/Fortinet%20Inc%20Silicon%20Valley%20office%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Sunnyvale, California-based Fortinet, Inc. (FTNT) provides cybersecurity and convergence of networking and security solutions. Valued at a market cap of $60.8 billion, the company’s offerings include network security, secure networking, zero trust access, and AI-driven security operations.

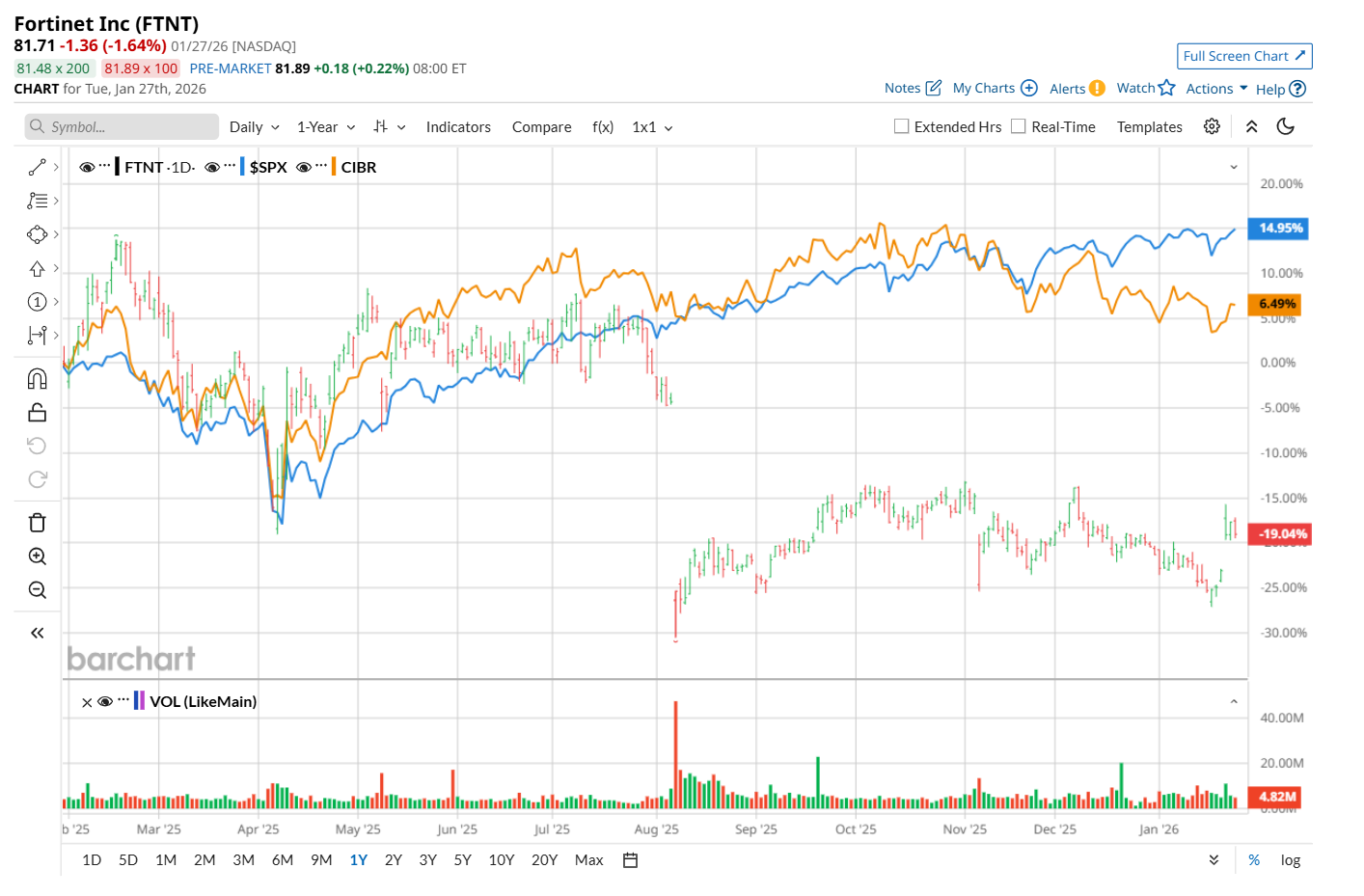

This cybersecurity company has considerably underperformed the broader market over the past 52 weeks. Shares of FTNT have declined 15.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. However, on a YTD basis, the stock is up 2.9%, outpacing SPX’s 1.9% return.

Narrowing the focus, FTNT has also lagged behind the First Trust NASDAQ Cybersecurity ETF (CIBR), which rose 10.2% over the past 52 weeks. Nonetheless, it has outpaced CIBR’s marginal YTD rise.

