Four financial sector companies have surged into the top 10th percentile of growth rankings, marking a standout week of operational and strategic execution.

What Does Growth Ranking Entail?

Benzinga Edge's “Growth” percentile is a composite metric designed to spotlight companies experiencing exceptional expansion. It measures both long-term and recent earnings and revenue growth, assigning each stock a ranking relative to its peers.

According to the latest Benzinga Edge Rankings, a quantitative system that aggregates performance in both historical and recent earnings and revenue trends— Brookfield Wealth Solutions Ltd. (NYSE:BNT), Gladstone Investment Corp. (NASDAQ:GAIN), HIVE Digital Technologies Ltd. (NASDAQ:HIVE), and World Acceptance Corp. (NASDAQ:WRLD) are the latest entrants to this elite category.

Surpassing Growth Milestones

The ascent of these firms is underscored by a sharp rise in their growth percentile scores, as captured in the latest growth percentile report. All four companies demonstrated substantial improvements, propelling them into the coveted top decile.

Entering the top 10% signifies that these firms not only surpassed the majority but also sustained momentum across dynamic market cycles. The quantitative discipline behind these rankings ensures a robust, unbiased comparison within the financial sector

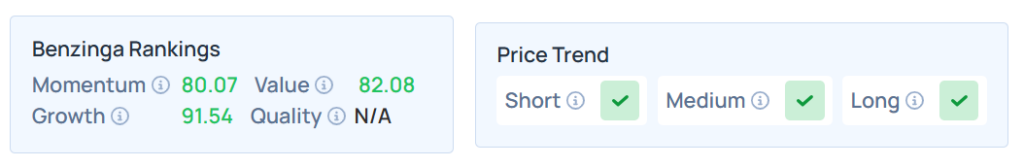

Brookfield Wealth Solutions

- Brookfield Wealth Solutions jumped from a prior growth score of 89.82 to a new high of 91.54, reflecting consistent performance in the insurance-diversified segment.

- Its shares have risen 12.70% on a year-to-date basis and 38.23% over a year.

- Not only does the stock maintain a stronger price trend over the short, medium, and long term, but it also scores well on the value and momentum rankings. Additional performance details are available here.

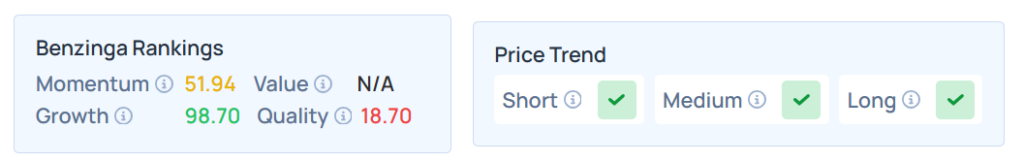

Gladstone Investment Corp.

- Gladstone Investment saw its score soar from 78.11 to a striking 98.7, highlighting momentum in asset management operations.

- GAIN shares were up 7.33% YTD and 5.73% higher over the year.

- Its quality rankings were poor, but it maintained a stronger price trend over the short, medium, and long term. Additional performance details are available here.

See Also: Viking’s 42% Plunge Splits Experts—A ‘$129 Strong Buy’ Or ‘Clearly Inferior’ Drug?

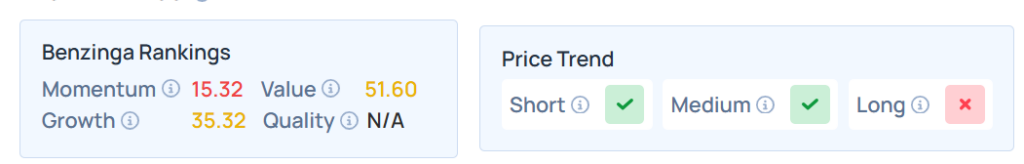

HIVE Digital Technologies Ltd.

- HIVE Digital Technologies posted remarkable growth, leaping from 34.72 to 98.76, signifying a dramatic turnaround in the capital markets sector.

- The stock dropped 22.65% YTD and 22.40% over the year.

- HIVE’s long-term price trend was poor, whereas it was strong in the short and medium term. The stock scored moderately on value rankings. Additional performance details are available here.

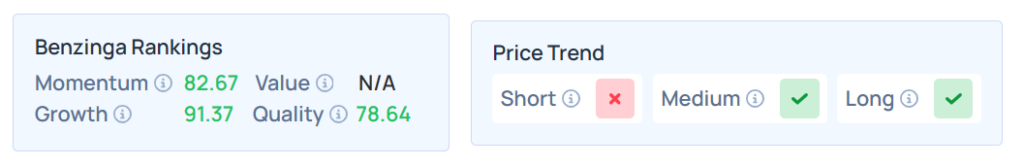

World Acceptance Corp.

- World Acceptance improved its score from 89.65 to 91.37, sustaining its upward trajectory within credit services.

- It gained 44.73% YTD and 46.23% over the year.

- WRLD’s short-term price trend was poor, whereas it was strong in the long and medium term. The stock scored very well on quality and value rankings. Additional performance details are available here.

What Does This Mean for Investors?

For investors, such advancements are significant signals. A jump into the top 10th percentile is typically a reflection of sound management, successful strategy execution, and resilience in adapting to evolving financial environments.

With the financial landscape continuing to shift, these four companies have now positioned themselves as growth leaders—making them highly watchable names in the quarters ahead.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Wednesday. The SPY was down 0.15% at $638.88, while the QQQ declined 0.22% to $568.03, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock