Valued at a market cap of $23 billion, Fox Corporation (FOX) is a news, sports, and entertainment company based in New York. It generates most of its revenues from advertising, affiliate fees, and broadcast rights. The company is scheduled to announce its fiscal Q1 earnings for 2026 before the market opens on Thursday, Oct. 30.

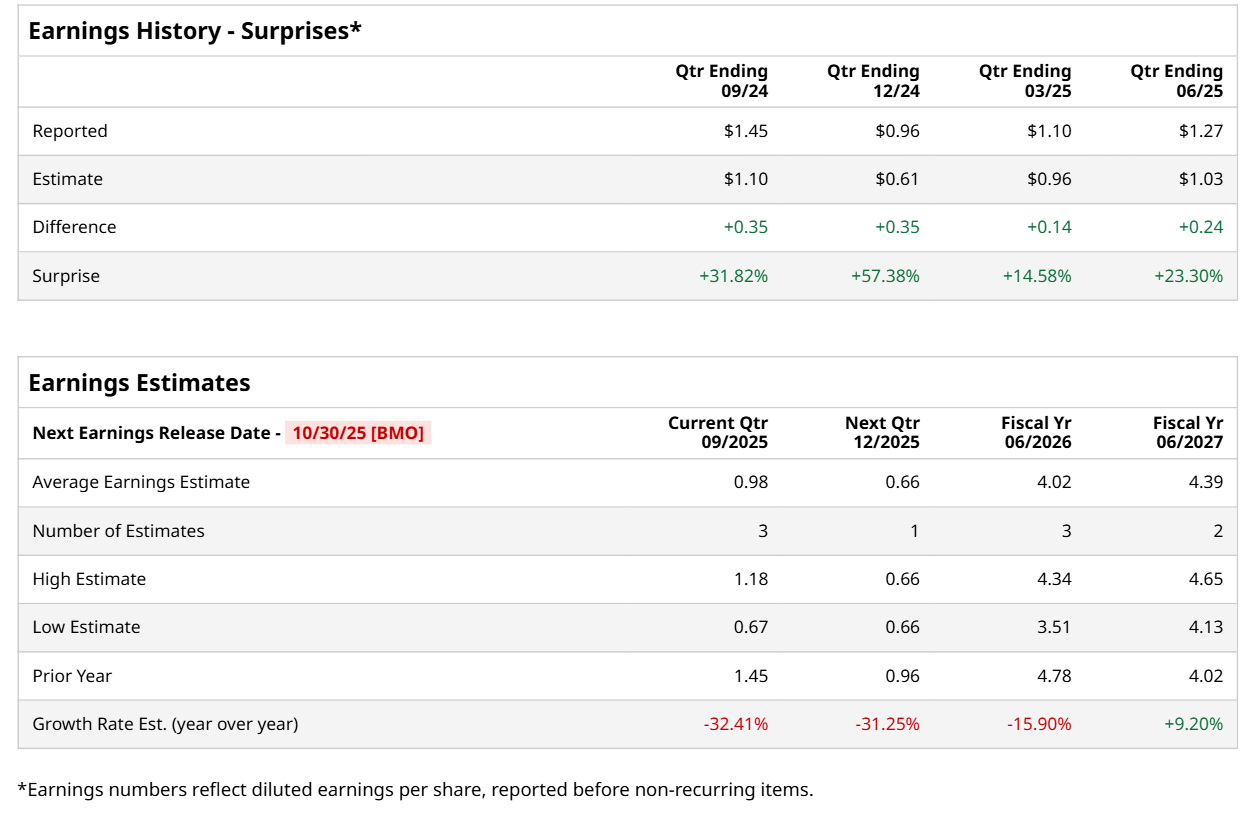

Ahead of this event, analysts expect this media company to report a profit of $0.98 per share, down 32.4% from $1.45 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. In Q4, FOX’s EPS of $1.27 exceeded the forecasted figure by 23.3%.

For fiscal 2026, analysts expect FOX to report a profit of $4.02 per share, down 15.9% from $4.78 per share in fiscal 2025. Furthermore, its EPS is expected to grow 9.2% year-over-year to $4.39 in fiscal 2027.

Shares of FOX have rallied 34.2% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 14.7% return and the Communication Services Select Sector SPDR Fund’s (XLC) 27.1% rise over the same time frame.

Fox Corporation released its Q4 results on Aug. 5. The company’s total revenue improved 6.3% from the year-ago quarter to $3.3 billion, driven by growth in both affiliate fees and advertising revenues. Moreover, on the earnings front, its adjusted EBITDA advanced by a notable 21.5% year-over-year to $939 million, while its adjusted EPS climbed 41.1% annually to $1.27, surpassing consensus estimates by a strong margin of 23.3%.

FOX also launched its new streaming platform, “Fox One”, that brings together the company’s full portfolio of news, sports and entertainment branded content all in one place, both live and on demand. However, despite this strategic move and its upbeat quarterly performance, its stock fell 3.8% after the earnings announcement

Wall Street analysts are moderately optimistic about FOX’s stock, with a "Moderate Buy" rating overall. Among 14 analysts covering the stock, seven recommend "Strong Buy," and seven suggest "Hold.” The mean price target for FOX is $60.67, implying a 17.6% potential upside from the current levels.