There is a common thread to much of what I see going on in the markets, has been going on in the markets for the past decade.

-

Inflation remains an issue for the US, due in part to trade policy, regardless of what USDA, and other government branches, try to tell us.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily. That being said, some key markets should still find longer-term investment interest.

It’s hard to believe we have reached the final Friday of September. This means a couple different things: First, the end of the financial quarter is fast approaching next Tuesday; and Second, during the quiet of the morning hours I can tackle some of the questions that have come in regarding my recent writings for Barchart. Before I dive deeper, let me say again I appreciate your questions, comments, and conversations. Granted there is a large part of the industry that disagrees with my opinions, but that’s fine. I will continue to take the advice found in the late Charlie Munger’s quote.

Let’s start with my piece from this past Tuesday, September 23, “Three Reasons US Cattle Markets are a Conundrum”. A question was asked about how to square what we see happening in cash cattle markets, live in particular, with what we are seeing in US boxed beef markets. The answer is actually simple, if we consider the background. Let’s start with cash prices, also known as the intrinsic value of the cattle markets. The last couple weeks have seen the average cash price in the south hold near $240, before slipping $2 to $3 so far this week. Still, this has the cash price at a solid $237 as compared to the nearby October futures contract (LEV25) priced at $232, putting national average basis at $5 over. The previous 5-year high weekly close for this week was $2.67 over from 2021. The bottom line is basis, the key fundamental read, is bullish. End of story.

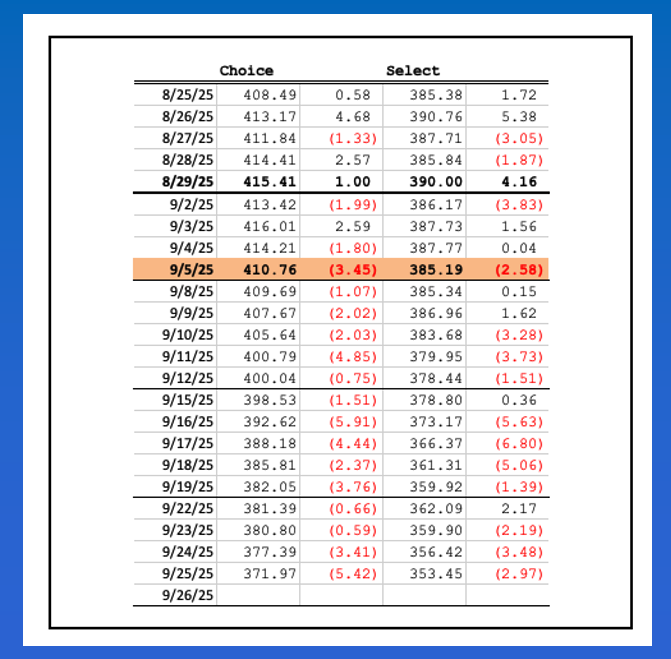

As for boxed beef, these prices have always come with an asterisk given they are “reported” by USDA. Now we have an Ag Secretary whose job requirement is to act as a cheerleader for the US president and make sure everything he says regarding agriculture is proven correct. Recall the president said, on September 8, he would lower beef prices. Since Friday, September 5 (highlighted in orange), the choice beef market has been reported lower every, single, day with select has been down all but four days. Choice is down nearly $40 with select off more than $30. It doesn’t take much of a political scientist/economist to see the “coincidence” in this, all while prices at the counter remain high.

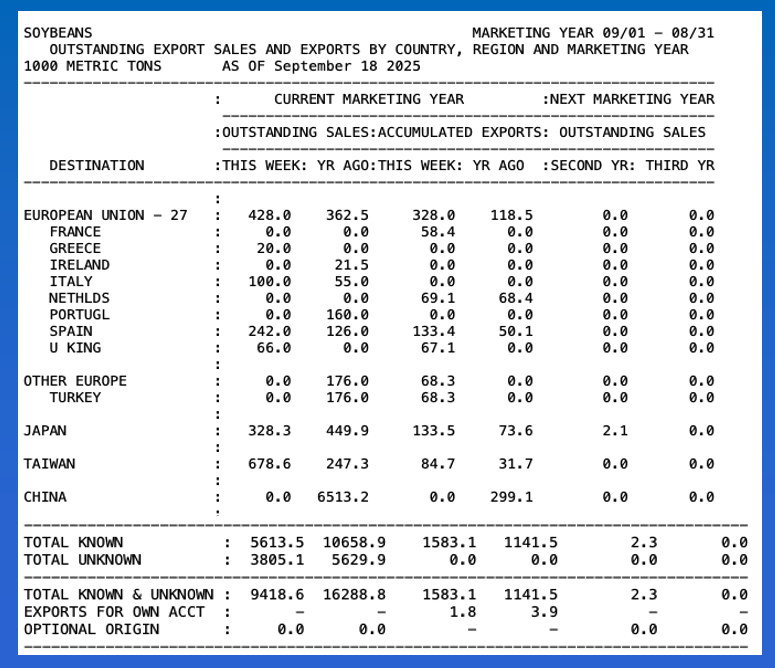

Next, let’s discuss my piece from September 16 that asked the question, “How has the US Soybean Industry Done with the Trade War?” I was asked if the recent goings on with Argentina, first lifting its export tax prompting China to buy 10 cargoes, then putting the tax back in place after the country’s export cap was hit within a couple days changed the situation for US soybeans ($CNSI). How can I put this politely. No, it does not. I find it interesting one doesn’t have to search too hard to find members of the BRACE Industry still writing about how “China Needs US Soybeans” and how “China will be forced to save the US soybean market”. I wish I was making this up, but alas, I am not. To those authors, I would suggest they put down the picture book titled “The Art of the Deal” and read Sun Tsu’s “The Art of War” instead. However, as Mr. Munger’s quote (see above) suggests, it is actually better for those of us who understand the real world if more people listen to the nonsense.

