/Fedex%20Corp%20cargo%20planes-by%20Teka77%20via%20iStock.jpg)

With a market cap of $66.6 billion, FedEx Corporation (FDX) is a global provider of transportation, e-commerce, and business services operating through its Federal Express and FedEx Freight segments across the United States and international markets. The company offers a broad portfolio that includes express and freight transportation, logistics and supply chain solutions, digital and printing services, and comprehensive business support offerings.

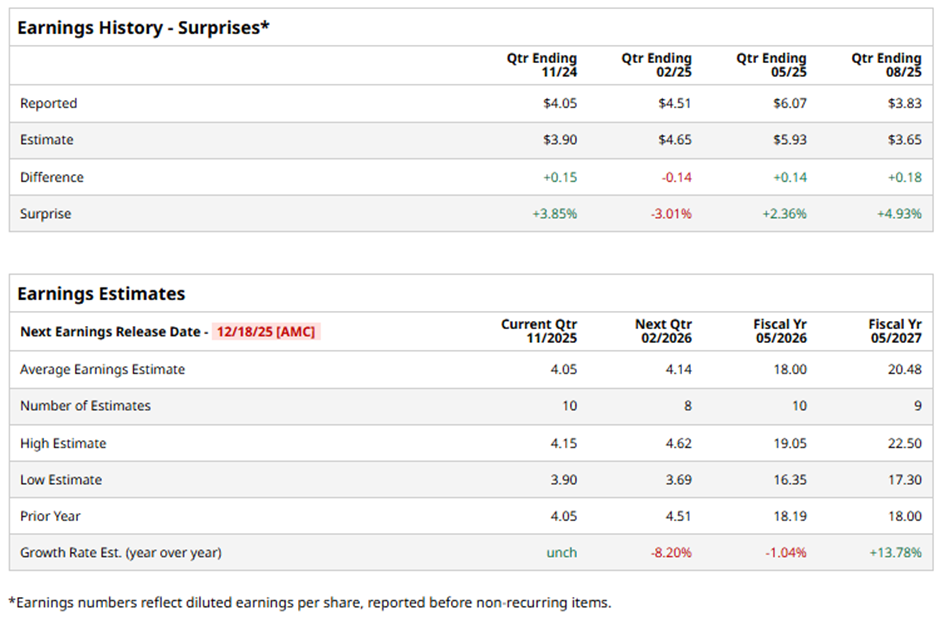

The Memphis, Tennessee-based company is set to report its Q2 2026 results after the market closes on Thursday, Dec. 18. Ahead of this event, analysts expect FDX to report an adjusted EPS of $4.05, in line with the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2026, analysts forecast FedEx to report an adjusted EPS of $18, down over 1% from $18.19 in fiscal 2025. However, adjusted EPS is anticipated to grow 13.8% year-over-year to $20.48 in fiscal 2027.

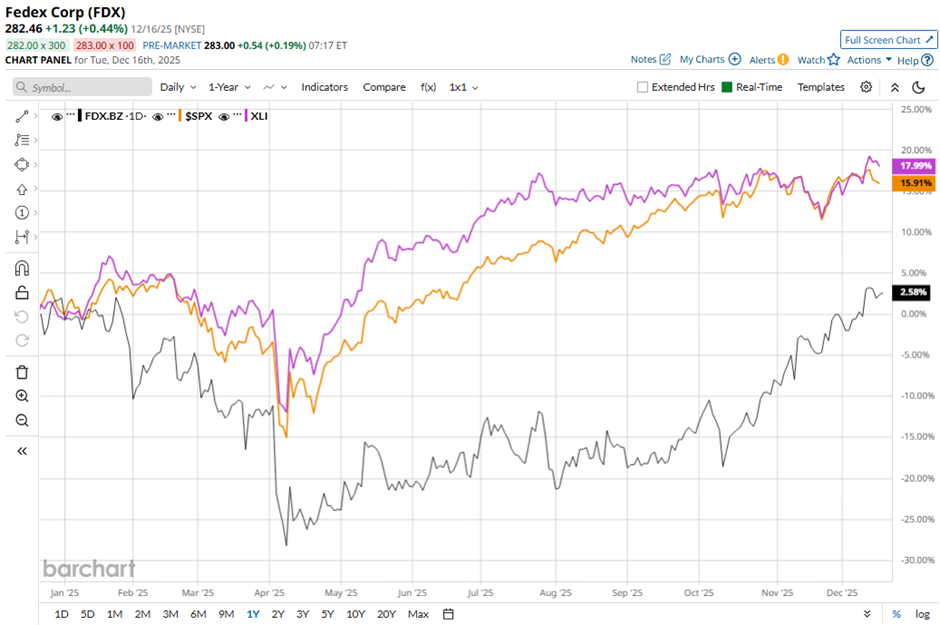

Shares of FedEx have dropped marginally over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) nearly 12% increase and the Industrial Select Sector SPDR Fund’s (XLI) 13.5% gain over the same period.

Shares of FDX rose 2.3% following its Q1 2026 results on Sep. 18 because the company posted solid year-over-year earnings growth, with adjusted operating income increasing to $1.30 billion and adjusted EPS rising to $3.83, driven by strong U.S. domestic package revenue and structural cost reductions. Investors were also encouraged by FedEx’s fiscal 2026 outlook, including 4% - 6% revenue growth and $17.20 - $19 adjusted EPS after excluding optimization, spin-off, and fiscal-year-change costs.

Additionally, confidence improved due to FedEx completing $500 million in share repurchases during the quarter and advancing toward the planned June 2026 spin-off of FedEx Freight.

Analysts' consensus view on FDX stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 29 analysts covering the stock, 16 recommend "Strong Buy," two "Moderate Buys," nine suggest "Hold," one has a "Moderate Sell," and one advises "Strong Sell." As of writing, it is trading above the average analyst price target of $276.39.