/Facebook%20on%20a%20phone%20by%20Firmbee_com%20via%20Unsplash.jpg)

Meta Platforms (META), the parent company of Facebook and Instagram, is once again facing legal scrutiny. This time, it is from a group of Italian families accusing the social media giant and China-based ByteDance’s TikTok of failing to protect children from harmful and addictive online environments. Meta’s stock is up 24.5% year-to-date, compared to the tech-heavy Nasdaq Composite Index ($NASX) gain of 18.9%. The question now is whether mounting regulatory pressure could ultimately affect Meta’s business and stock performance.

What Is the Lawsuit About?

According to Reuters, the legal action, filed by Turin-based law firm Ambrosio & Commodo in collaboration with the Italian Parents’ Movement (MOIGE), claims that Facebook, Instagram, and TikTok have enabled underage users to bypass age restrictions and become addicted to the platforms’ content. The plaintiffs are requesting that the businesses establish rigorous age-verification methods for users under the age of 14, as required by Italian law, as well as adjust the algorithms, which they believe are purposely designed to maximize screen usage among youngsters.

The lawsuit is due to be tried at Milan’s business chamber in February 2026, giving Meta time to prepare for what might be a historic trial in Europe. Reuters reported that a Meta representative defended the company’s current measures, claiming that teen safety is “an industry-wide priority.” The company emphasized its “Teen Accounts,” which have safeguards to limit who can contact minors, restrict the sort of content they see, and limit the amount of time they spend on the platforms. Meta also highlighted its attempts to keep underage users from falsifying their age. However, critics claim that those measures are still easy to bypass.

What Should Investors Be Concerned About?

For investors, a growing wave of lawsuits raises both short-term uncertainty and long-term strategic concerns. Meta’s major social media platforms, known as the Family of Apps, which include Facebook, Instagram, WhatsApp, Messenger, and Threads, are key to the company's massive advertising business. Meta is leaning heavily on artificial intelligence (AI) to fuel growth throughout its huge digital network of 3.4 billion daily users.

In the second quarter, the FoA segment generated $47.1 billion in revenue, representing a 21.8% year-over-year increase, with $46.5 billion derived from advertising alone. AI-driven advertising technologies, such as Advantage+, which help firms automatically optimize campaigns, contributed significantly to this growth. Meanwhile, Meta AI, the company’s intelligent assistant, has been thoroughly integrated across all platforms. However, ongoing legal and reputational risks may weigh on sentiment, particularly if challenges threaten the company’s engagement-based revenue model.

Furthermore, its metaverse division, Reality Labs, remains unprofitable, despite CEO Mark Zuckerberg’s belief that the company’s significant expenditures in the metaverse will eventually pay off. In the second quarter, while the segment sales increased by a modest 5% year over year, operating losses were $4.5 billion. With Reality Labs depleting funds, the FoA segment is the company’s lifeline.

In the near term, analysts are unlikely to predict any material impact on the company. In the long run, if the verdict goes against Meta, it may face higher compliance costs and operational disruptions across Europe. Despite the legal turbulence, Meta remains one of the most profitable companies in the world. Meta’s earnings grew 38% in the second quarter, with analysts projecting 17.3% growth in 2025 and another 7% in 2026.

Meta also had $47.07 billion in cash, cash equivalents, and marketable securities and a free cash flow balance of $8.55 billion at the end of Q2. The social media giant’s ability to generate free cash flow, scale its advertising business, and pivot toward next-generation technologies provides it with a solid foundation to deal with regulatory hurdles.

What Is Wall Street Saying About Meta Stock?

