Inflation continues to be a concern, with producer prices jumping a record 8.3% for the month of August. However, stocks saw a desperately needed bounce on Friday, led by reopening plays such as Delta Air Lines

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

Csg Systems Intl Inc (CSGS)

Csg Systems Intl Inc is our first Top Buy today. The company provides business support systems software and services, primarily to the telecommunications industry. Our AI systems rated Csg Systems B in Technicals, C in Growth, A in Low Volatility Momentum, and A in Quality Value. The stock closed down 1.59% to $47.54 on volume of 145,279 vs its 10-day price average of $48.21 and its 22-day price average of $47.53, and is up 5.86% for the year. Revenue grew by 2.25% in the last fiscal year and grew by 15.75% over the last three fiscal years, Operating Income grew by 17.84% over the last three fiscal years, and EPS grew by 12.02% in the last fiscal year and grew by 1.43% over the last three fiscal years. Revenue was $990.53M in the last fiscal year compared to $875.06M three years ago, Operating Income was $133.9M in the last fiscal year compared to $113.59M three years ago, EPS was $1.82 in the last fiscal year compared to $2.01 three years ago, and ROE was 14.34% in the last year compared to 18.79% three years ago. Forward 12M Revenue is expected to grow by 0.24% over the next 12 months, and the stock is trading with a Forward 12M P/E of 14.54.

Fedex Corp (FDX)

Fedex Corp is our second Top Buy today. FedEx is a delivery and logistics giant whose importance cannot be overstated due to surging growth and increased demand for e-commerce. Our AI systems rated Fedex B in Technicals, B in Growth, B in Low Volatility Momentum, and B in Quality Value. The stock closed down 0.69% to $259.22 on volume of 2,132,772 vs its 10-day price average of $264.95 and its 22-day price average of $269.17, and is up 2.38% for the year. Revenue was $83959.0M in the last fiscal year compared to $69693.0M three years ago, Operating Income was $7956.0M in the last fiscal year compared to $1581.0M three years ago, EPS was $19.48 in the last fiscal year compared to $2.03 three years ago, and ROE was 24.64% in the last year compared to 2.91% three years ago. The stock is also trading with a Forward 12M P/E of 12.18.

Qualcomm Inc (QCOM)

Semiconductor giant Qualcomm is our third Top Buy today. Outside of producing semiconductors, the San Diego-based Qualcomm creates intellectual property, software, and services related to wireless technology. Our AI systems rated Qualcomm C in Technicals, B in Growth, B in Low Volatility Momentum, and A in Quality Value. The stock closed down 0.66% to $141.58 on volume of 6,190,783 vs its 10-day price average of $144.39 and its 22-day price average of $144.6, and is down 4.66% for the year. Revenue grew by 38.44% in the last fiscal year and grew by 44.07% over the last three fiscal years, Operating Income grew by 65.95% in the last fiscal year and grew by 173.82% over the last three fiscal years, and EPS grew by 77.05% in the last fiscal year and grew by -335.85% over the last three fiscal years. Revenue was $23531.0M in the last fiscal year compared to $22611.0M three years ago, Operating Income was $6227.0M in the last fiscal year compared to $3774.0M three years ago, EPS was $4.52 in the last fiscal year compared to $(3.39) three years ago, and ROE was 94.63% in the last year compared to (31.46%) three years ago. Forward 12M Revenue is expected to grow by 8.8% over the next 12 months, and the stock is trading with a Forward 12M P/E of 15.74.

Rollins Inc (ROL)

Rollins Inc is today’s next Top Buy. Rollins Inc

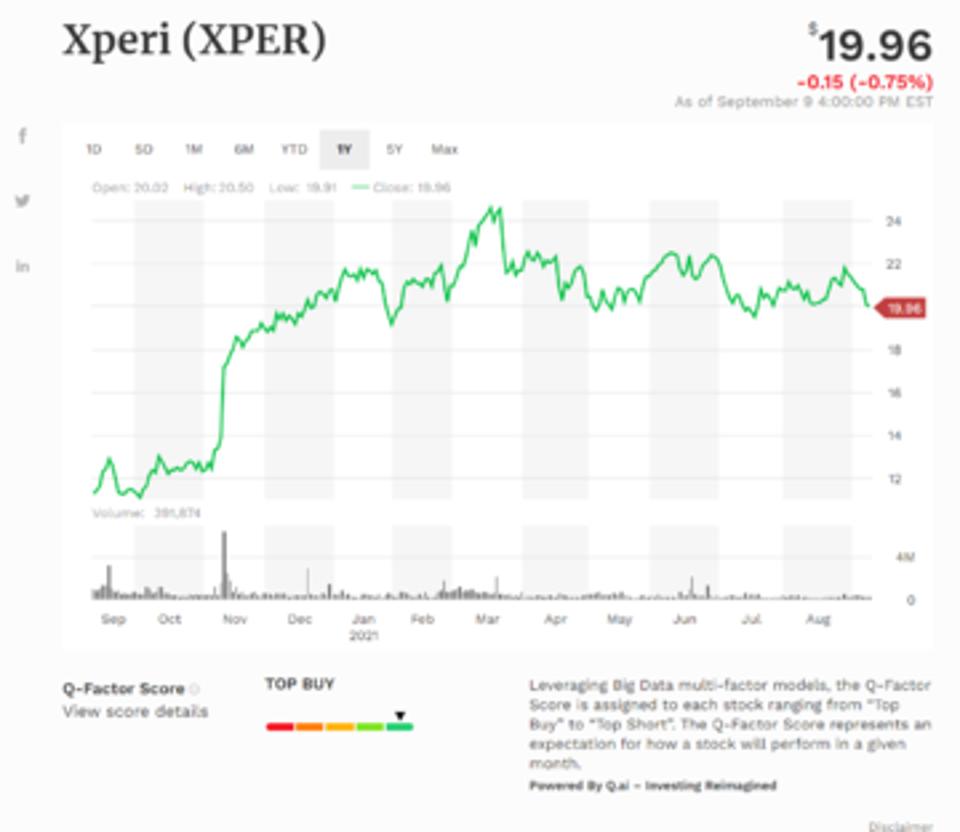

Xperi Holding Corp (XPER)

Xperi Holding Corp is our final Top Buy of the day. Xperi Holding Corp is a licenser of technology and intellectual property in sectors such as mobile computing, communications, memory and data storage, three-dimensional integrated circuit technologies, and more. Our AI systems rated the company A in Technicals, B in Growth, B in Low Volatility Momentum, and B in Quality Value. The stock closed down 0.75% to $19.96 on volume of 391,987 vs its 10-day price average of $20.93 and its 22-day price average of $20.75, and is down 1.82% for the year. Revenue grew by 21.14% in the last fiscal year and grew by 166.07% over the last three fiscal years, Operating Income grew by 6.34% in the last fiscal year and grew by 426.24% over the last three fiscal years, and EPS grew by -14422.39% over the last three fiscal years. Revenue was $892.02M in the last fiscal year compared to $406.13M three years ago, Operating Income was $247.83M in the last fiscal year compared to $50.08M three years ago, EPS was $1.75 in the last fiscal year compared to $(0.01) three years ago, and ROE was 14.41% in the last year compared to (0.33%) three years ago. The stock is also trading with a Forward 12M P/E of 13.8.

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.