/Fidelity%20National%20Information%20Services%2C%20Inc_%20logo%20outside%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market capitalization of $37.2 billion, Fidelity National Information Services, Inc. (FIS) is a leading American multinational headquartered in Jacksonville, Florida, providing financial technology solutions to over 20,000 clients worldwide, including banks, asset managers, and businesses.

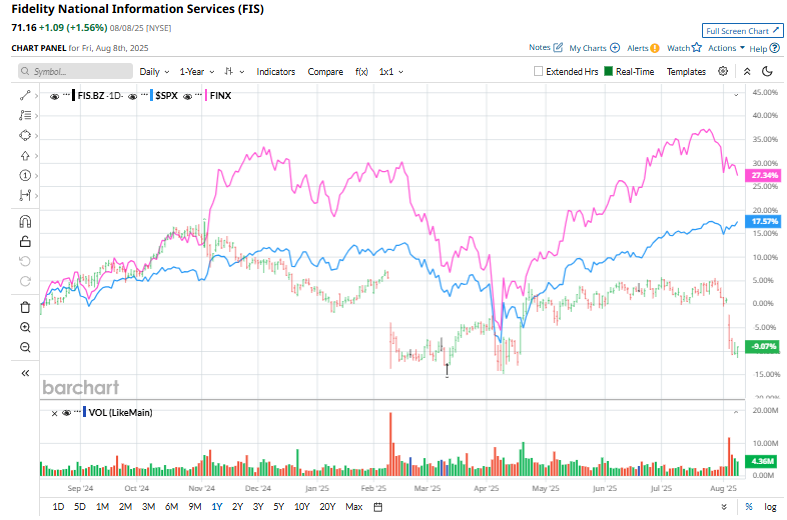

Shares of this leading fintech company have trailed the broader market over the past year. FIS has declined 6.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 20.1%. Moreover, in 2025, FIS stock is down 14.7%, compared to the SPX’s 8.6% rise on a YTD basis.

Zooming in further, FIS has also underperformed the Global X FinTech ETF (FINX). The exchange-traded fund has gained 30.2% over the past year and 4.9% in 2025.

On Aug. 5, FIS released its second-quarter earnings, and its shares dipped more than 8%. Its revenue rose 5% year-over-year to about $2.6 billion, driven by growth across both its Banking Solutions and Capital Markets segments. Adjusted EPS came in at $1.36, in line with expectations, while adjusted EBITDA margins held steady at roughly 39.8%.

However, the company reported a net loss of approximately $470 million, primarily due to a non-cash tax charge tied to the sale of Worldpay. Additionally, adjusted free cash flow decreased to $292 million from $504 million the previous year, reflecting higher expenses and timing factors.

For the current fiscal year, which ends in December, analysts expect FIS’ EPS to grow 10.3% to $5.76 on a diluted basis. The company’s earnings surprise history is solid. It beat or met the consensus estimate in each of the last four quarters.

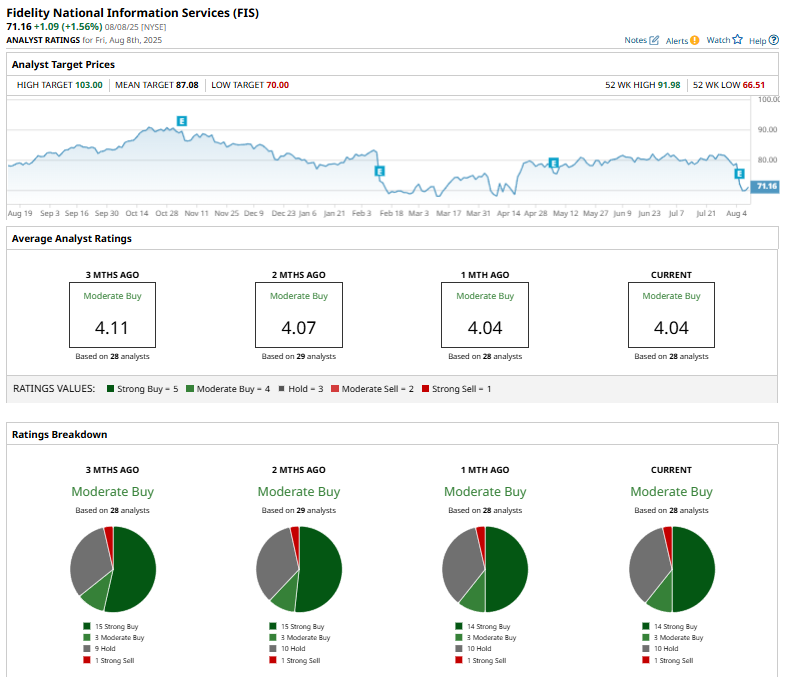

Among the 28 analysts covering FIS stock, the consensus is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, three “Moderate Buys,” ten “Holds,” and one “Strong Sell.”

This configuration is more bearish than two months ago, with 15 analysts suggesting a “Strong Buy.”

On August 6, Keefe, Bruyette & Woods’ Vasundhara Govil maintained an “Outperform” rating on Fidelity National Information Services but lowered the price target from $92 to $88.

The mean price target of $87.08 represents a 22.4% premium to FIS’ current price levels. The Street-high price target of $103 suggests an ambitious upside potential of 44.7%.