GameStop Corp (NYSE:GME) shares are trading higher on Thursday afternoon despite a lack of company-specific catalysts or filings.

The upward momentum appears tied to a broader resurgence of interest in so-called "meme stocks" this week, driven by speculative retail traders.

- GME stock is showing exceptional strength. Check out the latest moves here.

What To Know: This renewed enthusiasm was highlighted by extreme volatility in Beyond Meat Inc (NASDAQ:BYND), another heavily shorted stock. A social media-driven campaign, dubbed the “Capybara Meme Rally,” caused Beyond Meat shares to soar, reminiscent of the short-squeeze dynamics that first propelled GameStop to fame.

A short squeeze occurs when a rising stock price forces investors betting against the company (short-sellers) to buy shares to cover their positions, further accelerating the rally.

While GameStop filed for a potential future stock offering earlier this month, potentially diluting shareholder value, today's trading seems to be ignoring fundamentals. Instead, traders are focusing on the renewed speculative fervor in the market, positioning GME as a beneficiary of the spillover from this week’s meme stock frenzy.

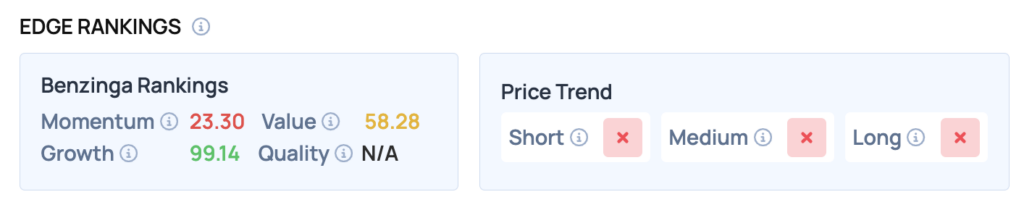

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, GameStop boasts an exceptional Growth score of 99.14 out of 100.

GME Price Action: GameStop shares closed Thursday up 5.07% at $23.63, according to data from Benzinga Pro. The stock is trading within its 52-week range of $20.35 to $35.81.

Currently, GameStop is trading approximately 2.3% below its 50-day moving average of $24.20 and about 6.8% below its 200-day moving average of $25.37. The relative strength index (RSI) sits at 35.19, suggesting that the stock is in neutral territory, which could indicate a potential for further upward movement if buying interest increases.

Read Also: Oil Stocks Rally On Trump’s Russia Sanctions: What’s Moving Markets Thursday?

How To Buy GME Stock

By now, you're likely curious about how to participate in the market for GameStop — be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of GameStop, which is trading at $23.64 at some point on Thursday, $100 would buy you 4.23 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option or sell a call option at a strike price above where shares are currently trading — either way, it allows you to profit from the share price decline.

Image: Shutterstock