Accounting is one of those necessary evils in life. You know, the sort of thing that needs to get done, but nobody really likes dealing with it. After all, who really wants to keep track of that pile of invoices, submitting them in the hopes of getting paid in a timely fashion, and resubmitting them as they remain unpaid.

If you are not careful, this can really cut into the main focus of the business, and become a serious time and workforce sink, and small businesses face the difficulty of not having a dedicated accounting department. But with emerging regulations like the UK's MTD rules, we need to be on top of our games.

Enter UK-based FreeAgent, which offers accounting software focused on the challenges of small business accounting. Their origins stretch back over a decade ago to 2007 when three freelance developer/developers, frustrated with the “mess and stress of bookkeeping,” put their expertise to use to tame the mountains of receipts and spreadsheets.

Today, FreeAgent has grown to a team of over 200, and has helped over 200,000 small business, freelancers and their accountants with their bookkeeping needs. Although FreeAgent maintains operational independence, it was acquired by NatWest in 2018 which means it has the financial backing of a much larger institution, which has allowed it to undergo a "turbo boost," as the company says.

- Want to try FreeAgent? Check out the website here

FreeAgent: Pricing

Many online software offerings bombard the user with a gaggle of tiers to suit every need with varying features at different price points. Still others go with the opaque pricing forcing the user to call and build a custom plan just to get an idea of the price.

A third strategy is a free tier, that is severely limited in some way that then forces the user to upgrade once they realize the fatal flaw.

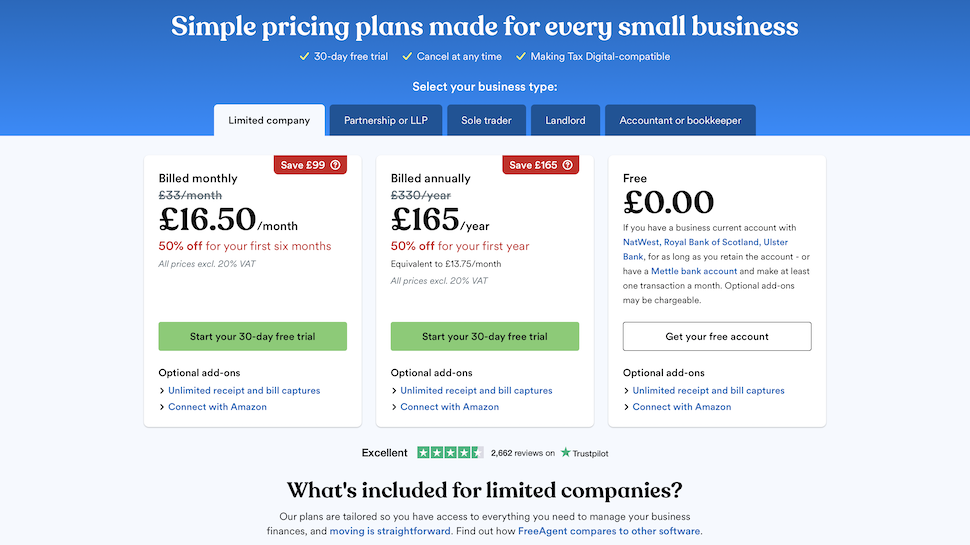

FreeAgent does a bit of everything by offering a single tier, if you have a business current account with NatWest, Royal Bank of Scotland, Ulster Bank, for as long as you retain the account - or have a Mettle bank account and make at least one transaction a month.

For the UK, FreeAgent then has monthly or annual different options to choose from. For example, Limited Company £33+VAT per month or £330+VAT a year.

There are also Partnership or LLP plans (£27/month or £270/year +VAT), Sole Trader (£19/£190+VAT) or Landlord (£10/£100+VAT). Accountants and bookkeepers can also had access to the platform, where they pay for client licenses rather than their own.

Like many of the big dogs in this game, FreeAgent runs regular promotions to get you through the door, including up to 50% discounts, but there are also 30-day free trials if you just need to get inside to decide whether this tool's for you.

Take note of the optional add-ons, too, like unlimited receipt and bill captures (for £5/month) and a tool to connect with your Amazon ecommerce site (for £6/month).

FreeAgent: Features

While the choice of plan is simple, we like that the plan is a good one, with a full feature set, and is not limited in any way. For example, there is no limit to the number of users, the number of clients, or the number of projects- making this an even better deal for a larger small business.

We found that setting up the account is painless, with questions along the way to customize the service to your business including your time zone, date format, and local currency. This is where you also enter your local sales tax details, and provide a link to your bank account.

