Federal Reserve Governor Christopher Waller argued for "continuing rate cuts" on Monday, stating he supports cutting the Fed’s policy rate at its next meeting in December to manage risks from a deteriorating labor market.

Waller Bats For Cuts, Harping On ‘Weak Labor Markets’

Speaking in London, Waller identified the “weak labor market” as his primary focus, overriding concerns about inflation. “I am not worried about inflation accelerating or inflation expectations rising significantly,” Waller said in prepared remarks.

Despite a 43-day government shutdown delaying key economic reports, Waller insisted policymakers are not “flying blind”. He argued that a “wealth of private and some public-sector data” provides an “actionable picture” of the economy.

That picture, he said, shows a labor market that is “still weak and near stall speed”. Citing private-sector data, such as reports from payroll firm ADP and surveys showing that companies expect a poor job market for 2026 college graduates, Waller argued that the slowdown is a problem of falling demand, not a lack of supply.

“The overwhelming share of the data I have… supports the weaker demand story,” he said.

Waller Argues AI Stock Boom Is Not Creating Jobs

On the other side of the Fed’s mandate, Waller argued that underlying inflation, accounting for tariff effects, is “relatively close” to the 2% target. He noted that despite five years of above-target inflation, medium- and longer-term inflation expectations remain “well anchored”.

Waller also pointed to strains on U.S. consumers, particularly “middle- and lower-income consumers” facing record-low housing affordability and high auto purchasing costs.

He noted that while the stock market is “booming,” the AI-related businesses driving it account for less than 3% of employment, offering little support for most Americans.

Rate Cut Is Needed For ‘Risk Management’

He concluded that a 25-basis-point cut in December is a matter of “risk management”. “A December cut,” Waller said, “will provide additional insurance against an acceleration in the weakening of the labor market and move policy toward a more neutral setting”.

The CME Group's FedWatch tool’s projections show markets pricing a 46.6% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, closed lower on Monday. The SPY was down 0.93% at $665.67, while the QQQ declined 0.85% to $603.66, according to Benzinga Pro data.

The futures of the S&P 500, Nasdaq 100, and Dow Jones Indices were trading lower on Tuesday, after a sharp fall on Monday.

Read Next:

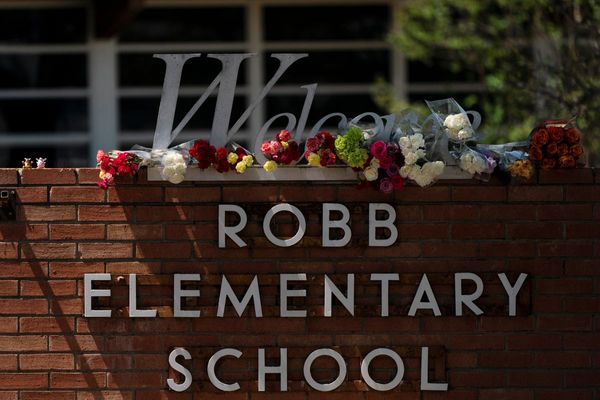

Photo courtesy: RozenskiP / Shutterstock.com