27.25, reflecting a daily increase of 4.49%. The stock is above its 50-day moving average of $23.37, indicating bullish momentum. Key resistance is identified near the recent high of $27.30, while support can be observed around the 100-day moving average at $25.08.

Read Also: IREN Stock Is Surging Monday: What’s Going On?

How To Buy GME Stock

By now you're likely curious about how to participate in the market for GameStop – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock