GameSquare Holdings, Inc. (NASDAQ:GAME) shares climbed higher after-hours after a $100 million Ethereum (CRYPTO: ETH) investment announcement spurred a 58% rally on Tuesday.

What Happened: The firm disclosed the pricing details of its underwritten public offering for the sale of 8.42 million shares of common stock at $0.95 per share. The majority of the proceeds will be used to accelerate its Ethereum-based treasury strategy, it said in a press release.

This initiative is backed by a strategic partnership with Dialectic, a company focused on crypto-native capital management.

GameSquare’s Board has given the green light for an Ethereum allocation of up to $100 million. The investments will be phased over time, ensuring adequate working capital for the operating business.

See Also: Bitcoin Miner Bit Digital Dumped All Its BTC For ETH—And Isn’t Looking Back

Why It Matters: GameSquare’s move aligns with a nascent but steadily growing trend in the industry.

A case in point is Bit Digital Inc. (NASDAQ:BTBT), which recently liquidated its Bitcoin (CRYPTO: BTC) holdings to focus solely on Ethereum. This strategic pivot was made possible through a capital raise, demonstrating the firm’s strong belief in the future of the Ethereum blockchain.

Additionally, BitMine Immersion Technologies (AMEX:BMNR), which recently roped in Wall Street veteran Tom Lee as chairman, has adopted ETH as its primary reserve asset.

Price Action: At the time of writing, ETH was exchanging hands at $2,605.62, up 2.90% in the last 24 hours, according to data from Benzinga Pro.

Shares of GameSquare spiked 6.49% in after-hours trading after exploding 58.8% to $1.540 during Tuesday’s regular trading session.

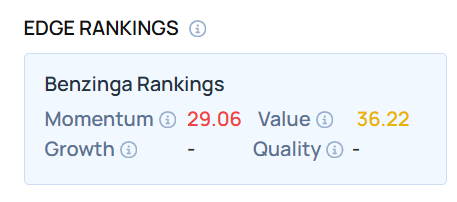

GAME Stock demonstrated a low momentum score—a measure of the stock’s relative strength based on its price movement patterns and volatility over multiple timeframes—as of this writing.

Benzinga Edge Stock Rankings can help you know how it compares to Bitcoin treasury company Strategy Inc. (NASDAQ:MSTR).

Read Next:

Photo Courtesy: Zakharchuk on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.