/Fortinet%20Inc%20Silicon%20Valley%20office%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

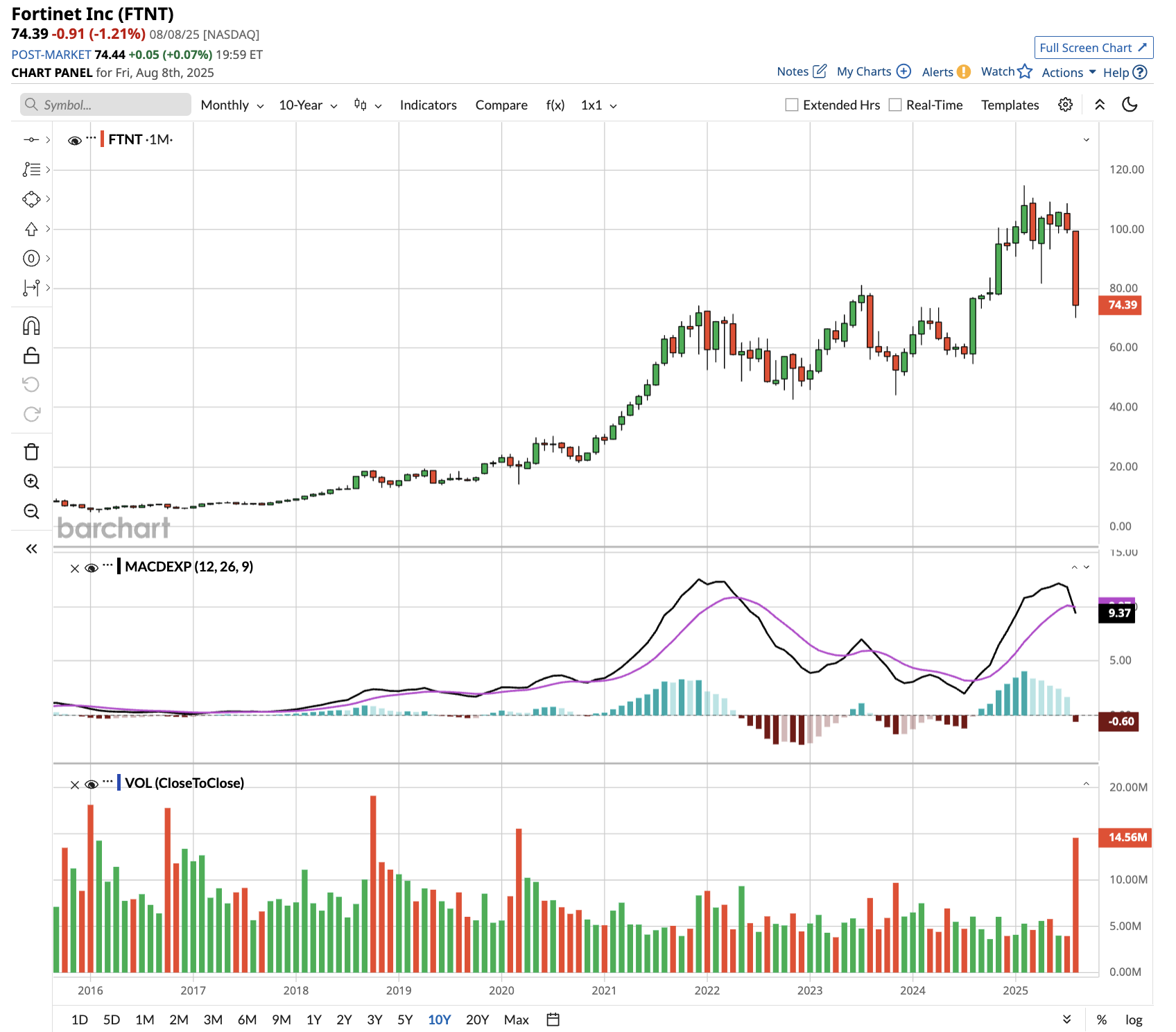

Fortinet (FTNT) stock plummeted over 20% on Aug. 7 after the cybersecurity company revealed disappointing details about its critical firewall refresh cycle, prompting multiple analyst downgrades. This comes despite the company beating second-quarter earnings expectations.

