/Fedex%20Corp%20ground%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Memphis, Tennessee-based FedEx Corporation (FDX) is the leader in global express delivery services, providing transportation, e-commerce, and business services in the U.S. and internationally. With a market cap of $63.1 billion, FedEx operates through FedEx Express and FedEx Freight segments.

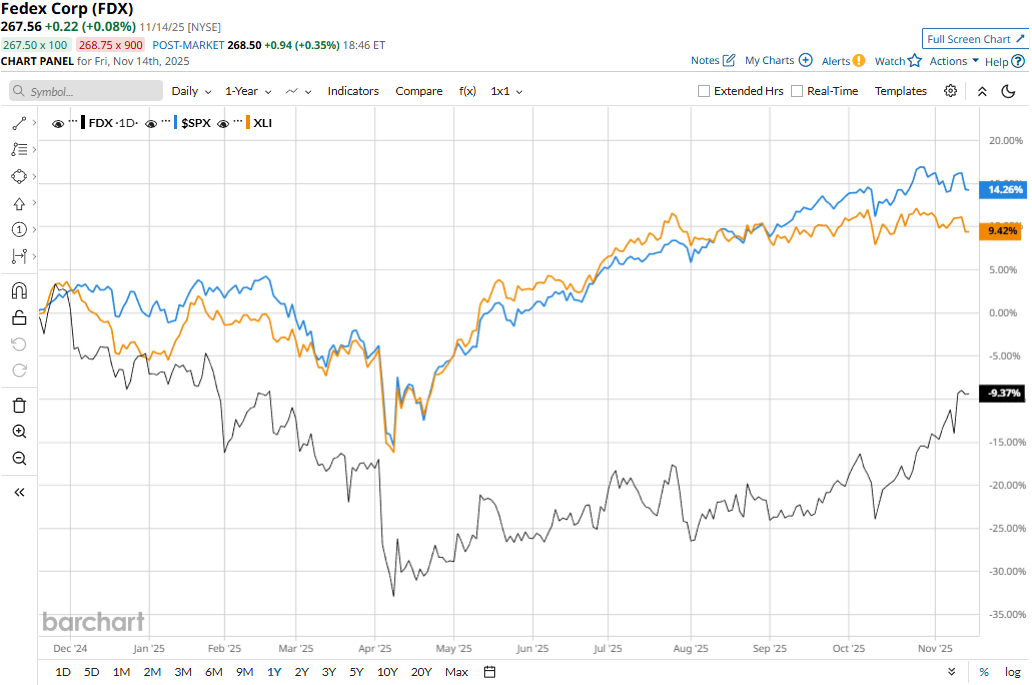

FedEx has significantly underperformed the broader market over the past year. FDX stock prices have declined 4.9% on a YTD basis and 8.5% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.5% gains in 2025 and 13.2% returns over the past year.

Narrowing the focus, FedEx has also underperformed the sector-focused Industrial Select Sector SPDR Fund’s (XLI) 15.4% surge on a YTD basis and 8.7% uptick over the past 52 weeks.

FedEx’s stock prices gained 2.3% in the trading session following the release of its better-than-expected Q1 results on Sept. 18. Driven by the solid growth observed in its express segment, the company’s overall topline for the quarter grew 3.1% year-over-year to $22.2 billion, beating the Street’s expectations by 2.2%.

Meanwhile, the company has been focused on improving its operational efficiency by leveraging its extensive network, which moves 17 million packages daily. Its strategic initiatives have led to notable margin improvements. FedEx’s adjusted EPS for the quarter grew 6.4% year-over-year to $3.83, beating the consensus estimates by 4.9%. Further, the company remains committed to reducing its costs by $1 billion permanently from its structural cost reductions.

For the full fiscal 2026, ending in May, analysts expect FDX to deliver an adjusted EPS of $17.97, down 1.2% year-over-year. The company has a mixed earnings surprise history. It has surpassed the Street’s bottom-line estimates thrice over the past four quarters, while missing on one other occasion.

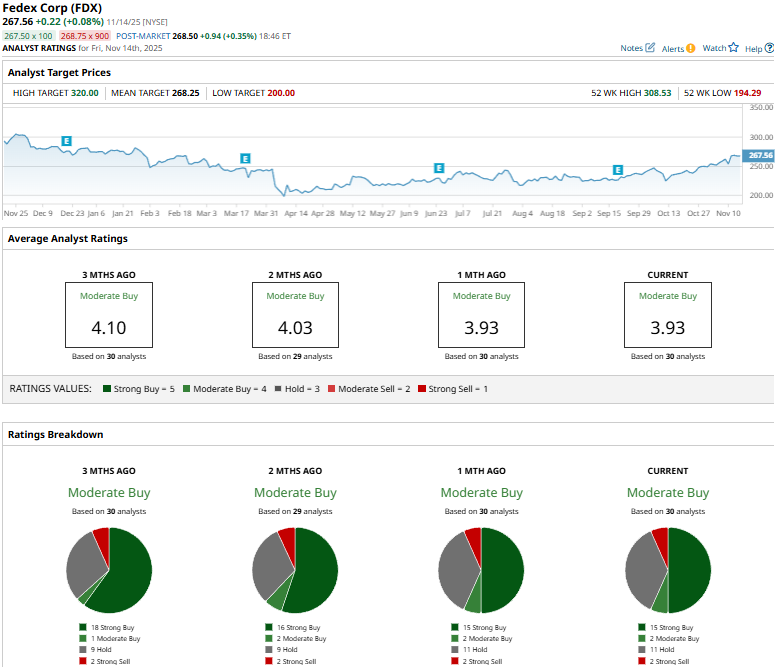

Among the 30 analysts covering the FDX stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buys,” two “Moderate Buys,” 11 “Holds,” and two “Strong Sells.”

This configuration is substantially less optimistic than three months ago, when 18 analysts gave “Strong Buy” recommendations.

On Nov. 7, Wells Fargo (WFC) analyst Christian Wetherbee maintained an “Equal-Weight” rating on FDX and raised the price target from $250 to $280.

FedEx’s mean price target of $268.25 represents a marginal premium to current price levels. Meanwhile, the street-high target of $320 suggests a notable 19.6% upside potential.