The cost you pay for car insurance also includes hidden fees - and these are becoming more common, research has found.

In fact the charges tucked away in motor insurance policies have risen in the past five years, according to financial data firm Defaqto.

Not only are these costs going up, but the number of policies they are applied to is increasing too.

For example, in 2016 around one in 10 drivers paid a set-up fee when buying car insurance - but that figure is now around half.

On top of these fees, drivers also pay extra if they opt to pay insurance costs monthly, rather than yearly.

Extra charges are also levied if drivers take out extra insurance, known as 'add-on' insurance - such as key cover or protection for handbags.

1) Set-up fees

Half of all policies now include a 'set-up' fee of up to £60.

As the name suggests, this is a cost paid when taking out an insurance deal for the first time.

Defaqto said 44 percent of car insurance deals now include a set-up fee, up from 14 percent in 2016.

The firm said now around 10 percent of motorists are charged £60 or more.

Have you been stung by these fees? Message mirror.money.saving@mirror.co.uk

2) Renewal fees

As well as set-up fees, car insurers also charge 'renewal fees'.

These are paid when a car insurance deal ends and the driver renews the policy with the same insurer.

In 2016 around 9% of car insurance policies charged these fees, but now this has risen to 44% of providers.

More than a quarter of insurers charge between £20 and £39.99 to renew policies, while 8 percent ask for £60 or more.

3) Cancellation fees

If you take out an insurance policy you can also be charged a fee if you cancel it within the 14 days you legally get as a cooling-off period.

In fact, 51 percent of car insurance deals now charge for cancelling within this period, which can be more than £60.

4) Adjustment fees

Motorists can also pay adjustment fees for altering policies - such as adding a second driver.

These costs can reach £35.

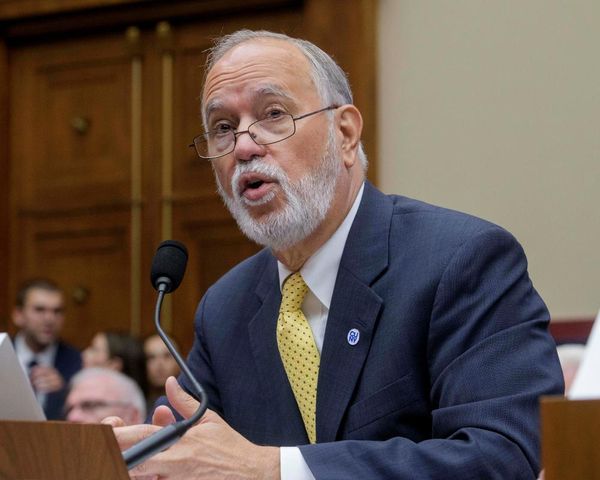

Defaqto car insurance expert Mike Powell said: "With new taxes relating to emissions and rules on what you can and can't drive, many people in the UK are buying new cars this year but could run the risk of being caught out with extra costs.

"With the greater use of price comparison sites, often customers are looking for the cheapest deal and not reading the small print on fees.

"It is worth taking your time when choosing a policy and find out exactly what you are going to be charged."

How to check if you will be charged a fee

Insurance providers have a 'Terms of Business' document which will list all of the policy fees. Make sure that you look for this document before purchasing cover.

If you cannot find this document, the information may be included within the policy document or on the insurance provider's website. Look out for the policy fees to make sure you know what will be charged.

If you cannot find the information, speak to an actual person at your insurance firm and ask them to confirm the policy fees that are charged in writing, so you have a record.