/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

A few years back, GameStop (GME) grabbed headlines during the meme stock frenzy. However, one Wall Street analyst argues that Tesla (TSLA) currently holds the title of the original meme stock.

Barclays analyst Dan Levy recently told CNBC that Tesla's 29% September rally mirrors the retail-driven mania of 2020 and 2021, with a crucial difference: this time, the fundamentals might support the hype.

Levy doesn't mince words about Tesla's unconventional valuation. Trading at 180 times 2026 earnings, TSLA stock trades at a premium valuation. Yet the analyst believes Elon Musk's renewed focus on Tesla represents a significant shift. The CEO's recent open-market stock purchase and proposed compensation package signal that he's back in what Wedbush analyst Dan Ives calls "wartime CEO" mode.

Ives raised his TSLA stock price target from $500 to $600 and expects the automaker to surpass a $2 trillion market capitalization by early 2026. Moreover, Ives estimates Tesla’s market cap to soar to $3 trillion by the end of next year.

These aggressive targets are primarily driven by Tesla's autonomous vehicle ambitions. Ives forecasts the robotaxi opportunity is worth $1 trillion, as Musk plans to launch in over 30 U.S. cities within a year.

Notably, the Trump administration's more favorable stance toward autonomous technology could accelerate federal approvals that previously hindered Tesla's progress.

Is Tesla Stock a Good Buy Right Now?

Tesla reported second-quarter results that showcased near-term headwinds and ambitious plans. The EV maker launched its robotaxi service in Austin, offering fully autonomous rides, a key milestone despite operating with just a handful of vehicles. CEO Elon Musk announced plans to dramatically expand the service area within weeks, aiming to reach half of the U.S. population by year-end, pending regulatory approvals.

The elimination of the $7,500 federal EV tax credit at quarter-end created a rush of purchases that may have borrowed sales from future periods. Meanwhile, tariffs added approximately $300 million in costs during the quarter, with more impact expected ahead. Regulatory credit revenue is also declining due to changes in emission standards.

Internationally, Tesla continues to struggle amid fierce competition. European sales declined 23% year-over-year (YoY) in August, while overall EV registrations increased 26%, with Chinese competitor BYD (BYDDY) more than tripling its European presence. However, Tesla expects supervised Full Self-Driving (FSD) approval in Europe and China to reverse these trends.

Musk continues to focus on Tesla’s transformation beyond auto manufacturing. He expects the production of Optimus humanoid robots to surpass 100,000 units per month within five years. Additionally, the new Cybercab robotaxi, optimized purely for autonomous operation, could achieve operating costs below thirty cents per mile and should be a key revenue driver for the EV giant.

Is TSLA Stock Undervalued?

While analysts are bullish on Tesla’s expansion plans, investors should remain cautious given the company’s slowing revenue and earnings growth. Tesla expects capital expenditures to exceed $9 billion in 2025 as it continues to invest heavily in AI infrastructure, manufacturing expansion, and the development of new products.

In Q2, it reported a free cash flow of $146 million and is forecast to end 2025 with an FCF of $4 billion, down from $7.5 billion in 2022. However, analysts forecast Tesla’s FCF to increase to $25.3 billion in 2029.

Analysts tracking Tesla stock forecast adjusted earnings to narrow to $1.70 per share in 2025 from $2.42 per share in 2024. Earnings are then forecast to expand by 53% annually to $9.5 per share in 2029.

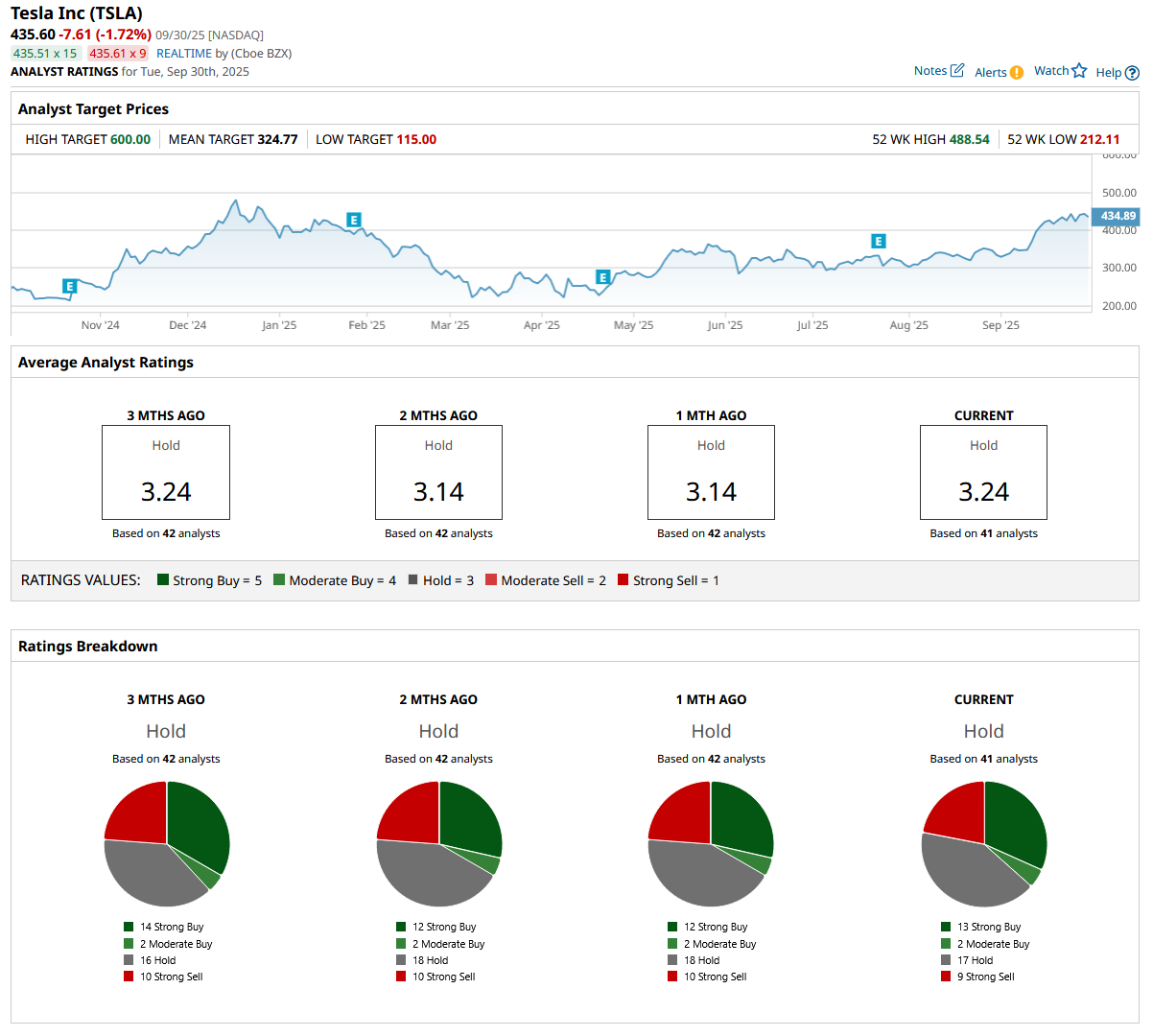

Out of the 41 analysts covering TSLA stock, 13 recommend “Strong Buy,” two recommend “Moderate Buy,” 17 recommend “Hold,” and nine recommend “Strong Sell.” The average TSLA stock price target is $324, below the current price of $435.