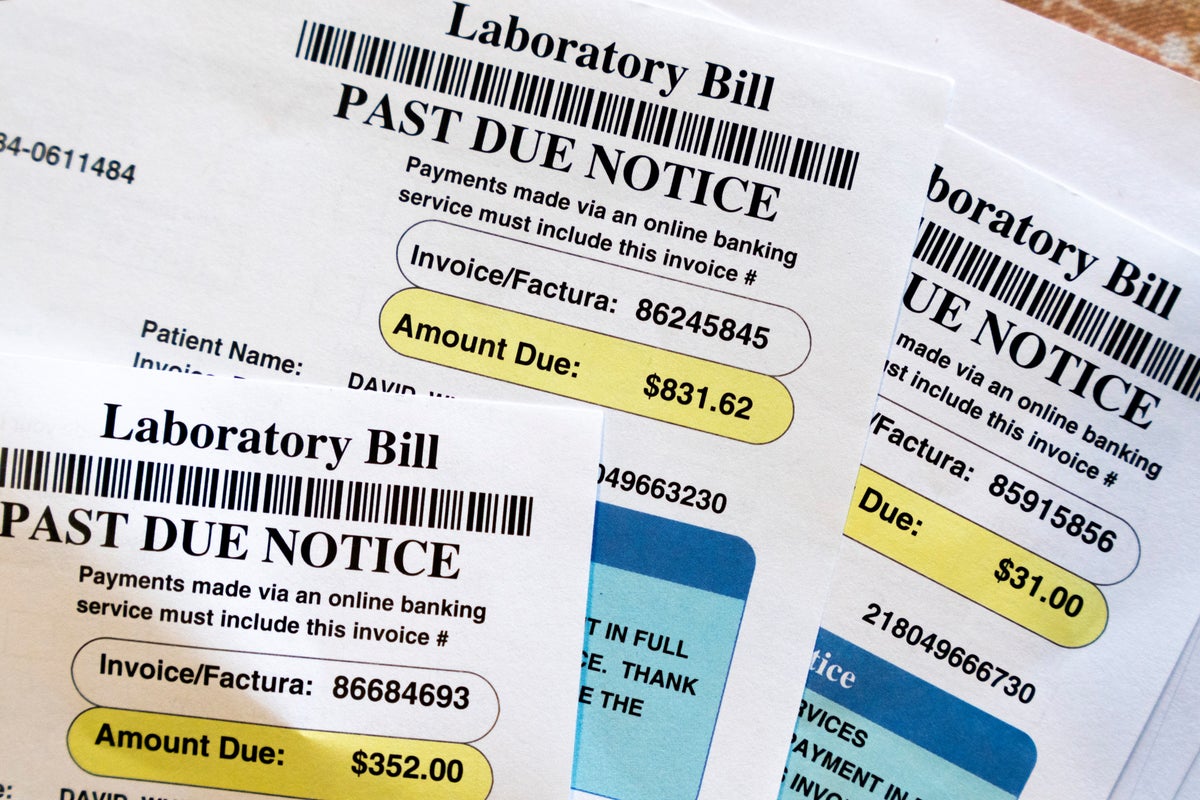

A federal judge in Texas removed a Biden-era finalized ruled by the Consumer Financial Protection Bureau that would have removed medical debt from credit reports.

U.S. District Court Judge Sean Jordan of Texas's Eastern District, who was appointed by Trump, found on Friday that the rule exceeded the CFPB 's authority. Jordan said that the CFPB is not permitted to remove medical debt from credit reports according to the Fair Credit Reporting Act, which protects information collected by consumer reporting agencies.

Removing medical debts from consumer credit reports was expected to increase the credit scores of millions of families by an average of 20 points, the bureau said. The CFPB states that its research has shown outstanding healthcare claims to be a poor predictor of an individual’s ability to repay a loan, yet they are often used to deny mortgage applications.

The three national credit reporting agencies — Experian, Equifax, and TransUnion — announced last year that they would remove medical collections under $500 from U.S. consumer credit reports. The CFPB’s rule was projected to ban all outstanding medical bills from appearing on credit reports and prohibit lenders from using the information.

The CFPB estimated the rule would have removed $49 million in medical debt from the credit reports of 15 million Americans. According to the agency, one in five Americans has at least one medical debt collection account on their credit reports, and over half of the collection entries on credit reports are for medical debts. The problem disproportionately affects people of color, the CFPB has found: 28% of Black people and 22% of Latino people in the U.S. carry medical debt versus 17% of white people.

The CFPB was established by Congress after the 2008 financial crisis to monitor credit card companies, mortgage providers, debt collectors and other segments of the consumer finance industry. Earlier this year, the Trump administration requested that the agency halt nearly all its operations, effectively shutting it down.

—

“The Associated Press receives support from Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy. The independent foundation is separate from Charles Schwab and Co. Inc. The AP is solely responsible for its journalism.”