/solar%20power%20ecology%20by%20vvaldmann%20via%20Shuttershock.png)

First Solar (FSLR) is on deck to report its Q2 2025 earnings report after tonight’s closing bell, with analysts expecting revenues of $1.04 billion and earnings per share of $2.68, on average. Heading into the release, FSLR stock is trading down about 10% from its year-to-date high set in January, having underperformed the broader equities market in 2025.

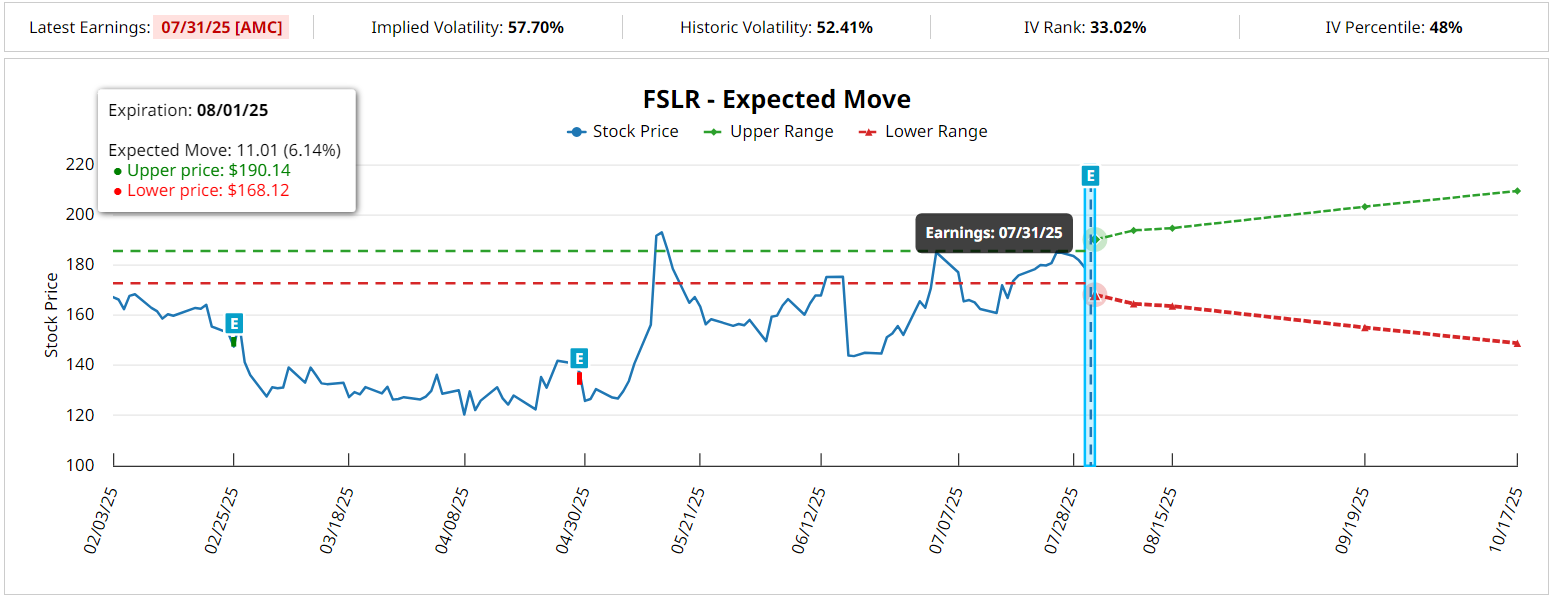

Options traders are looking for a bigger-than-usual price swing out of FSLR in tomorrow’s post-earnings session. The stock’s weekly Aug. 1 options series reflects expectations for a 6.14% move in either direction, compared to FSLR’s average earnings reaction of 5.40% over the past four quarters.

That projected move would put FSLR stock around $190 on the upside, and near $168 on the downside.

The high end of that range roughly coincides with the solar stock’s May highs, while the low end roughly aligns with the site of First Solar’s 50-day and 200-day moving averages.

First Solar’s Footing in a Volatile Industry

The company's strategic focus on expanding U.S. manufacturing capacity has been advantageous, and FSLR in particular has benefited from Section 45X tax credits for domestically manufactured modules. However, First Solar faces challenges from lower capacity utilization at its Malaysian and Vietnam facilities due to U.S. tariff impacts, while a shift in sales mix toward the lower-priced Indian market could pressure margins.

Despite these headwinds, First Solar's strong project pipeline and healthy balance sheet suggest the potential for continued growth. Plus, the company's foothold in the U.S. market could continue to provide a competitive edge as demand for domestically produced solar components continues to rise, and as the U.S. investigates potential tariff circumvention by Chinese manufacturers operating through facilities in Indonesia, India, and Laos.

What Does Wall Street Say About FSLR Stock?

Recent analyst actions have been largely positive, with Susquehanna, J.P. Morgan, and Bank of America all raising their respective price targets within the past week. FSLR is rated a “Strong Buy” overall, with an average price target of $205.37.

Looking ahead, First Solar's ability to execute on its capacity expansion plans and optimize its global manufacturing footprint will be critical factors for the stock's performance, but domestic energy policy remains a potential wild card that could contribute to headline-driven volatility in the near term. At a historically discounted 11.74 times forward adjusted earnings, however, investors with a long-term time frame may want to consider FSLR shares around current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.