On Nov. 12, Fortinet shares fell 1.8% after Daiwa Securities downgraded the stock from “Outperform” to “Neutral,” pointing to slowing near-term growth momentum and valuation pressures across the broader cybersecurity sector.

For the current fiscal year, ending in December, analysts expect FTNT’s EPS to grow 13.9% year over year to $2.38. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

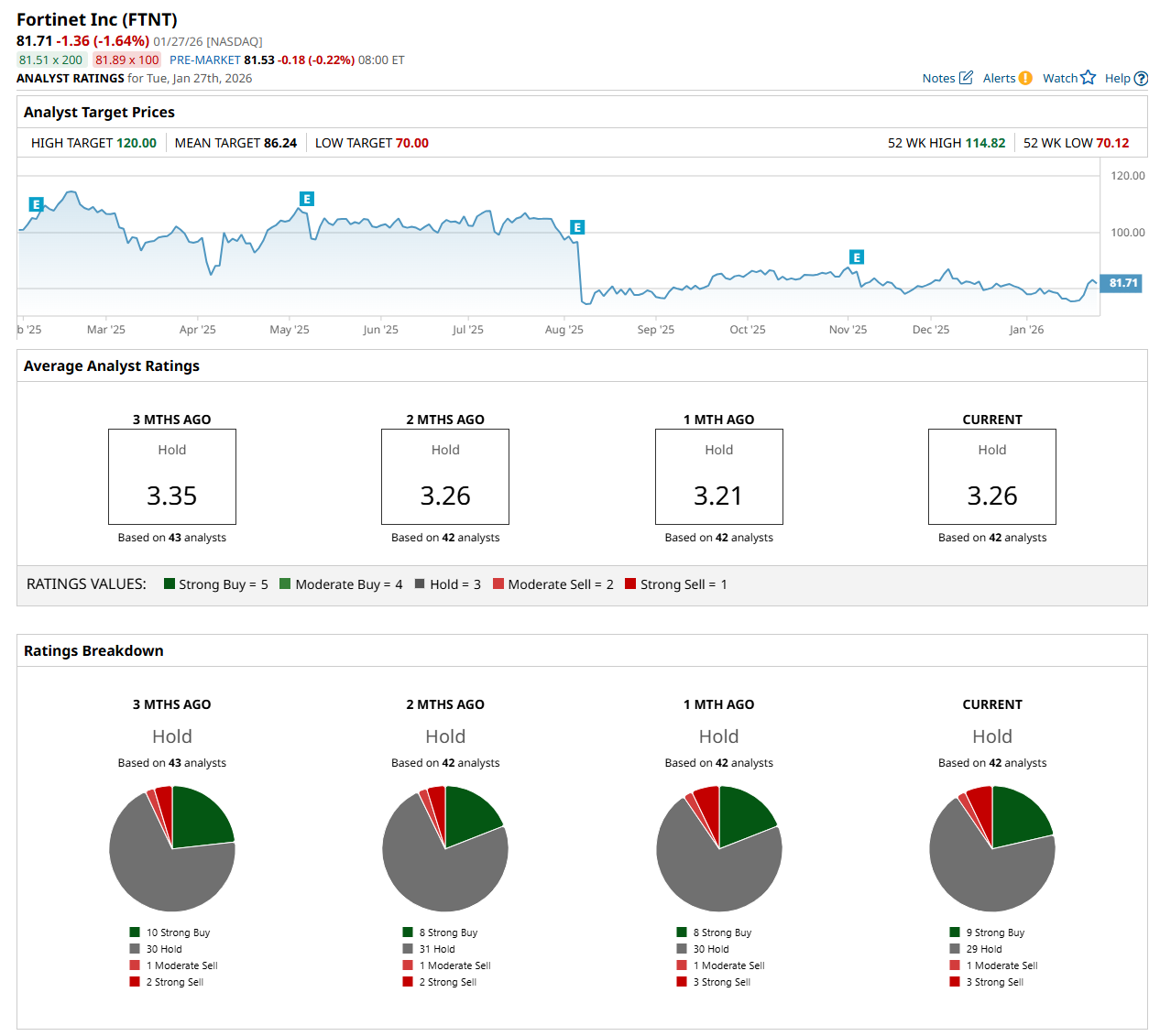

Among the 42 analysts covering the stock, the consensus rating is a "Hold,” which is based on nine “Strong Buy,” 29 “Hold,” one "Moderate Sell," and three “Strong Sell” ratings.

The configuration is more bullish than a month ago, with eight analysts suggesting a “Strong Buy” rating.

On Jan. 23, The Toronto-Dominion Bank (TD) analyst Shaul Eyal upgraded FTNT to "Buy," with a price target of $100, indicating a 22.4% potential upside from the current levels.

The mean price target of $86.24 represents a 5.5% premium from FTNT’s current price levels, while the Street-high price target of $120 suggests a 46.9% potential upside from the current levels.