With a market cap of $23.2 billion, FirstEnergy Corp. (FE) is a diversified energy company that generates, transmits, and distributes electricity through its subsidiaries across the United States. Operating through its Distribution, Integrated, and Stand-Alone Transmission segments, the company serves customers in six states with a mix of coal, nuclear, hydroelectric, wind, and solar energy sources.

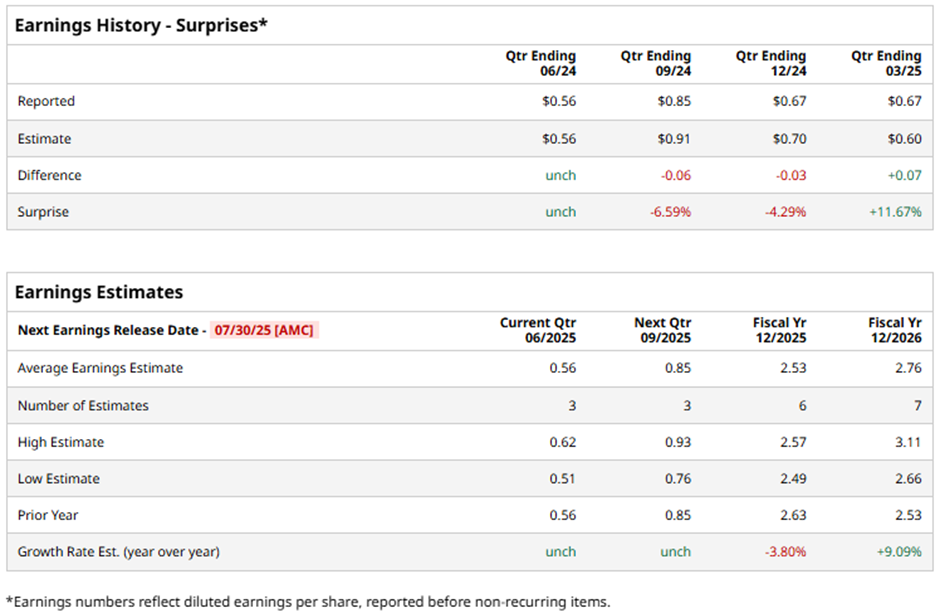

The Akron, Ohio-based company is slated to announce its fiscal Q2 2025 earnings results after the market closes on Wednesday, Jul. 30. Ahead of this event, analysts expect FirstEnergy to report an adjusted EPS of $0.56, matching the figure from the year‑ago quarter. It has exceeded or met Wall Street's earnings expectations in two of the past four quarters while missing on two other occasions. In Q1 2025, FE beat the consensus adjusted EPS estimate by 11.7% margin.

For fiscal 2025, analysts expect the utility company to report adjusted EPS of $2.53, a decline of 3.8% from $2.63 in fiscal 2024. However, adjusted EPS is anticipated to grow 9.1% year-over-year to $2.76 in fiscal 2026.

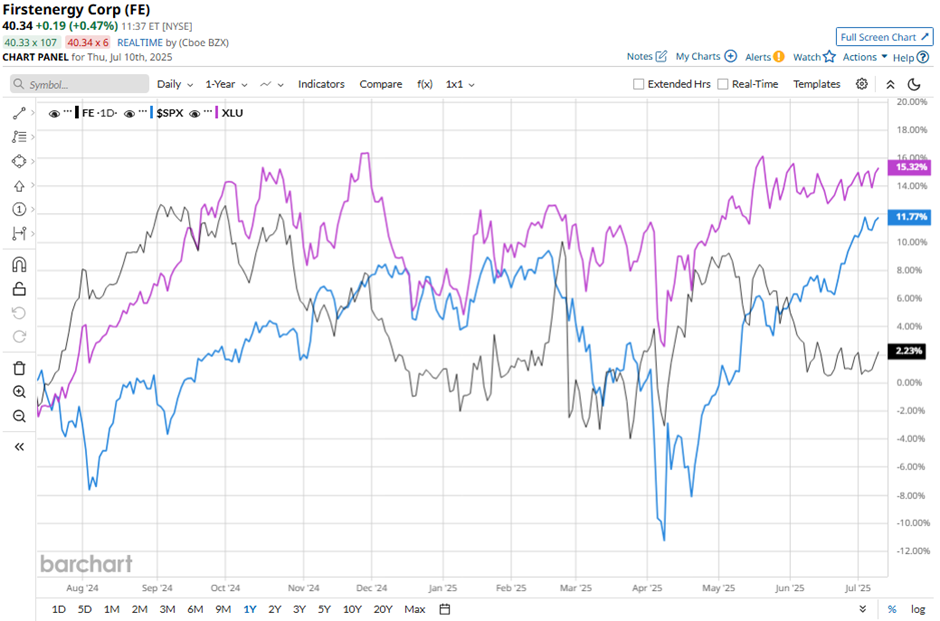

Shares of FirstEnergy have risen 3.7% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 11.3% return and the Utilities Select Sector SPDR Fund's (XLU) 18.2% gain over the same period.

Despite FirstEnergy beating Q1 2025 expectations with adjusted EPS of $0.67 and revenue of $3.8 billion on Apr. 23, shares fell marginally the next day due to cautious investor sentiment around its full-year guidance. The company projected 2025 core EPS in the range of $2.40 - $2.60, below the consensus estimate.

Analysts' consensus view on FirstEnergy stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 16 analysts covering the stock, six recommend a "Strong Buy," one "Moderate Buy," and nine "Holds."

As of writing, the stock is trading below the average analyst price target of $45.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.