The selloff was triggered by management’s disclosure that the company is already 40% to 50% through its 2026 firewall upgrade cycle. This revelation suggests fewer revenue opportunities remain from customers upgrading legacy equipment than previously expected.

Fortinet reported second-quarter revenue of $1.63 billion, meeting estimates, and adjusted earnings of $0.64 per share beat the $0.59 consensus. However, Fortinet’s third-quarter revenue guidance of $1.67 billion to $1.73 billion disappointed, with the midpoint falling short of the $1.71 billion analyst estimate.

The underwhelming outlook reflects broader challenges facing the cybersecurity sector. Macroeconomic uncertainty from global trade tensions has prompted businesses to delay technology investments. Additionally, industry consolidation, highlighted by Palo Alto Networks’ (PANW) recent $25 billion acquisition of CyberArk (CYBR), is intensifying competitive pressures.

KeyBanc, Morgan Stanley, and Piper Sandler all downgraded FTNT stock, citing concerns about the accelerated refresh timeline and weaker underlying product revenue growth. The firms noted that subscription revenue and upsell activities missed expectations.

However, Fortinet raised its annual billings forecast to $7.33 billion to $7.48 billion, up from its previous guidance. Management maintains confidence in achieving 12% compound annual growth over the next three to five years.

For investors considering the dip, Fortinet’s long-term fundamentals remain intact, but the stock likely faces a multi-quarter period requiring execution to rebuild confidence.

Is Fortinet Stock a Good Buy?

Fortinet’s strategic transformation into a unified cybersecurity platform is gaining significant traction. Its Unified SASE and SecOps solutions grew over 20% in the second quarter, now representing 35% of total billings combined. This diversification reduces dependence on traditional firewall hardware and positions the company for recurring revenue growth.

Unlike competitors, Fortinet has developed all core SASE capabilities within a single operating system, FortiOS, providing customers with simplified operations and reduced costs. Fortinet’s infrastructure investments are creating sustainable competitive advantages.

Fortinet has invested approximately $2 billion in building its global-owned infrastructure spanning 5 million square feet across data centers and operations centers. This ownership model ensures better customer experience, cost efficiency, and data sovereignty compared to third-party dependent competitors.

Customer expansion metrics remain robust. The number of deals exceeding $1 million increased 29%, while their total dollar value grew 51%. Large enterprise adoption continues accelerating, with 13% now purchasing FortiSASE solutions, representing 60% year-over-year growth in penetration.

Fortinet’s artificial intelligence capabilities provide another growth catalyst. The company holds over 500 AI patents and offers solutions including FortiAI-Protect, FortiAI-Assist, and FortiAI-SecureAI, making AI add-ons the fastest-growing business segment.

Is FTNT Stock Undervalued Right Now?

Analysts tracking Fortinet expect sales to rise from $6 billion in 2024 to $11 billion in 2029. In this period, free cash flow is forecast to expand from $1.88 billion to $3.91 billion in 2029. Today, FTNT stock trades at 25x forward FCF. If it maintains a similar multiple, FTNT stock could gain over 60% over the next three years.