The latest weekly export sales and shipments update, for the week ending Thursday, September 18, showed China had no US soybeans on the books for 2025-2026, 2026-2027, or 2027-2028. At the same time, unknown destinations had 3.806 million metric tons for this marketing year, down 33% from the same week last year. Remember what we’ve been told, “Trade wars are good, and easy to win”.

The next question had to do with what I wrote on Sunday, September 14, ahead of the latest US Federal Open Market Committee Meeting. In the piece I talked about how a 25-basis point rate cut was likely, based on what the Fed fund futures forward curve was showing, but also to pacify a president known for wanting low to negative interest rates despite his trade policies stoking the fires of inflation. After the expected cut was announced on Wednesday, September 17, the US dollar index ($DXY) saw a knee-jerk reaction selloff down to 96.22 before actually closing higher that day. Since then, the greenback has extended its really to a Thursday high of 98.61.

Why? Much of the chatter from talking heads this week has been about recent comments from US Fed Chairman Powell “surprising” the market. Really? In his post-meeting statements, Mr. Powell clearly said inflation and US jobs were an ongoing concern, and that a cautious approach would be best. He said the same thing again this week, leaving me wondering who was actually “surprised”.

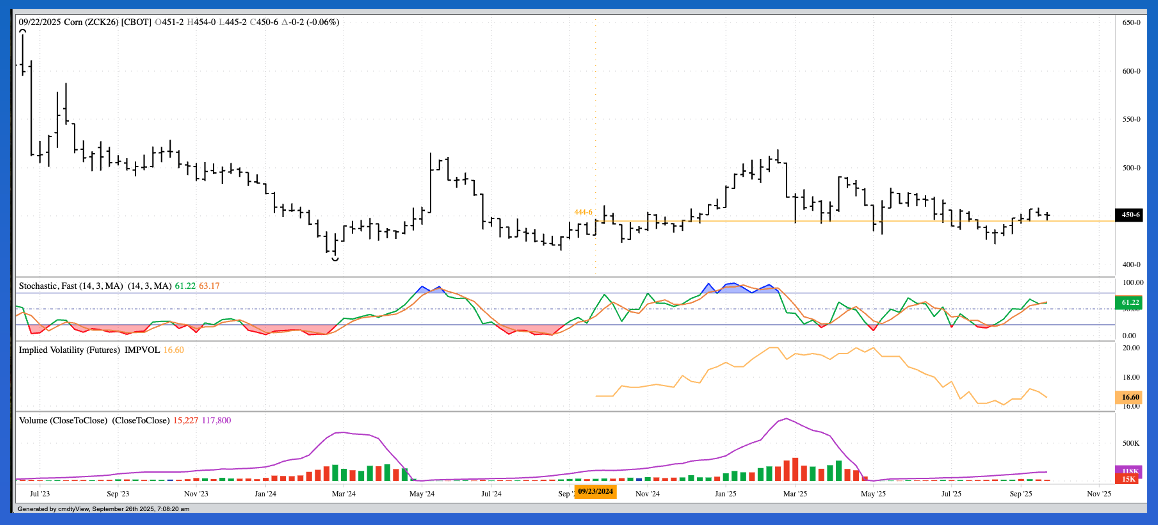

Last, but certainly not least, I had a question come in regarding my piece on the recent announcement by Tyson Foods (TSN) saying it would “stop using high fructose corn syrup and other ingredients in its branded products”. Recall my conclusion was this would not collapse demand for US corn, at least based on what we see in the deferred May-July futures spread. Given this spread continues to cover a bullish level of calculated full commercial carry, the May futures contract could attract longer-term buying interest from investment traders.

It’s interesting to note the May26 issue (ZCK26) is priced near $4.5075 early Friday morning when the May25 issue closed this same week last year at $4.4475. Additionally, the 2025 edition of the May-July futures spread settled this same week last year covering 26% calculated full commercial carry. On the noncommercial side, last year at this time Watson held a net-short futures position of 64,200 contracts with the most recent Commitments of Traders report showing a noncommercial net-short futures position of 36,200 contracts. In other words, based on the Horseshoe Proximity (close is close enough), the corn market is showing a similar structure to last year when funds eventually built a net-long futures position of 468,700 contracts as the May futures contract rallied to a high just short of $5.20. Is this guaranteed in 2026? No, Chaos Theory tells us there is no such thing as a guarantee or analogous years. But again, at this time, the market structure is similar. And that’s all I have to say about that.