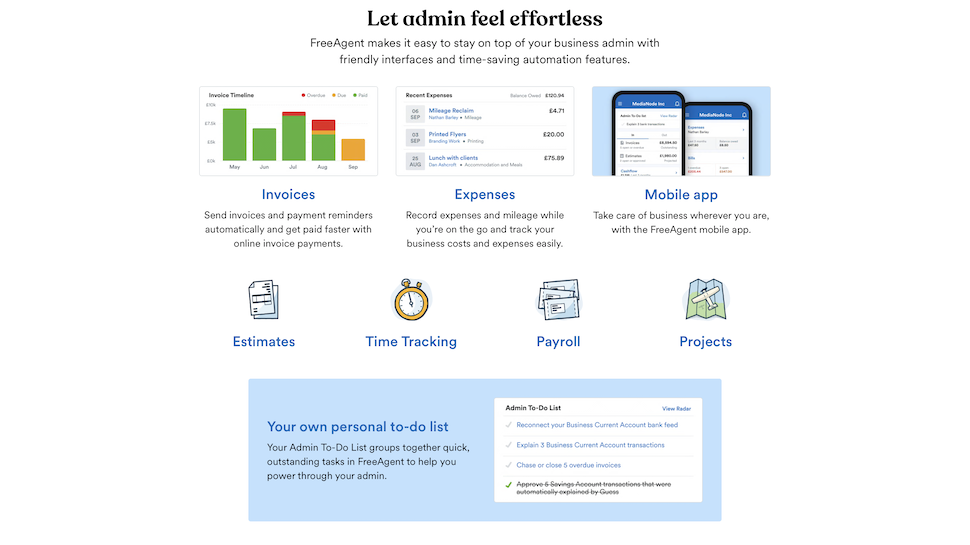

By connecting FreeAgent to the bank account gives a live view of the business’ cash flow as it can automatically import transactions on a daily basis through its ‘Bank Feeds’ feature.

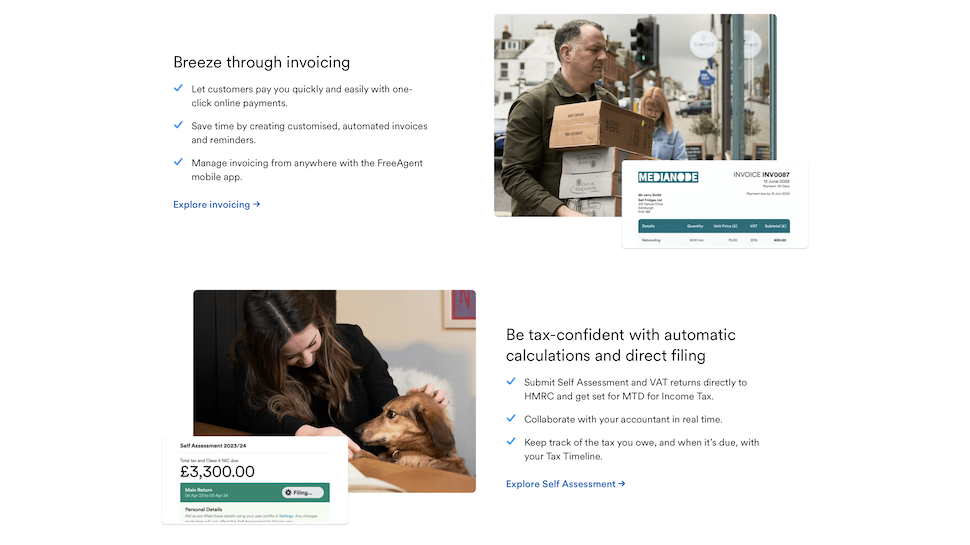

A labor intensive part of running any business is invoicing, from creating them, to sending them, and finally tracking them to payment, which can too often require sending multiple invoices.

reeAgent really excels on this core task, as through a series of dialogue boxes the invoice is created, and there is opportunity to attach the invoice to a project, provide payment terms, and customize reference numbers. Then the line items and unbilled expenses are entered.

There is also a neat feature that can easily transform a previously created estimate into an invoice for efficient workflow.

Further supporting invoicing, there is an option to set up recurring invoices, that are sent automatically. In addition, FreeAgent can track each invoice until payment, and automated reminders can be created to prod customers that still owe money for a truly ‘hands free’ process.

Another drudgery of running a business is expense tracking, and FreeAgent comes through here as well. Receipts for business expenses can be added by simply snapping a pic with a smartphone, and then upload it to FreeAgent. These can then be easily organized into custom categories, for a full accounting at tax filing time.

