/Fortinet%20Inc%20Silicon%20Valley%20office%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Sunnyvale, California-based Fortinet, Inc. (FTNT) provides cybersecurity and networking solutions worldwide. It offers network security appliances and unified threat management network security solutions to enterprises, service providers, and government entities. With a market cap of $65 billion, Fortinet’s operations span various countries in the Americas, EMEA, and the Indo-Pacific.

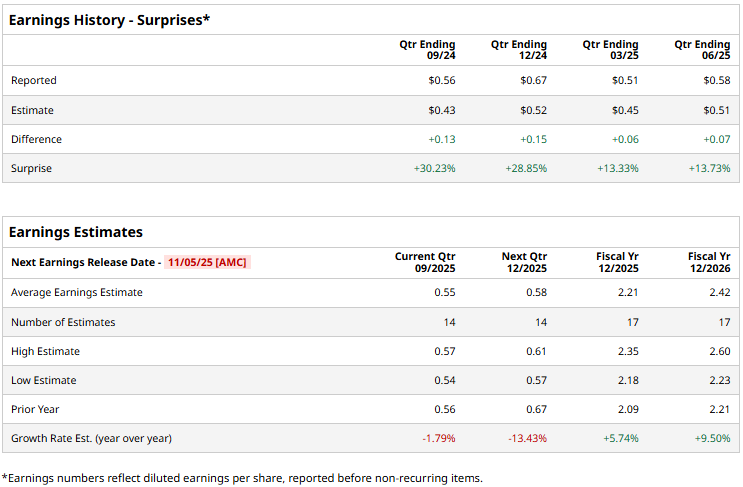

The cybersecurity giant is set to unveil its third-quarter results after the market closes on Wednesday, Nov. 5. Ahead of the event, analysts expect FTNT to report non-GAAP profit of $0.55 per share, down 1.8% from $0.56 per share reported in the year-ago quarter. On a positive note, the company has surpassed Wall Street’s earnings projections in each of the past four quarters by substantial margins.

For the full fiscal 2025, FTNT is expected to deliver an adjusted EPS of $2.21, up 5.7% from $2.09 reported in 2024. While in fiscal 2026, its earnings are expected to grow 9.5% year-over-year to $2.42 per share.

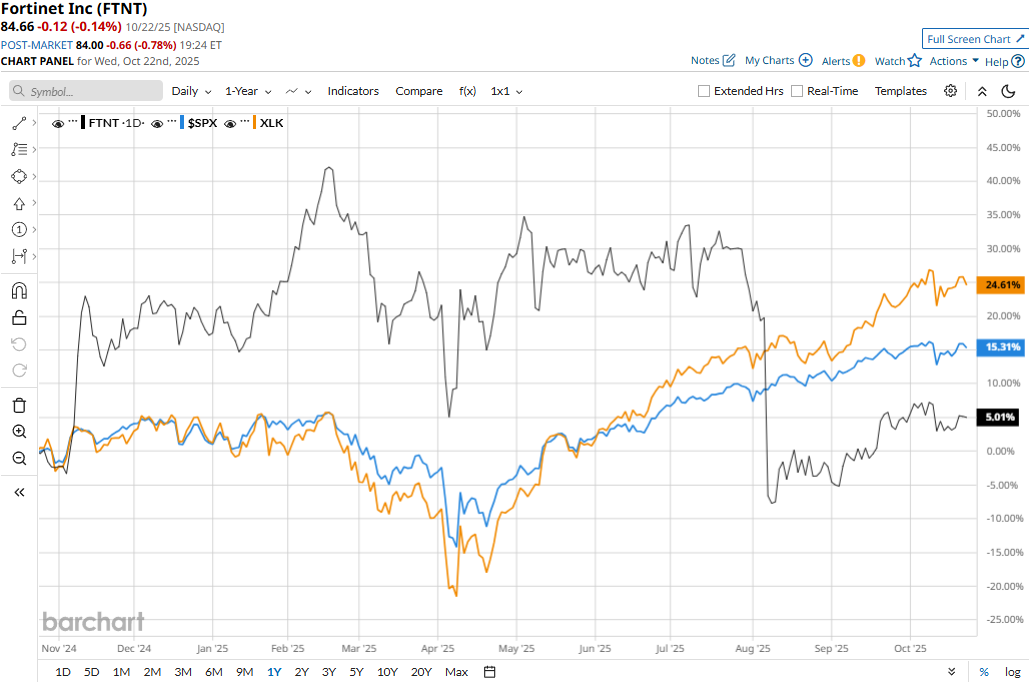

FTNT stock prices have observed a modest 2.7% uptick over the past 52 weeks, notably underperforming the Technology Select Sector SPDR Fund’s (XLK) 23.2% gains and the S&P 500 Index’s ($SPX) 14.5% returns during the same time frame.

Despite reporting better-than-expected financials, Fortinet’s stock prices tanked more than 22% in a single trading session following the release of its Q2 results on Aug. 6. Driven by the growth in its newer offerings and AI-driven security solutions, the company’s topline for the quarter grew 14% year-over-year to $1.6 billion, surpassing the Street’s expectations by a small margin. Further, its net income surged 15.9% year-over-year to $440.1 million, beating the consensus estimates.

However, Fortinet’s Q3 revenue guidance of $1.67 billion - $1.73 billion missed the Street’s expectations and led to several price target cuts and downgrades by analysts, which hurt investor sentiment.

Analysts remain cautious about the stock’s prospects. FTNT has a consensus “Hold” rating overall. Of the 43 analysts covering the stock, opinions include nine “Strong Buys,” 31 “Holds,” one “Moderate Sell,” and two “Strong Sells.” As of writing, the stock is trading slightly below its mean price target of $88.30.