New York-based Fox Corporation (FOX) operates as one of the world’s top news, sports, and entertainment companies. With a market cap of over $28.1 billion, Fox operates through Cable Network Programming, Television, Credible, and The FOX Studio Lot segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Fox fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the media industry.

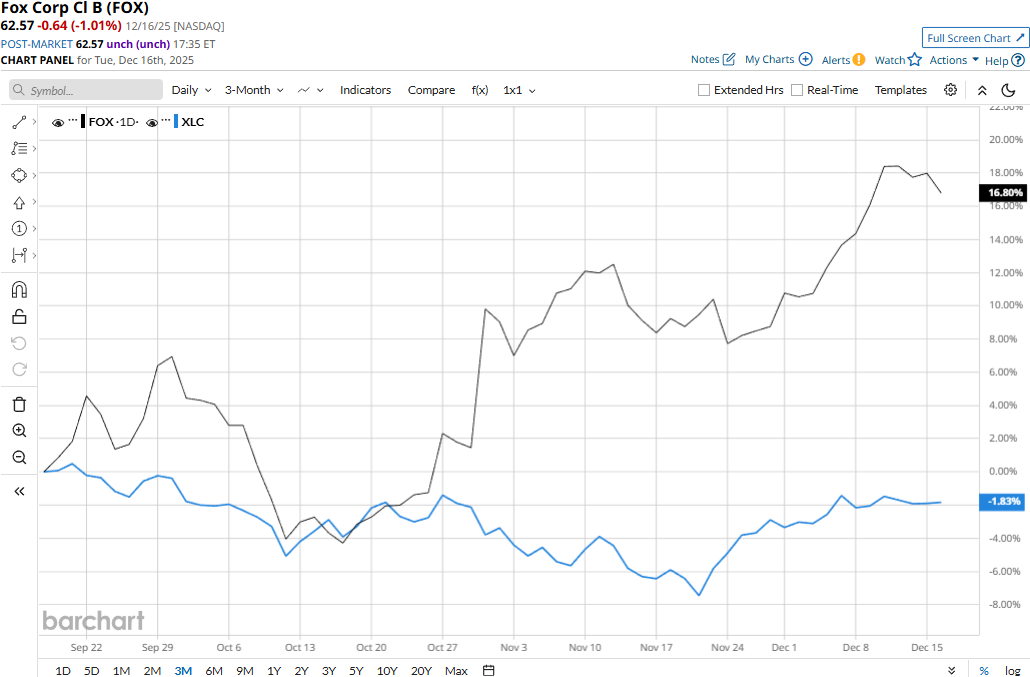

Fox touched its all-time high of $64.22 on Dec. 11 and is currently trading 2.6% below that peak. Meanwhile, Fox’s stock prices have soared 20.3% over the past three months, notably underperforming the Communications Services Select Sector SPDR Fund’s (XLC) 1.6% dip during the same time frame.

Fox’s performance has remained impressive over the longer term as well. Fox stock has soared 36.8% on a YTD basis and 40.1% over the past 52 weeks, outpacing XLC’s 20.5% gains in 2025 and 15.1% returns over the past year.

Fox has traded consistently above its 200-day moving average over the past year and above its 50-day moving average since late October, underscoring its bullish trend.

Fox’s stock prices soared 8.2% in the trading session following the release of its better-than-expected Q1 results on Oct. 30. Driven by growth in the cable network programming segment and television segment, the company’s distribution revenues increased 2.5% compared to the year-ago quarter. Meanwhile, driven by digital growth led by Tubi AVOD service, stronger news pricing, and higher sports prices, Fox’s advertising revenues increased by a notable 6.2%. Further, the company registered a solid 12% growth in content and other revenues, which was supported by growth in entertainment content.

Overall, Fox’s topline grew 4.9% year-over-year to $3.7 billion, surpassing the Street’s expectations by 4.7%. Meanwhile, its adjusted EPS grew 4.1% compared to the year-ago quarter to $1.51, beating the consensus estimates by a staggering 42.5%.

Further, Fox has notably outperformed its peer News Corporation’s (NWSA) 6% decline in 2025 and 9.6% plunge over the past 52 weeks.

Among the 14 analysts covering the Fox stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $65.42 suggests a modest 4.6% upside potential from current price levels.