Vendor lock-in is never a pretty thing, so it's a big tick when someone like FreeAgent is able to offer integrations with other platforms – around 65 in this case. It just makes things easier when you patch together different pieces of software for different parts of the business, which often becomes the case when you're trying to save some cash.

FreeAgent: Performance

This platform is about so much more than just logging money in and money out – you can use your figures to produce cash flow and tax liability overviews, or use the forecasting tools to see which areas of your business need attention before it's too late.

FreeAgent is so confident in their service that it is even easy to leave by downloading the business’ data if it does not work out for any reason. Then again, if you decide to leave, make sure to grab your data as otherwise once the subscription is over you lose total access to all historic data.

FreeAgent: Ease of Use

All of the software revolves around a clean, intuitive interface with simple menus and clearly labelled tabs, so getting around and finding where you need to log and update data is easy.

Though larger organizations may want to impose greater customization, templates to simplify repeated tasks like invoices and estimates are certainly worth having for the less experienced startups.

On the whole, we think it's well suited to non-accountants. The minimal learning curve should pacify freelancers, sole traders and small business owners, but bigger companies won't feel let down by a lack of features.

Another plus are the mobile apps, for both the iOS and Android platforms, making FreeAgent available while mobile, for use on a smartphone, or for those that prefer working on a tablet interface.

FreeAgent: Support

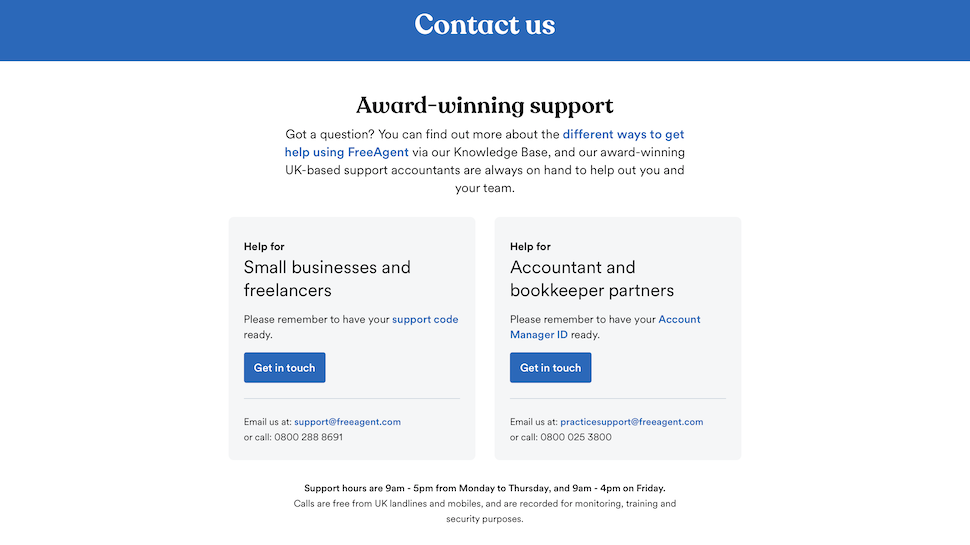

Support is available via phone, email and live chat to UK-based support accountants, who should be able to understand both finance questions and platform questions, though it's important to note that these are not dedicated accountants.

There's also a whole portion of the website set up for getting started, and you can watch a 30-minute on-demand webinar to help you find your feet.

Besides the knowledge base with helpful tips about how to get the most out of FreeAgent, there are also ongoing events and webinars that get recorded, so if you miss them, you can catch up on them. Some topics include MTD, FreeAgent automations and understanding payroll.

FreeAgent: Final Verdict

FreeAgent is a strong entry into the online bookkeeping market. It's up against the likes of FreshBooks, QuickBooks, Xero, Sage Business Cloud Accounting, Kashoo, Zoho Books and Kashflow. You can decide if the ‘one size fits all’ offering is a good fit for your business, but we like the unlimited aspect that will scale as your business grows.

Ultimately this means that it could end up being on the pricey side for smaller setups, but bigger companies or those with sufficient turnover will soon see the benefits.

The feature set is strong, and can certainly support common business tasks, like invoicing, creating estimates, and receipts. We lament that there is only a single tier offered, as while it is an excellent deal for a small business with several employees, the monthly cost can be more expensive for a sole proprietorship with more modest needs.

It's also worth noting the affiliation with NatWest, especially for customers of partner banks who can get free access to the platform – a real selling point.

Still, for a small business that has outgrown a simple spreadsheet for their accounting needs, FreeAgent is a recommended choice.

- We've also highlighted the best tax software