/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

Ford (F) stock tumbled Tuesday, Oct. 7, after reports of a fire at Novelis’s Oswego, New York, plant. The company, which is part of India’s Hindalco Industries, is a key aluminum (ALZ25) supplier to the U.S. automotive industry, and the fire is expected to disrupt aluminum supply in the country.

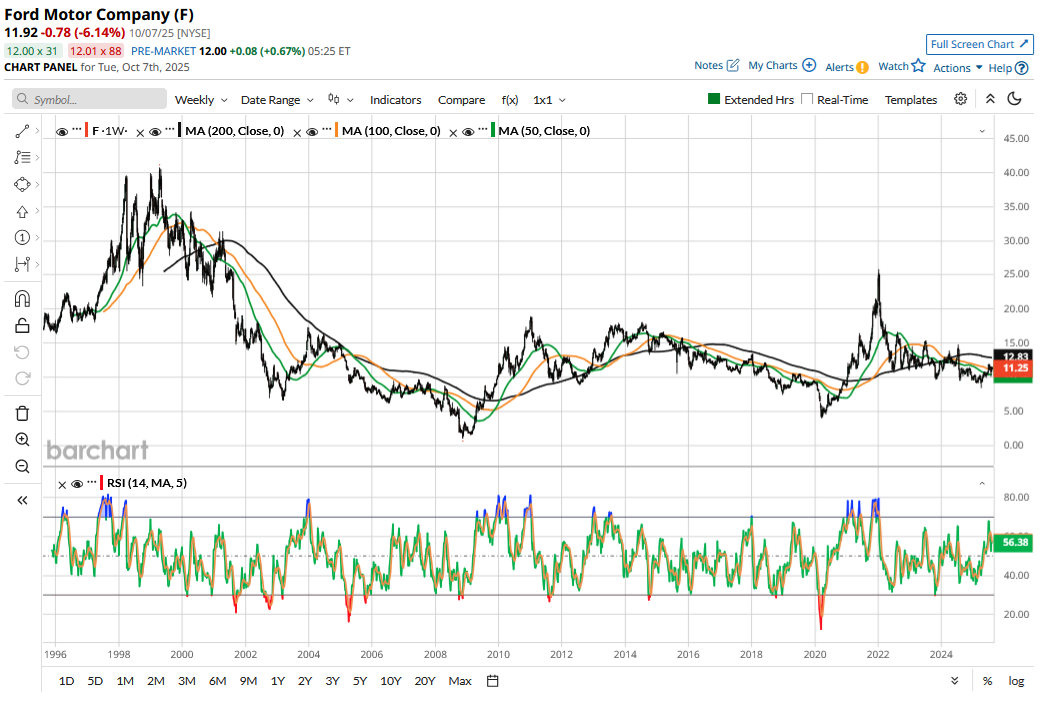

Notably, Ford was having a good run before yesterday’s drawdown and is still up nearly 20% for the year. While that won’t be the kind of “joyride” that we usually associate with stocks, it came amid a challenging market environment, marked by tariffs, which will shave off billions of dollars from the U.S. automotive industry’s profits this year.

Despite the headwinds, Ford is outperforming the S&P 500 Index ($SPX) this year, which is no easy feat in itself. Moreover, it is outperforming peers like General Motors (GM), Stellantis (STLA), and Toyota (TM).

Ford’s operating performance has meanwhile been mixed this year. Its deliveries have been strong, and U.S. sales rose 8.2% in Q3 2025 as it extended the growth streak to seven consecutive months, led by growth in both internal combustion engine (ICE) and electric vehicle (EV) portfolios. However, it has been marred by costly recalls.

Novelis Fire Could Impact Aluminum Supply for U.S. Automakers

Returning to the fire at Novelis’ facility, the company stated that it is “taking steps to minimize the impact” by sourcing materials from its plants outside the U.S. and collaborating with peers to source additional materials, while cautioning that the hot mill at the plant will not come online until early next year. Notably, while Novelis and automakers could potentially import aluminum to make up for the shortfall, these imports would attract a 50% tariff that President Donald Trump imposed earlier this year.

Meanwhile, even as an aluminum shortage could bite the U.S. automotive industry that’s still battling tariffs, pricing pressure amid macro slowdown, and still high interest rates, Ford might see the biggest impact from the supply disruption arising from the Novelis plant fire.

