Fox Corporation (FOXA) is a major American media company known for its news, sports, and entertainment content, headquartered in New York City. In recent times, Fox has spent money buying new companies, such as Red Seat Ventures and Caliente TV. It also started Fox One, a new streaming service, showing it wants to grow further in entertainment and digital media. The company has a market capitalization of $25.92 billion.

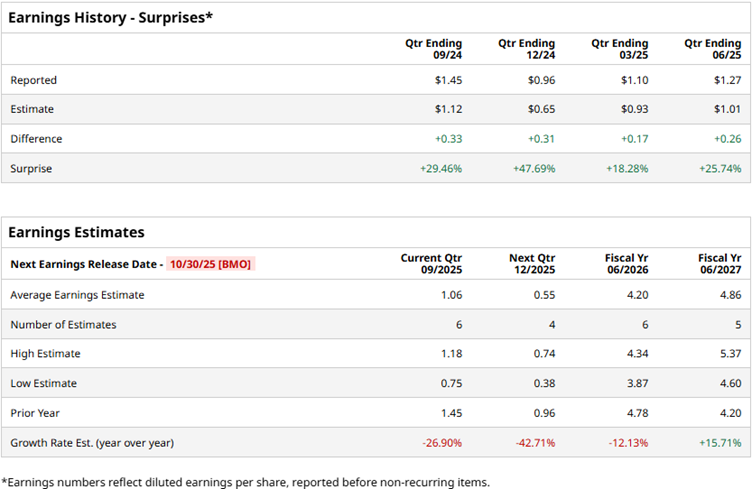

Fox Corp is set to report its first-quarter results for fiscal 2026 on Oct. 30, 2025, before the market opens. Ahead of the results, Wall Street analysts don’t have a favorable view of the company’s bottom-line growth. For the upcoming quarterly result, its profit is expected to decline 26.9% year over year (YOY) to $1.06 per diluted share.

For the current fiscal year, its profit is projected to drop by 12.1% annually to $4.20 per diluted share. On the other hand, in the next fiscal year, its EPS is expected to improve by 15.7% YOY to $4.86. Moreover, the company has a history of surpassing consensus EPS estimates, topping them in all four trailing quarters.

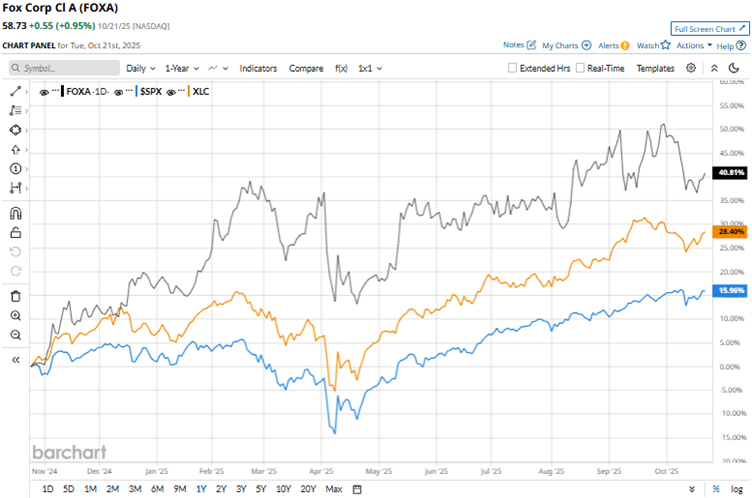

Strong financial performance has kept Fox’s stock robustly buoyed this year. Over the past 52 weeks, the stock has gained 39.7%, while it is up 20.9% year-to-date (YTD). This has outperformed the broader market, as the S&P 500 Index ($SPX) has gained 15.1% and 14.5% over the same periods, respectively.

Its performance has also outperformed the communication services sector, as the Communication Services Select Sector SPDR ETF Fund (XLC) is up 28.4% over the past 52 weeks and 20.5% YTD.

On Aug. 5, Fox Corp reported its fourth-quarter results for fiscal 2025 (the quarter that ended on June 30). Despite the results being better than what analysts had expected, the stock fell 3.7% intraday.

Fox’s latest quarterly results show the company is firing on all cylinders, with increases in affiliate fees and advertising revenue driven by Tubi AVOD services. Its revenue increased by 6.3% YOY to $3.29 billion, exceeding the $3.11 billion that Wall Street analysts had expected. Its adjusted EPS was $1.27, up 41.1% YOY and higher than the $1.01 expected figure.

Wall Street analysts have been moderately bullish about Fox Corp’s future. Among the 20 analysts covering the stock, the consensus rating is “Moderate Buy.” The ratings configuration has remained the same over the past two months, with eight “Strong Buys,” one “Moderate Buy,” and 11 “Holds.”

The mean price target of $61.82 indicates a 5.3% upside from current levels, while the Street-high price target of $74 implies a 26% upside.