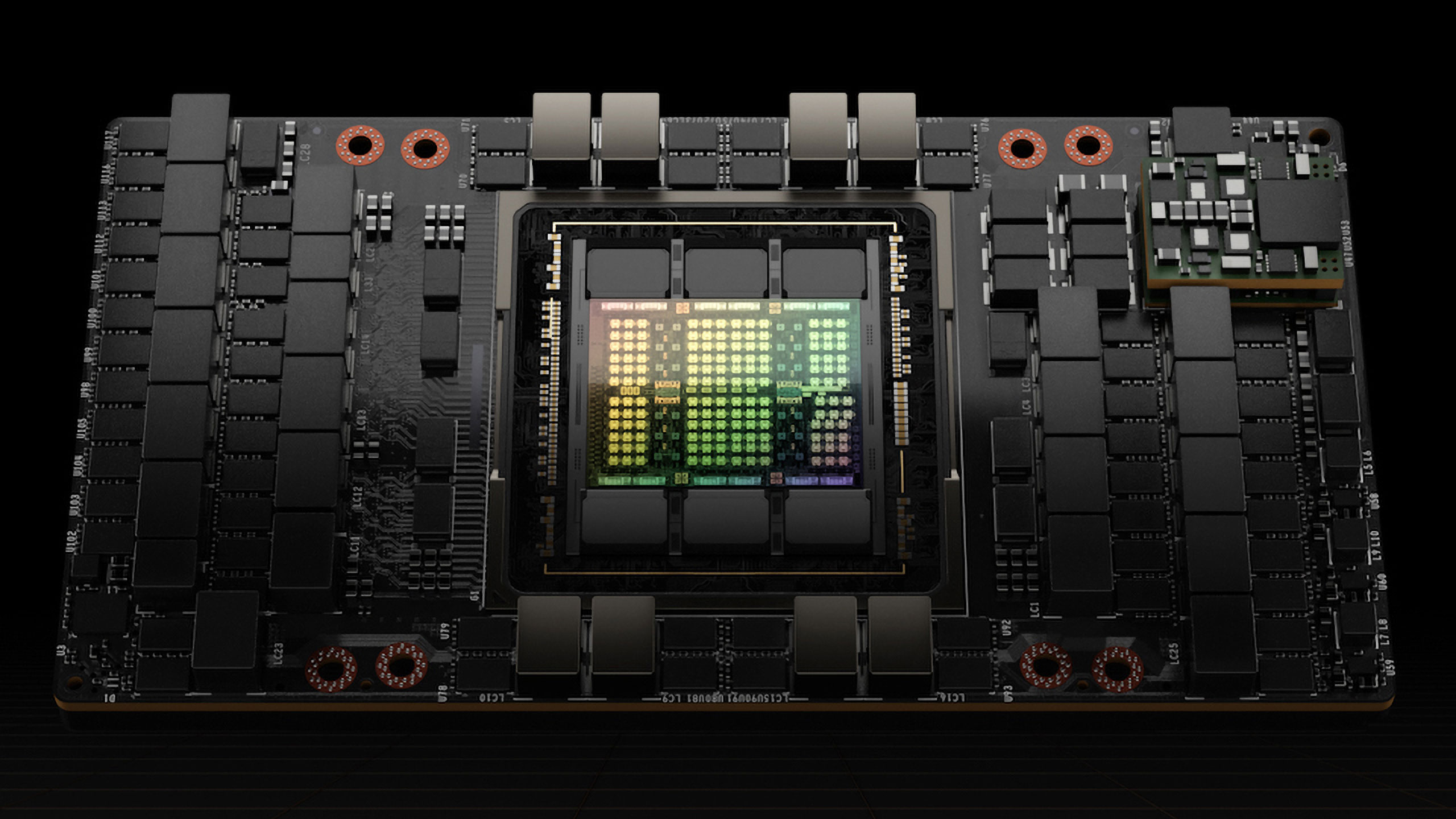

CoreWeave, a cloud provider of GPU-accelerated computing that is backed by Nvidia, has secured a $2.3 billion credit line by putting its Nvidia's H100 compute GPUs up as collateral. The company already has a fleet of H100s and will use the funding to buy additional H100 hardware, build new data centers, and recruit to cater to the increasing demand for AI workloads, Reuters reports.

CoreWeave has benefited from the surge in generative AI, owing to its purpose-built large-scale cloud infrastructure and exclusive access to Nvidia's latest compute GPUs and systems on their base, such as the H100 processors and the HGX H100 supercomputing platforms, which are in limited supply. The latter provides the company a competitive edge over traditional cloud providers such as AWS, Google, and Microsoft.

Despite being competitors, the company collaborates with AI startups and big cloud service providers to construct clusters that power AI workloads. These competitors are currently dealing with Nvidia GPU supply constraints while simultaneously developing their own chips for AI. Such a strategy is not particularly surprising as many AI and HPC applications in use today were designed for Nvidia's CUDA platform, so they have to be run on Nvidia hardware. Meanwhile, emerging AI workloads can use AI processors developed by AWS and Google in-house.

CoreWeave's competitive edge, enabled by access to Nvidia's latest hardware, is a primary reason why CoreWeave secured such a huge debt facility, led by Magnetar Capital and Blackstone. The debt facility also includes contributions from other lenders such as Coatue, DigitalBridge, BlackRock, PIMCO, and Carlyle. CoreWeave had previously raised $421 million from Magnetar at a valuation of over $2 billion.

This is not the first time an Nvidia-backed startup has reaped huge benefits from its relationship with the green giant. Just last month, Inflection AI built a supercomputer based on 22,000 Nvidia H100 compute GPUs that cost hundreds of millions of dollars.

The collateralization of the Nvidia H100-based hardware, one of the most powerful processors for artificial intelligence and high-performance computing workloads, underscores the significance of such hardware in the capital-intensive AI and HPC cloud business.

Also, this substantial loan signifies the expanding market for private asset-based financing. Private equity firms increasingly opt for lower-risk lending, secured by tangible assets, and are taking on more corporate debt as banks become more cautious.

"We negotiated with them to find a schedule for how much collateral to go into it, what the depreciation schedule was going to be versus the payoff schedule," said Michael Intrator, chief executive at CoreWeave. "For us to go out and to borrow money against the asset base is a very cost effective way to access the debt markets."

Last week, the company announced a $1.6 billion data center in Texas and has plans to extend its reach to 14 locations within the U.S. by the end of the year.