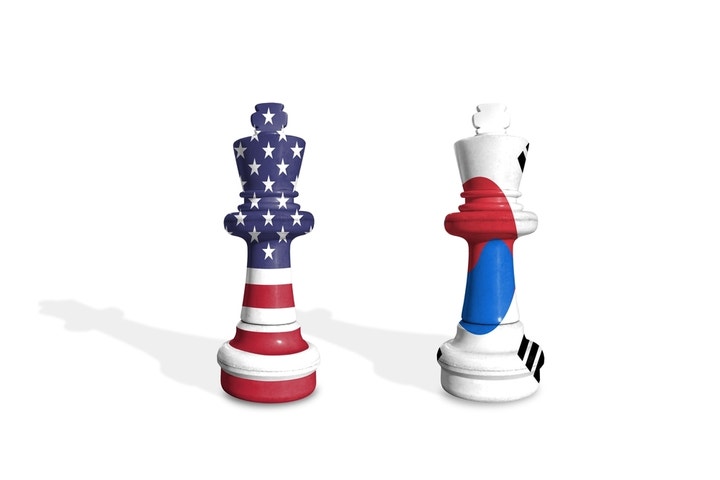

In a high-stakes chess game of international trade, President Donald Trump recently moved his queen, announcing a historic trade deal with South Korea that imposes tight restraints on tariffs and frees billions in cross-border investments. But this is more than a diplomatic headline. ETF investors now face a shifted landscape of sector-specific plays and geopolitical earthquakes to hedge against.

Here’s how the 15% tariff agreement and South Korea’s promise of $350 billion of investments are echoing throughout the ETF universe.

The Big Deal

Under the terms of the newly signed trade agreement, the U.S. will impose a 15% duty on South Korean imports, a reduction from the initially proposed 25% increase. South Korea has, in turn, promised to invest $350 billion in U.S. infrastructure and manufacturing projects within the next five years, as well as $100 billion worth of U.S. energy buys.

No retaliatory tariffs on U.S. shipments to South Korea were declared, pointing to a short-term benefit strongly in Washington’s favor.

Korea-Focused ETFs: Opportunity Or Headwind?

South Korea’s equity markets have been unstable under the specter of tariff uncertainty. The iShares MSCI South Korea ETF (NYSE:EWY), a bellwether for Korean equities, has already risen by almost 43% year-to-date, driven by hopes for trade clarity. The ETF hit a 52-week high during Wednesday’s trading session, possibly as a result of the clarity that finally came. With the 15% tariff now enshrined in law, however, investors may consider examining which sectors will bear the brunt of the impact.

Export-intensive sectors in the list, such as electronics, autos, and semiconductors, will face the heat. Simultaneously, domestically driven Korean companies that are not impacted by the imposition of tariffs will be seeing more ETF inflows.

Even other Korea-specific ETFs, such as the Franklin FTSE South Korea ETF (NYSE:FLKR) and the First Trust South Korea AlphaDEX Fund (NYSE:FKO), will also witness capital rotation as investors become accustomed to the new order of things.

U.S. Sector ETFs: Clear Winners In Infrastructure & Energy

With $350 billion in capital that will flow in and $100 billion in U.S. energy commitments Seoul has pledged, a handful of U.S.-themed ETFs might be the silent winners:

Infrastructure & Industrials: Watch for heightened scrutiny and potential flows into the Global X U.S. Infrastructure Development ETF (BATS:PAVE) and iShares U.S. Industrials ETF (BATS:IYJ). They might be among the first to catch the wave of Korean capital.

Semiconductors: With South Korea’s tech muscle and U.S. chip policy tailwinds, look for ripples in funds such as the VanEck Semiconductor ETF (NASDAQ:SMH) and iShares Semiconductor ETF (SOXX), particularly as supply chains rebalance.

Energy: The Energy Select Sector SPDR Fund (NYSE:XLE) and iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO) stand to gain from the export boom associated with South Korea’s $100 billion energy buy-in.

Hidden Angles: Volatility Hedges & Defensive Plays

The deal may have soothed some anxiety, but it has not eradicated geopolitical risk. As Trump continues with his MAGA campaign (“Make America Great Again”), policy uncertainty is always present. Investors could hedge with:

Minimum volatility ETFs, such as iShares MSCI USA Min Vol Factor ETF (BATS:USMV), in case of a downturn.

Domestic small-cap ETFs that are sheltered from the trade shock, like the iShares Core S&P Small-Cap ETF (NYSE:IJR).

Gold ETFs, like SPDR Gold Shares (NYSE:GLD) or iShares Gold Trust (NYSE:IAU), for investors who think this tariff calm might be the calm before the storm.

Looking Ahead

This transaction is not all about tariffs; it’s all about capital allocation, sector exposure, and sentiment-driven flows. U.S. sectors set to attract Korean investment, meanwhile, might experience speculative inflows rather than underlying policy implementation.

Read Next:

Photo: Shutterstock