During its first earnings report as a publicly traded company, design tools maker Figma Inc. (NYSE:FIG) revealed a surprise in its balance sheet: a sizable position in Bitcoin (CRYPTO: BTC).

FIG is feeling the pressure from bearish momentum. Track the latest developments here.

Bitcoin Treasury Holdings

On Wednesday, during its second-quarter earnings call, Figma’s CFO, Praveer Melwani, disclosed that the company held a $91 million stake in a Bitcoin exchange-traded fund, part of its $1.6 billion treasury holdings, comprising cash and marketable securities.

“Within the $1.6 billion, we also held approximately $91 million in our Bitcoin exchange-traded fund,” Melwani said, and while this figure pales in comparison to the company’s $33.2 billion market cap, it joins the growing list of Bitcoin treasury companies, which maintain a significant portion of their liquidity in the digital asset.

See Also: Here’s How Much You Would Have Made Owning Adobe Stock In The Last 20 Years

Neither Melwani nor the company addressed its Bitcoin holdings any further than this, so there is no clarity regarding what exactly the company plans to do with Bitcoin in its treasury holdings.

Margin Compression And ‘M&A At Scale’

During the call, Melwani warned that Figma’s margins could come under pressure, as it ramps up its growing list of AI products and features.

“We anticipate that we will see further gross margin compression in the near term as we roll out our AI products, including FigmaMake, and recognize increases in inference spend,” he said. “This is the largest driver of the quarter-over-quarter change in our gross margin.”

Talking more about capital allocation, co-founder and CEO Dylan Field emphasized that the company is willing to take bold bets. “As I indicated in my founder letter, we're very willing to take big bets if we truly believe in them,” Field said. He added that for larger acquisitions, “we have a very high bar for M&A at scale.”

Stock Plunges Amid Earnings Miss

The company released its second-quarter results on Wednesday, reporting $249.64 million in revenue, up from $177.19 million a year ago and ahead of consensus estimates at $228.2 million.

Earnings, however, fell significantly short of estimates at zero cents per share during the quarter, against analyst consensus of $0.18 per share.

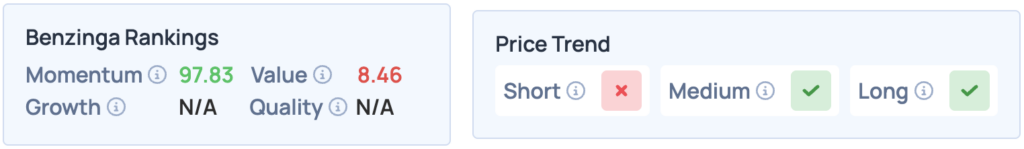

Figma shares were up 3.90% on Wednesday, closing at $68.13, but are down 15.36% after hours, following the earnings announcement. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the Medium and Long terms. Click here for deeper insights into the stock.

Read More:

Photo courtesy: M.oo / Shutterstock.com