The UK’s Serious Fraud Office (SFO) has brought fraud charges against four people, including a former director, relating to the collapse of the British cafe and cake chain Patisserie Valerie.

The company, which ran almost 200 high street cafes in the UK, collapsed in early 2019, just months after reports emerged of a multimillion-pound black hole in its finances, which was blamed on “potentially fraudulent” accounting irregularities.

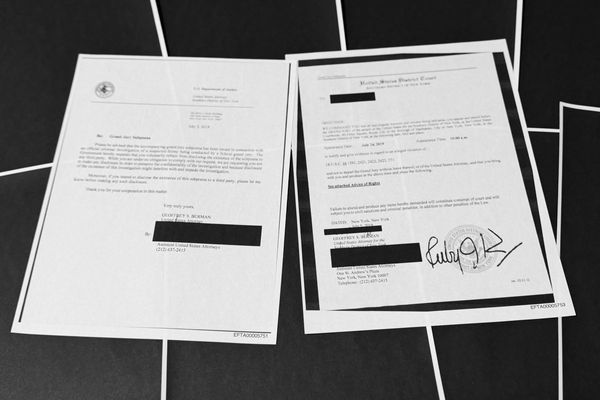

The SFO has now charged the chain’s former director and chief financial officer, Christopher Marsh, who worked at the company for 12 years.

His wife, the accountant Louise Marsh, has also been charged, along with the financial controller Pritesh Mistry and financial consultant Nileshkumar Lad. All four suspects were served with the charges at their homes.

Patisserie Valerie abruptly stopped trading in October 2018 after allegedly discovering financial irregularities, which led to the immediate closure of 70 stores, followed by the loss of 900 jobs across the country.

At the time, the SFO opened a full investigation into the conduct, which it codenamed “Operation Venom”.

All four suspects named on Wednesday have been charged with conspiring to inflate the cash in the balance sheets and annual reports of the chain’s owner Patisserie Holdings between 2015 and 2018. The SFO said this included providing false documentation to the company’s auditors.

The four defendants have been summoned to appear at Westminster magistrates court on 10 October to hear the charges against them.

Lisa Osofsky, the SFO director, said: “Patisserie Valerie’s abrupt collapse rocked our high streets – leaving boarded-up shops, devastating job losses and significant investor losses in its wake … Today is a step forward in getting to the bottom of this scandal.”

Patisserie Valerie – which traded for 92 years after being started by a Belgian, Madame Valerie, in the 1920s – ended up calling in administrators in January 2019.

The chain was chaired by the serial entrepreneur Luke Johnson, who at the time called the the public emergence of problems at Patisserie Valerie a “nightmare” and the “most harrowing week of my life”. There is no allegation of wrongdoing in Johnson’s case.

Before flagging up the financial irregularities, the company had been valued at £450m, but its administration wiped out its shareholders, including Johnson, who had a 37% stake.

After the bakery chain’s collapse, Grant Thornton, the auditor of its parent company, Patisserie Holdings, was fined £2.3m and accused of a “serious lack of competence” over its role in the accounting scandal.

Grant Thornton, which served as Patisserie Holdings’ auditor from 2007 until the company’s collapse in early 2019, accepted there were failures in the audit work, including statements on revenue, cash and the company’s fixed assets.

Patisserie Valerie was saved from closure in 2019 by a management buyout backed by Irish private equity firm Causeway Capital Partners. It still operates a couple of dozen cafes across the UK, while Patisserie Valerie cakes are available at some branches of Sainsbury’s.