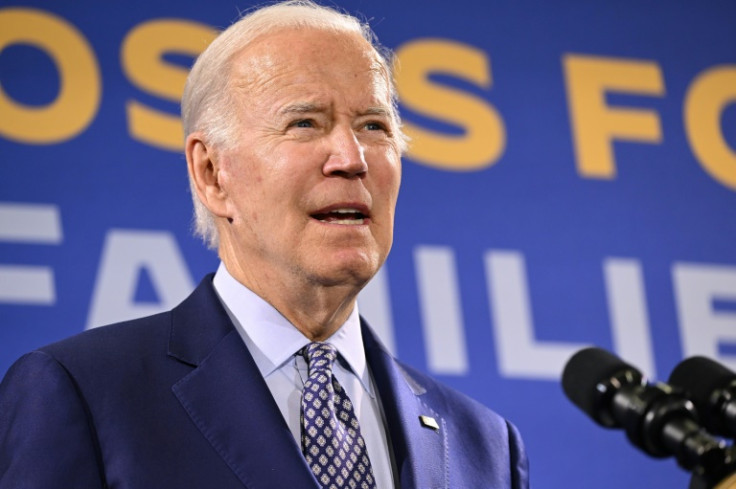

NEW YORK CITY - President Joe Biden has canceled an additional $1.2 billion in student loan debt, the Department of Education announced on Wednesday. Nearly 153,00 borrowers currently enrolled in the new repayment plan launched by the administration are expected to get an email Wednesday notifying them of the update.

The relief is the latest effort by the Biden administration to address the nation's $1.77 trillion in student debt. Last year, these efforts suffered a significant blow when the Supreme Court blocked the administration's program aimed at delivering up to $20,000 of relief to millions of borrowers struggling with outstanding debt.

Wednesday's email, which was the first to notify students of their forgiveness eligibility, includes a congratulatory message from President Biden.

"From day one of my Administration, I vowed to fix student loan programs so higher education can be a ticket to the middle class— not a barrier to opportunity," the message reads.

People who qualify for the latest debt forgiveness are those who are enrolled in the Saving on a Valuable Education (SAVE) repayment plan and who made at least 10 years of payments. Additionally, those who have had to borrow $12,000 or less for college qualified.

But what will this mean for Latino students? For some, the landscape of student loan and education is not necessarily an optimistic field. From inequities to education gaps, there are many disparities within the education system that affect minority students. Here are five quick facts about Latinos and student loan.

- White non-Hispanic families in the U.S. have a median wealth of $188,200, compared with $36,100 for Hispanic families, according to data analyzed by the Brookings Institution. Because of reasons like this, in 2016, about half of Hispanic families weren't able to contribute anything to the costs of their children's higher education, UnidosUS, an advocacy organization found.

- Latinos tend to take longer to graduate college, often because they're balancing school with work, CNBC reported. Financial stress and caregiving burdens lead to half of Hispanic students saying it is "very difficult" or "difficult" for them to remain in their post-secondary education program, a Gallup poll from last year found.

- Loan defaults (stopping loan repayment) tend to exacerbate long-standing wage, wealth and opportunity gaps. Around 29% of white borrowers default on their federal student loans compared to 40% of Hispanic borrowers and 50% of Black borrowers, according to The Pew Charitable Trusts.

- The Supreme Court's block on Biden's student loan debt relief plan last year heavily impacted Latinos. Under this plan, about half of all Latino borrowers would have had their entire debt forgiven, according to Excelencia in Education, a Latino student advocacy organization.

- Despite these shortcomings, Latino enrollment in higher education has increased significantly. According to Excelencia, the Latino student population has risen from 1.5 million in 2000 to 3.8 million in 2019 and more than 4 in 10 Hispanic students are the first in their family to attend college.

© 2024 Latin Times. All rights reserved. Do not reproduce without permission.