Fannie Mae (FNMA) appointed Peter Akwaboah as acting CEO while the board searches for a permanent replacement. The mortgage giant also promoted John Roscoe and Brandon Hamara to co-presidents, signaling a leadership overhaul pushed by its regulator, the Federal Housing Finance Agency.

Akwaboah will continue to oversee operations while working alongside the newly appointed co-presidents. The leadership transition adds near-term uncertainty around the company’s strategic direction.

Until Fannie Mae exits conservatorship and returns to normal operations with a permanent CEO in place, investors should approach FNMA stock cautiously despite the experienced talent now leading the organization.

Is FNMA Stock a Good Buy Right Now?

In Q2 of 2025, Fannie Mae reported net income of $3.3 billion, a 26% year-over-year (YoY) decline. The drawdown was tied to higher provision for credit losses as the mortgage giant built its allowance to address emerging pressures in both single-family and multifamily portfolios.

Despite the earnings dip, Fannie Mae showed progress on efficiency and capital building that could support its eventual exit from government conservatorship. The mortgage financier provided $102 billion of liquidity to the market during the quarter, helping 381,000 households, including 183,000 homebuyers.

More than half of these buyers were first-time purchasers navigating what management described as a sluggish spring home-buying season. Net revenues held steady at $7.2 billion, while the company cut noninterest expenses by over $250 million from the first quarter, bringing its efficiency ratio to 31.5%.

Fannie Mae crossed a key milestone by surpassing $100 billion in total equity, ending the quarter at $101.6 billion. FNMA added $3.7 billion in regulatory capital during the period, though it still faces a $29 billion total capital deficit, as its senior preferred stock held by the Treasury does not count toward regulatory requirements. Management reported a 9.5% return on required common equity in the quarter.

Notably, single-family loans 30 days past due ticked up 10 basis points from the first quarter, though management attributed part of the increase to seasonal patterns. Seriously delinquent rates remained elevated compared to a year earlier, up nine basis points on a total book basis.

The company observed regional home price softness, including outright declines in some metropolitan areas, which led to lower home price-growth assumptions in its credit models. The multifamily business faced headwinds as well, with property value deterioration leading to increased allowance building. Net charge-offs in multifamily jumped four basis points from the previous quarter, though the portfolio's smaller size means just a handful of loan losses can move these metrics significantly.

Is FNMA Stock Undervalued?

Analysts tracking Fannie Mae stock forecast revenue to fall marginally from $30 billion in 2025 to $29.6 billion in 2027. In this period, adjusted earnings are forecast to expand from $2.55 per share to $3 per share. If FNMA stock is priced at eight times forward earnings, it should trade at $24 in early 2027, indicating an upside potential of 110% from current levels.

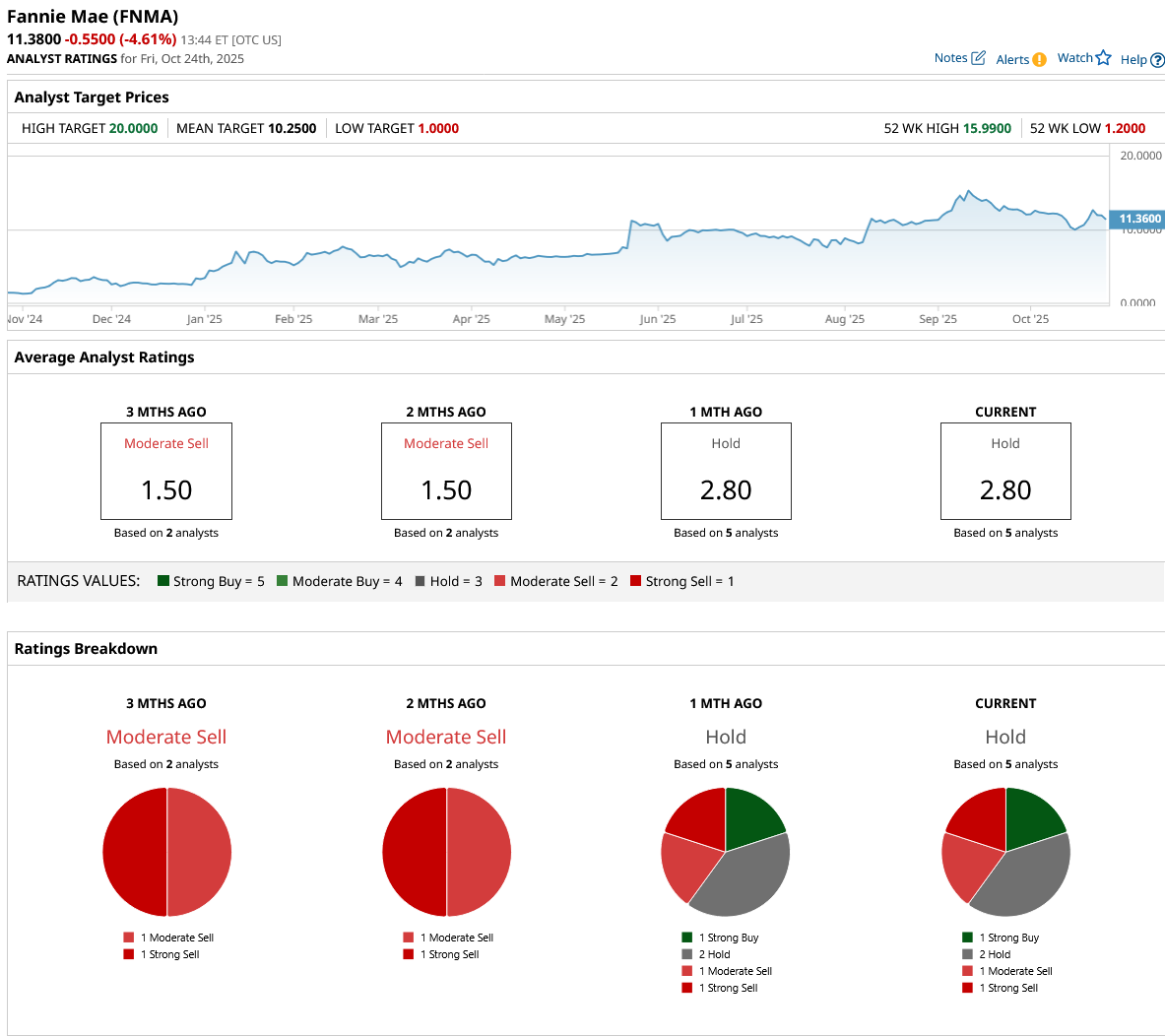

Out of five analysts tracking FNMA stock, one recommends “Strong Buy,” two recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average FNMA stock price target is $10.25, below the current trading price of $11.38.