FTX's overnight implosion caused an earthquake that the business community is trying to figure out by putting the different pieces of the puzzle together.

John Ray, a veteran of restructurings, was appointed CEO of the bankrupt cryptocurrency exchange on November 11 to carry out its restructuring.

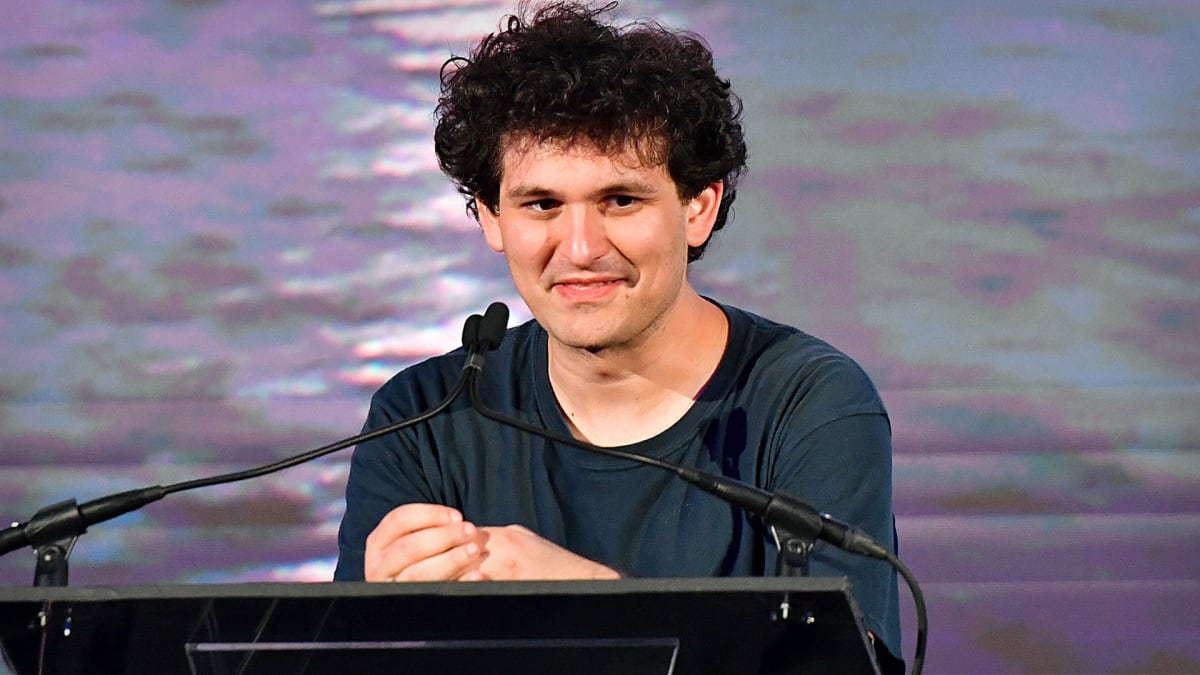

Ray, who notably led the liquidation of the energy broker Enron, has just made his first statement to the court. And this statement is a scathing indictment of the years of founder Sam Bankman-Fried, who was forced to resign as Chief Executive Officer on November 11 after filing for Chapter 11 bankruptcy.

His empire consists of FTX and Alameda Research, a trading platform.

Ray said Bankman-Fried and his team failed at many levels.

"I have supervised situations involving allegations of criminal activity andmalfeasance (Enron)," Ray wrote in a 30-page document filed with the United States Bankruptcy court for the District of Delaware.

He continued: "I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources and systems integrity."

'Inexperienced, Unsophisticated and Potentially Compromised Individuals'

But Ray said FTX, which valued $32 billion in February, is unique. He claimed that the financial information provided by FTX is not reliable and deplores a total lack of control and risk management.

"Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here," he said.

"From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented."

Bankman-Fried was anticipating the criticism as he claimed in a series of tweets on Aug. 16 that he didn't know what was on FTX's books.

"Roughly 25% of customer assets were withdrawn each day--$4b. As it turned out, I was wrong: leverage wasn't ~$5b, it was ~$13b. $13b leverage, total run on the bank, total collapse in asset value, all at once. Which is why you don't want that leverage."

He does say that he thought the leverage was $5 billion and later discovered that it was almost three times that amount. This admission frames two alternatives. In the first, Bankman-Fried is sincere and didn't really know what was in FTX's books, which makes him look incompetent or ignorant at best. In the second, Bankman-Fried is lying, which means he's a crook as FTX allegedly embellished its accounting.

.jpg?w=600)