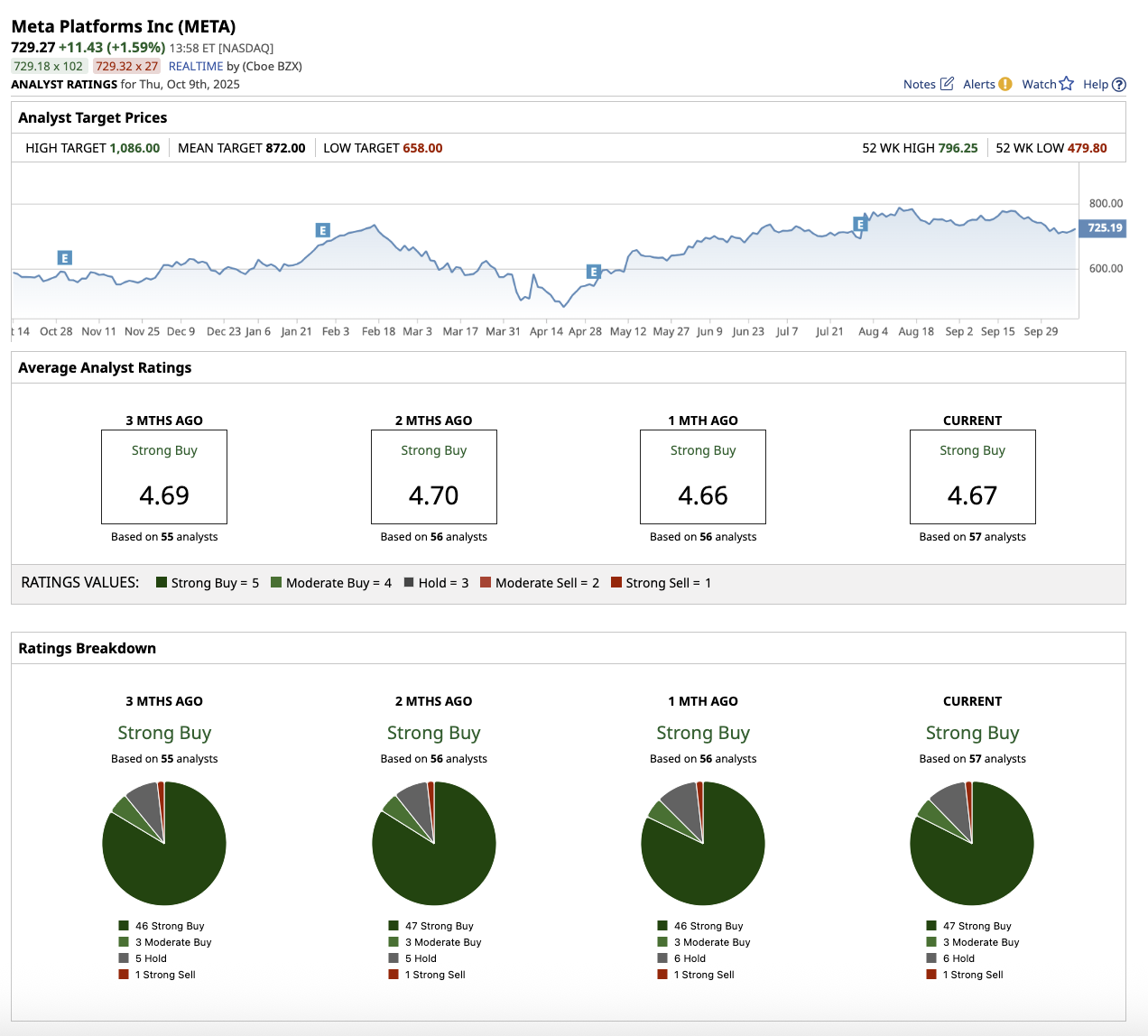

Overall, the consensus for META stock is a “Strong Buy.” Among the 57 analysts covering the company, 47 give it a “Strong Buy” rating, three recommend a “Moderate Buy,” six suggest holding, and one rates it a “Strong Sell.” The average price target of $872 indicates potential 19.6% upside from current levels. Meanwhile, the high price target of $1,086 implies the stock could surge by as much as 49% over the next year.

The Key Takeaway

While the lawsuit may not yet pose an existential threat to Meta’s business, it adds another layer of uncertainty to a company already navigating political scrutiny, competitive challenges, and shifting public attitudes. Investors will want to keep an eye on how Meta addresses this situation. For now, Meta’s stock continues to trade on the strength of its AI and advertising engines, making it a great AI stock to put your money behind now.