GameStop Corporation (NYSE:GME) was surgin 14% on Tuesday after above-average volume began to enter into the stock at around 1 a.m. EST. The move caused the stock to print a higher high at the $117.35 level, which was above the Feb. 1 high of $116.65.

On Feb. 3, GameStop announced it had partnered with Ethereum (CRYPTO: ETH) Layer 2 solution Immutable X (CRYPTO: IMX) for its new NFT marketplace. GameStop immediately began selling the crypto and as of Monday it had cashed out a total of $47 million worth of Immutable X tokens.

Immutable X traders were likely not happy about GameStop dumping the token because the selling pressure has helped to drop the crypto down 50% off the Feb. 3 high-of-day. GameStop investors likely see the profits the company has generated from selling the crypto as positive for the business and on Tuesday GameStop’s volume indicates a high level of interest has returned into the stock.

See Also: Is GameStop Stock a Buy Right Now?

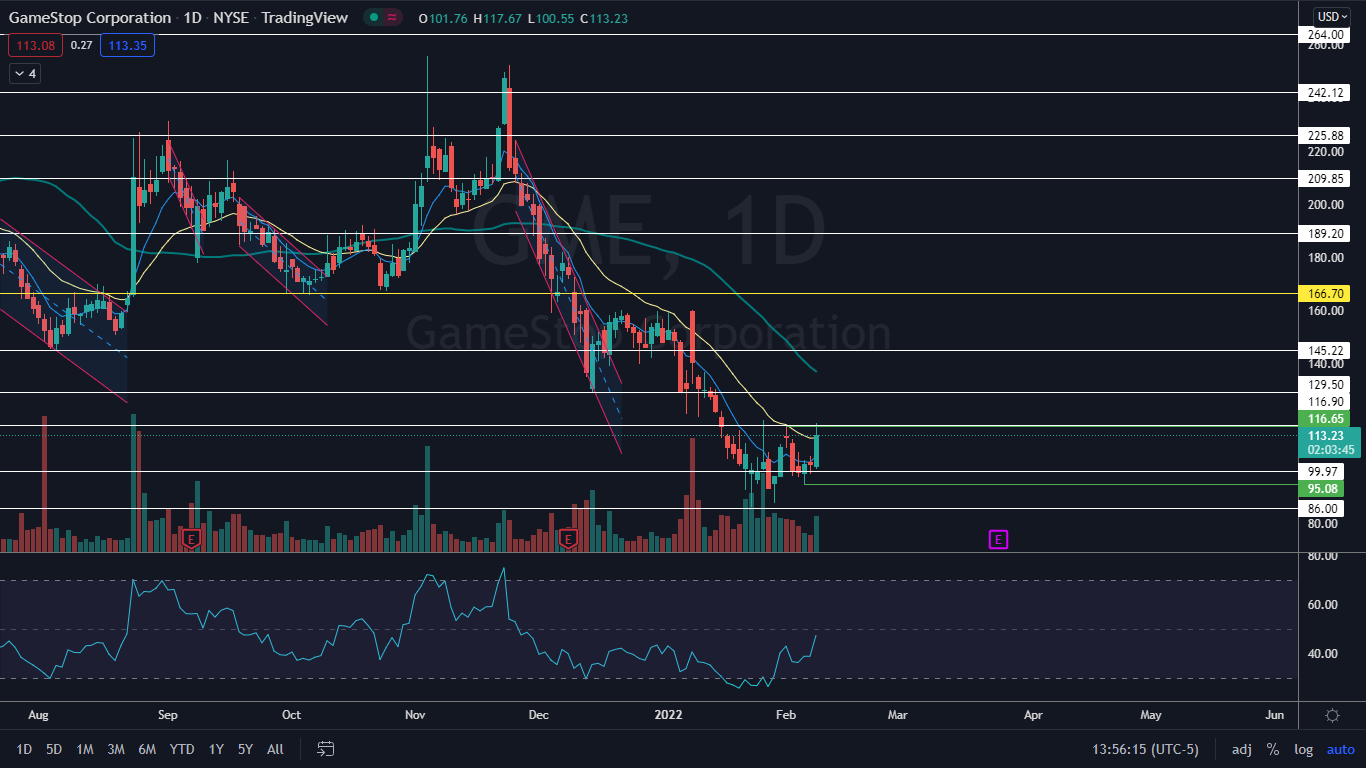

The GameStop Chart: When GameStop printed its higher high on Tuesday, it confirmed the uptrend the stock has been trading in since Jan. 24 is still intact, even though GameStop rejected and wicked from resistance level at 116.90 intraday. The stock will eventually need to print a higher low above the Feb. 4 low at the $95.08 mark, which may give bullish traders not already in a position a solid entry point.

The move higher has caused GameStop to regain the eight-day exponential moving average (EMA) as support. Traders will want to see the stock regain the 21-day EMA in the near future. If GameStop can trade above the 21-day EMA for a period of time, the eight-day EMA will cross above it, which would give bulls more confidence going forward.

If GameStop closes the trading day near its high-of-day price, it will print a bullish Marubozu candlestick, which could indicate higher prices will come on Wednesday. If higher prices don’t come, the most likely scenario is for the stock to print an inside bar, which would be bullish because the stock was trading higher before creating the pattern.

The stock has resistance above the $116 level at $129.50 and $145.22 and support below at $99.97 and $86.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.