Ford Moved to an Aluminum Body for the F-150 With the 2015 Model Year

A decade back, Ford ditched steel and instead started using aluminum in its F-150 pickup. The move wasn’t surprising, as since aluminum is lighter than steel, aluminum-bodied trucks can have better fuel economy and higher payload capacity. It was a big gamble that Ford took with the F-150, which paid off well, and the F-150 continued to be America’s best-selling pickup. The over four-decade reign only ended last year as the Toyota RAV4 took the honors – a claim Ford disputed.

Why Are F-Series Trucks So Important for Ford?

Ford does not provide a breakdown by models, but the F-series trucks are believed to account for a large and outsized chunk of the company’s profits. While the electric vehicle (EV) pickup market never really took off, the F-150’s electric variant outsold Tesla’s (TSLA) Cybertruck in Q3 2025. Ford hasn’t yet provided any color on the impact from the Novelis fire incident apart from the boilerplate comment that it is “exploring all possible alternatives to minimize any potential disruptions.”

Ford is expected to provide an update on the financial repercussions in its upcoming Q3 earnings, scheduled for Oct. 23, where the company may update its full-year guidance if the financial impact is material.

How Would Novelis Fire Impact Ford?

Meanwhile, as things stand today, we don’t have much clarity on how the Novelis fire incident will impact F-150 production and, importantly, Ford’s profits. Given the lack of clarity, there hasn’t been any significant analyst action following reports of the incident.

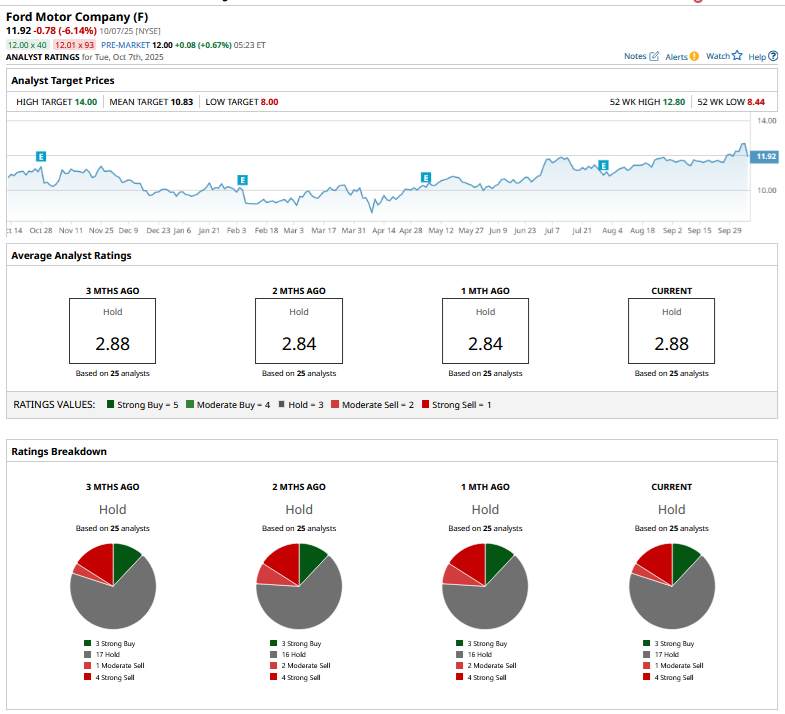

That said, Ford’s strong Q3 delivery performance is not lost on brokerages, and UBS and Wells Fargo have raised the stock’s target price this month. Jefferies went a step further and upgraded the stock from an “Underperform” to “Hold” while raising its target price from $9 to $12. However, Ford has a consensus rating of “Hold” from the 25 analysts tracked by Barchart, and the stock trades above its mean target price of $10.83.

Should You Sell Ford Stock?

I won’t panic sell my Ford holdings on the Novelis fire news, although it could have a significant impact on the company. I find Ford stock reasonably valued, even as the forward price-earnings multiple is now 10.95x, which is higher than what we have seen over the last three years.

The multiples appear elevated due to the earnings hit from tariffs, which Ford estimates will be $2 billion this year. There is still a lot of uncertainty over tariffs, and if the current regime continues, Ford might need to increase its U.S. manufacturing imprint, which would mean higher costs, as the reason Detroit auto giants moved production across the Southern border was to take advantage of low-cost labor.

Overall, I find Ford’s risk-reward quite balanced here. However, I won’t add to my positions yet as the current valuations are not tempting enough to trigger fresh purchases.