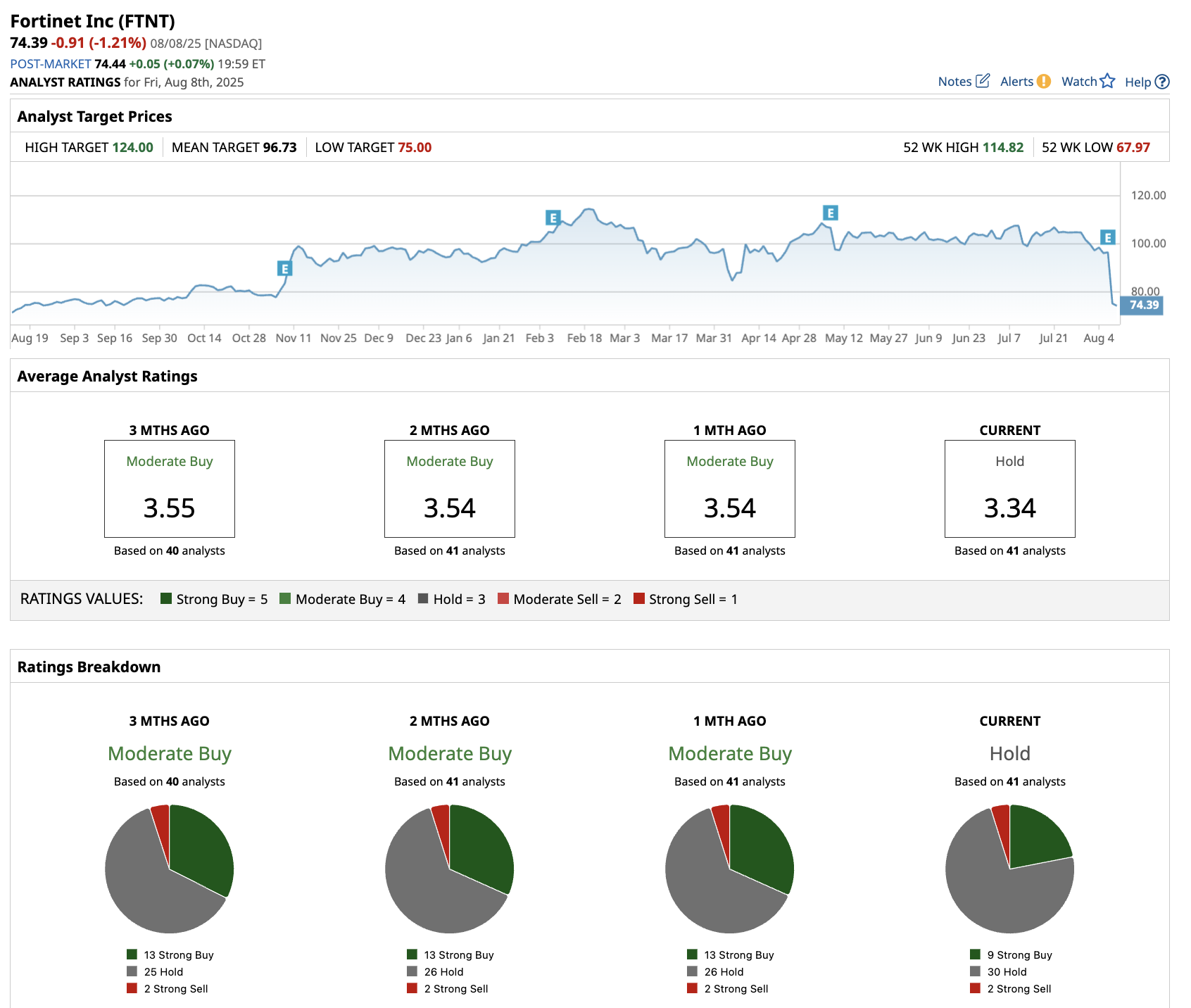

Out of the 41 analysts covering FTNT stock, nine recommend “Strong Buy,” 30 recommend “Hold,” and two recommend “Strong Sell.” The average FTNT stock target price is $97, roughly 30% above the current price.

While the refresh cycle disappointment creates near-term headwinds, Fortinet’s platform strategy, infrastructure investments, and AI capabilities position it well for sustained growth. The current valuation decline may offer an attractive entry point for investors focused on the company’s multi-year transformation rather than quarterly firewall upgrade timing.