Famed short-seller Jim Chanos has publicly questioned the quality of Oracle Corp.'s (NYSE:ORCL) massive new backlog, arguing a cornerstone $300 billion deal with OpenAI is risky, years away from starting, and reminiscent of the company’s past accounting controversies.

Check out ORCL's stock price here.

Jim Chanos Questions ORCL’s Accounting Principles

The critique, delivered in a series of posts on X, aims to deflate the investor euphoria that sent Oracle's stock soaring this week.

To build his case for caution, Chanos revived past scrutiny of Oracle's business practices. “Well, it's not like $ORCL has been credibly accused of accounting ‘issues' recently,” he wrote sarcastically, alluding to a 2016 whistleblower lawsuit.

That suit raised questions over the company’s cloud accounting and alleged that Oracle used aggressive audit tactics to pressure customers into buying cloud products.

Oracle did not immediately respond to Benzinga’s request for comment.

Is The ORCL’s Backlog Overstated?

Chanos further zeroed in on the five-year, $300 billion OpenAI contract, which accounts for a substantial portion of Oracle's newly announced future revenue. He emphasized the significant delay and risk involved, stating, “Even better, this $300B deal doesn't even begin until…2027!”

He portrayed the agreement as a gamble, questioning how OpenAI, a startup with roughly $10 billion in annual revenue, could commit to a contract averaging $60 billion per year.

The short-seller’s skepticism comes as Oracle’s stock enjoys a monumental rally, despite narrowly missing first-quarter revenue and earnings estimates.

The market's excitement was driven entirely by a 359% explosion in Oracle's Remaining Performance Obligations (RPO), or future contracted revenue, which ballooned to an immense $455 billion.

Price Action

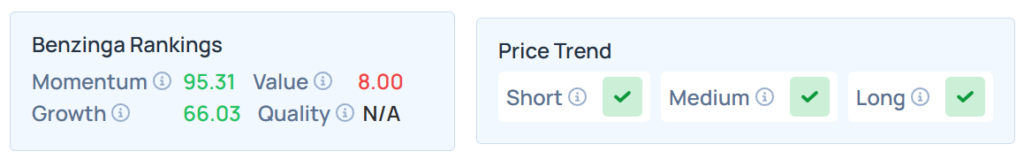

Benzinga's Edge Stock Rankings indicate that ORCL maintains a stronger price trend in the short, medium, and long terms. However, the stock's growth ranking was relatively moderate at the 66.03th percentile. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 and Nasdaq 100 indices, respectively, were higher in premarket on Thursday. The SPY was up 0.21% at $653.57, and the QQQ advanced 0.28% to $582.33, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Jonathan Weiss / Shutterstock