When it comes to trading options, finding the right contract is only half the battle. The real edge comes from knowing exactly how that trade could perform under different market conditions.

In one of our latest videos, Rick Orford explains how to analyze deep in-the-money call options using Barchart’s Profit and Loss (PnL) charting tool. Here’s a quick overview of what you’ll learn in the clip.

Step 1: Start with the Profit & Loss Tab

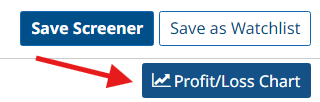

Clicking the chart icon on the options screener pulls up the PnL chart:

- Hover over price to see exact profit/loss at expiration.

- Track open interest to gauge liquidity.

This lets you visualize risk and reward before entering the trade.

Step 2: Review the Greeks

PnL charts also display the Greeks — Delta, Theta, Gamma, Vega, and Rho.

Example: Theta = -1.78 → the option loses about $1.78/day in extrinsic value, all else being equal.

As the stock rises, theta impact declines — a key insight for long calls.

Step 3: Check the Expected Move

The Expected Move tab graphs the likely price range based on at-the-money straddle premiums. For SMCI, it showed $31–$90.42.

You’ll also see earnings dates & average post-earnings moves over the last four quarters.

Step 4: Analyze Volatility

Don’t just look at implied volatility; always put it in context using the IV Rank.

SMCI’s IV of 80.99% looks high, but IV Rank shows it’s actually low compared to its 52-week high of 219%.

This changes the whole picture of whether options are expensive or cheap.

Step 5: Use the Trend Tab for Technicals

Technical traders will love the Trend tab:

- Moving average signals (20, 50, 100-day)

- ATR (average daily move = $2.73 for SMCI)

- RSI = 68.55 (nearing overbought territory)

These indicators give you another layer of confidence before pulling the trigger.

Bottom Line

Barchart’s PnL charts give traders a 360° view of any options trade — from Greeks and volatility to technical trends. Combine this with strategies like deep ITM calls, and you’re trading with clarity instead of guesswork.

Watch the full video with Rick Orford for more, and try Barchart’s Profit & Loss tool directly from our options screeners.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.