FirstEnergy Corp. (FE) is a leading Ohio-based electric utility holding company that provides electricity generation, transmission, and distribution services. With a market cap of $27.1 billion, FirstEnergy operates through multiple regulated subsidiaries serving approximately 6 million customers across Ohio, Pennsylvania, West Virginia, Maryland, New Jersey, and New York.

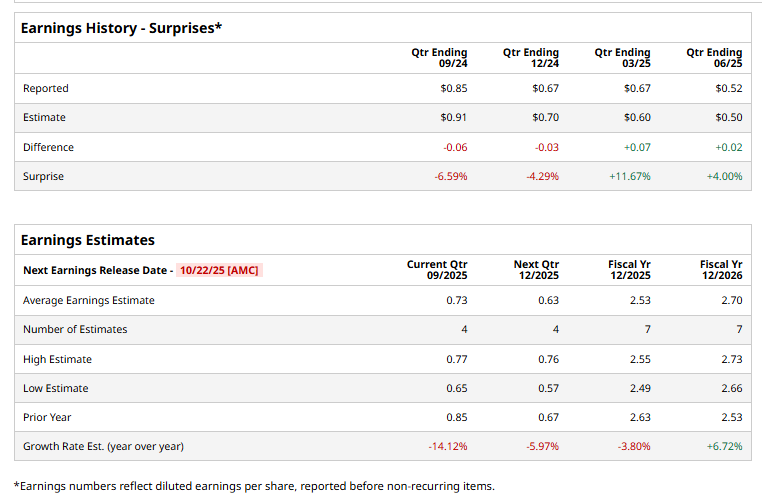

The utility company is set to announce its fiscal Q3 2025 earnings results after the market closes on Wednesday, Oct. 22. Ahead of this event, analysts expect FirstEnergy to report an adjusted EPS of $0.73, down 14.1% from $0.85 in the year‑ago quarter. It has exceeded Wall Street's earnings expectations in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the utility company to report adjusted EPS of $2.53, a decline of 3.8% from $2.63 in fiscal 2024. However, adjusted EPS is anticipated to grow 6.7% year-over-year to $2.70 in fiscal 2026.

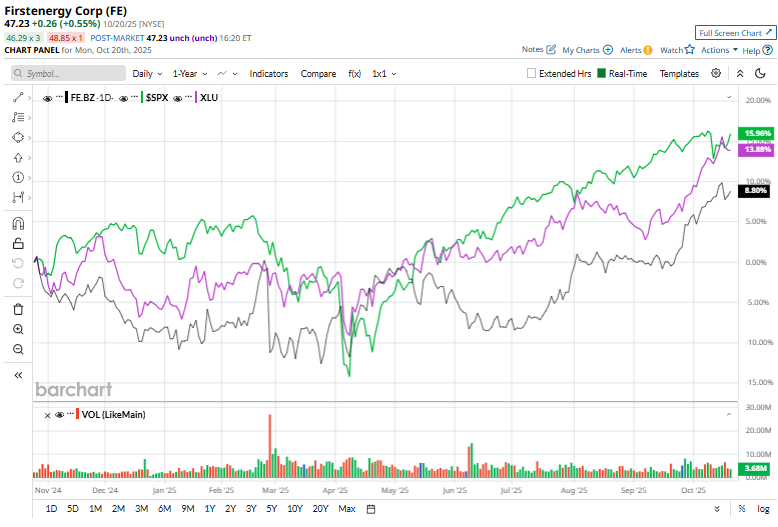

Shares of FirstEnergy have risen 8.2% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 14.8% return and the Utilities Select Sector SPDR Fund's (XLU) 11.7% gain over the same period.

On Oct. 16, FE shares slumped 1.9% after JPMorgan Chase & Co. (JPM) analyst Jeremy Tonet reaffirmed a “Hold” rating on FirstEnergy, with a price target of $47. Tonet cited the company’s stable utility operations and steady cash flow as supporting factors but highlighted ongoing challenges in the power generation segment, including regulatory pressures and the transition toward cleaner energy sources, which could weigh on near-term growth.

Analysts' consensus view on FirstEnergy stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 17 analysts covering the stock, six recommend a "Strong Buy," one "Moderate Buy," and 10 "Holds."

The mean price target of $47.83 implies a marginal upswing from the current market prices.