/Video%20game%20controllers%20by%20TheXomil%20via%20Pixabay.jpg)

GameStop (GME) faced significant technical challenges last week as preorders for the Nintendo Switch 2 went live, with overwhelming demand causing website outages and frustrating customers.

According to a report from MarketWatch, the videogame retailer’s online platform crashed with “bad gateway” error messages when preorders launched. GameStop later acknowledged these issues on social media, citing “overwhelming demand” while its team worked on fixes.

Many consumers turned to GameStop after experiencing similar technical glitches with Target (TGT), Walmart (WMT), and Best Buy (BBY) during their midnight preorders. Some dedicated fans reportedly lined up overnight at physical GameStop locations, hoping for better luck in-store.

The $450-$500 gaming console has proven exceptionally popular, with Nintendo’s (NTDOY) president previously apologizing to Japanese customers after 2.2 million people applied for preorder slots in that market alone.

Resellers have already listed the coveted console on platforms like eBay (EBAY) with significant markups, ranging from $700 to $800, nearly double the retail price. Nintendo has implemented a lottery system through its official store for additional preorder opportunities. However, the company warned that even successful lottery winners might not receive their consoles by the June 5 release date due to unprecedented demand.

Despite current supply issues, Nintendo has indicated that Switch 2 prices will not increase due to tariffs at launch, although future price adjustments remain possible.

Should You Own GME Stock Right Now?

While robust demand for the Nintendo Switch 2 might positively impact GameStop’s top line in the near term, it is unlikely to move the needle significantly. In fact, analysts expect GameStop’s sales to fall from $3.82 billion in fiscal 2024 to $3.13 billion in fiscal 2027. Notably, the video-game retailer reported sales of $9.36 billion in fiscal 2016.

GameStop reported adjusted earnings per share of $0.33 in fiscal 2024, which are forecast to improve to $0.46 per share in 2026. Priced at 60x forward earnings, GME stock trades at a premium, given its revenue decline.

Earlier this year, GameStop disclosed plans to add Bitcoin (BTCUSD) to its treasury. In March, GameStop announced the pricing of $1.3 billion in convertible senior notes due in 2030, sold to qualified institutional buyers in a private offering. These zero-interest notes will mature in April 2030, unless they are converted, redeemed, or repurchased earlier. GameStop estimates net proceeds of $1.28 billion, which it plans to use for general corporate purposes, including the acquisition of Bitcoin, consistent with its investment policy.

Is GME Stock a Good Buy Right Now?

GameStop’s business pivot suggests that the company expects its core operations to remain under pressure in the future. A single analyst covering GameStop stock recommends a “Strong Sell” with a target price of $13.50, which is more than 50% below the current trading price.

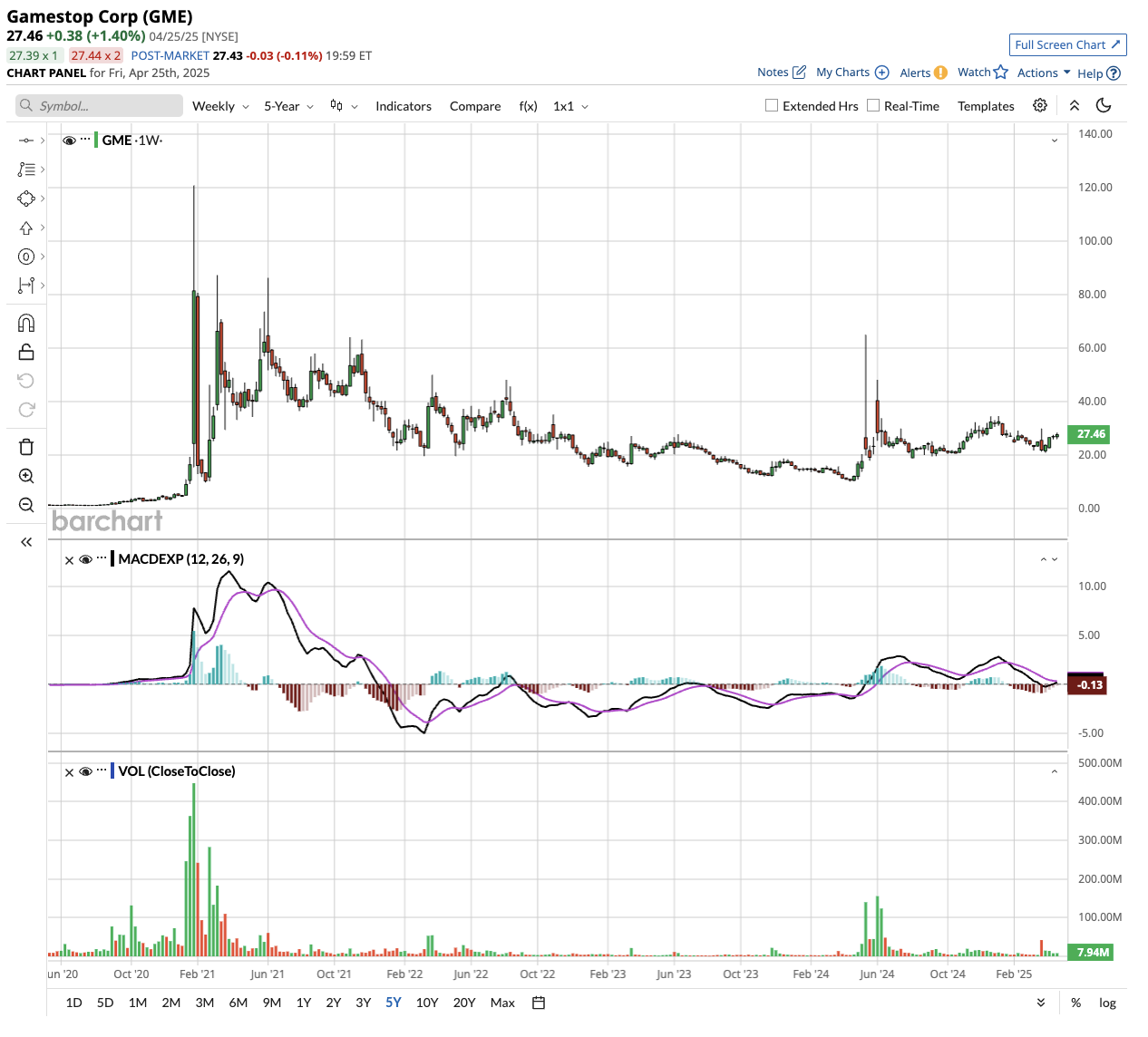

GME stock has returned more than 1,700% to shareholders over the last five years. However, the majority of these gains can be tied to the meme stock mania that gripped Wall Street four years back.

Today, GME stock remains fundamentally weak and is expected to deliver underwhelming returns to shareholders in 2025 and beyond.