/Fortive%20Corp%20logo%20and%20stock%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Everett, Washington-based Fortive Corporation (FTV) develops, manufactures, and services engineered products, software, and workflow technologies to support safety, productivity, and health across a wide range of industries. Valued at a market cap of $16.9 billion, the company is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Wednesday, Oct. 29.

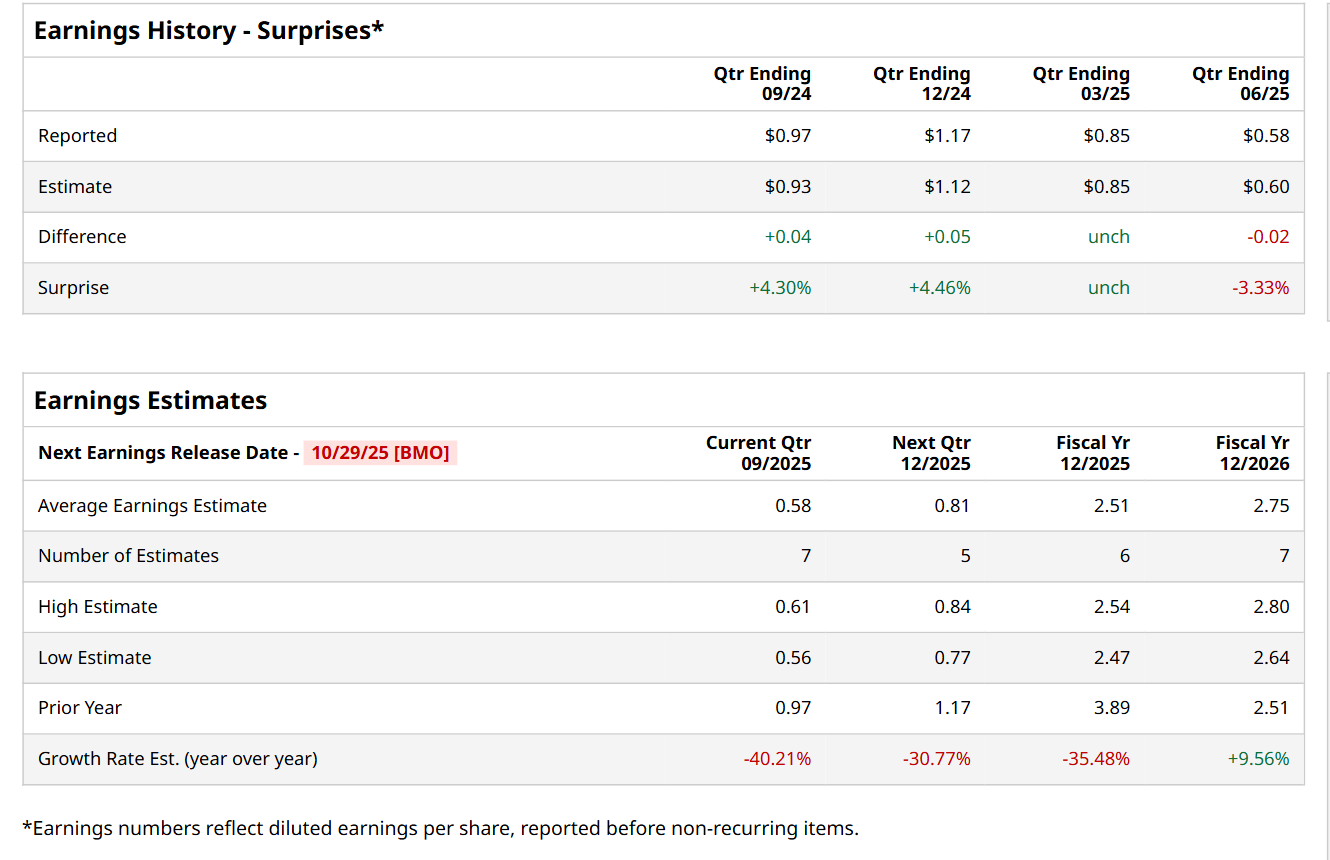

Before this event, analysts expect this tech company to report a profit of $0.58 per share, down 40.2% from $0.97 per share in the year-ago quarter. The company has met or exceeded Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $0.58 per share in the previous quarter missed the consensus estimates by 3.3%.

For the current fiscal year, ending in December, analysts expect FTV to report a profit of $2.51 per share, down 35.5% from $3.89 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound in fiscal 2026 and grow by 9.6% year-over-year to $2.75.

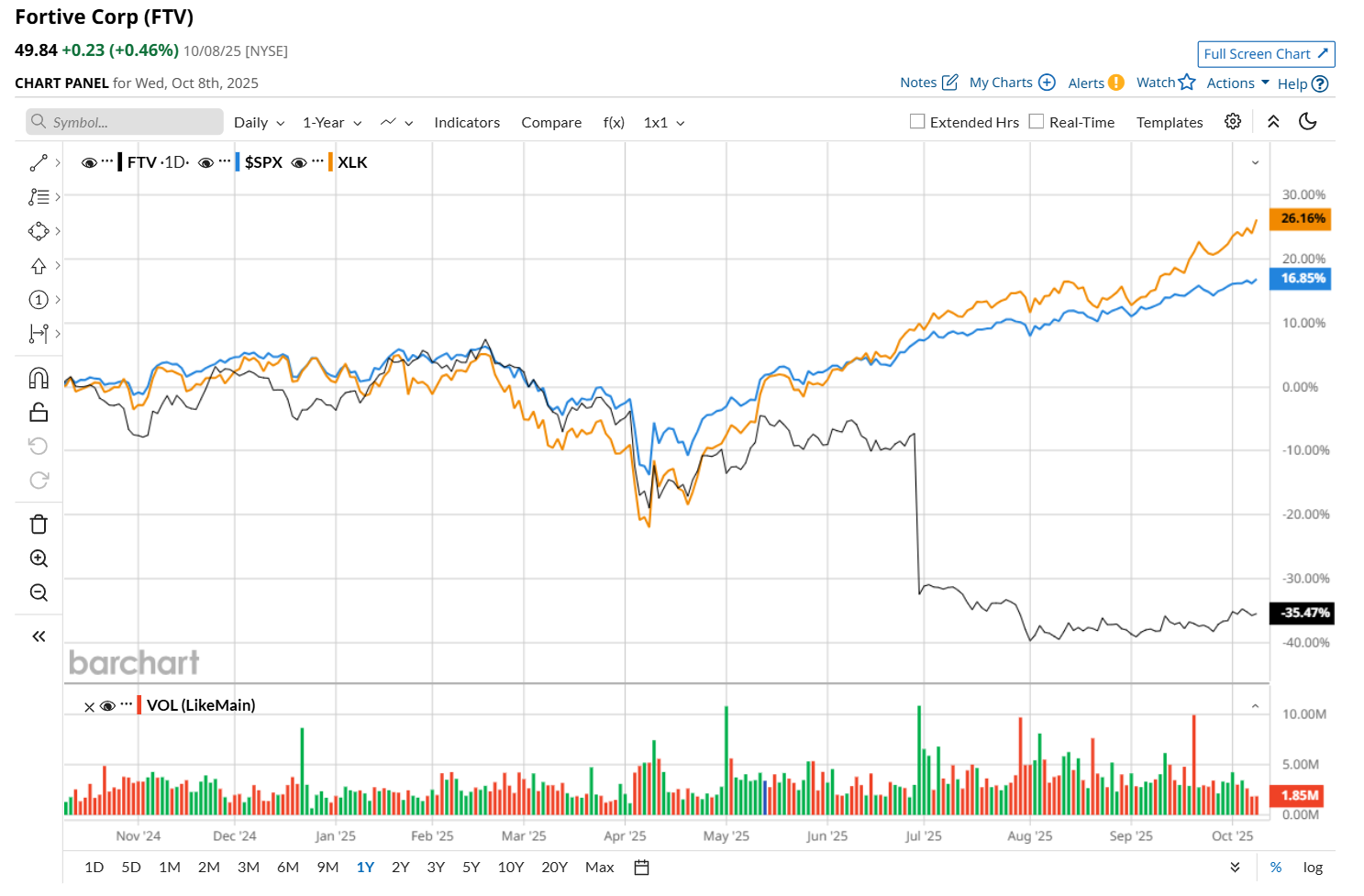

Shares of FTV have declined 34.8% over the past 52 weeks, significantly underperforming both the S&P 500 Index's ($SPX) 17.4% return and the Technology Select Sector SPDR Fund’s (XLK) 27.5% uptick over the same time frame.

On Jul. 30, shares of Fortive fell 2.5% after its mixed Q2 earnings release. While the company’s revenue declined marginally year-over-year to $1 billion, it topped the consensus estimates by 1%. However, its adjusted EPS of $0.58 increased 3.6% from the year-ago quarter, but missed the analyst estimates by 3.3%, making investors jittery. Adding to the quarter’s highlights, Fortive successfully completed the spin-off of Ralliant, marking a strategic step in its ongoing portfolio optimization efforts.

Wall Street analysts are moderately optimistic about FTV’s stock, with a "Moderate Buy" rating overall. Among 19 analysts covering the stock, four recommend "Strong Buy," one indicates a "Moderate Buy," and 14 suggest "Hold.” The mean price target for FTV is $56.50, implying a 13.4% potential upside from the current levels.