/Fair%20Isaac%20Corp_%20FICO%20picture-by%20Hairullah%20Bin%20Ponichan%20via%20Shutterstock.jpg)

With a market cap of $37.6 billion, Fair Isaac Corporation (FICO) is a global leader in analytics and digital decisioning technologies that help businesses automate, enhance, and connect their decision-making processes. Through its Scores and Software segments, FICO empowers organizations across industries to improve customer engagement, manage risk, prevent fraud, and drive profitable growth.

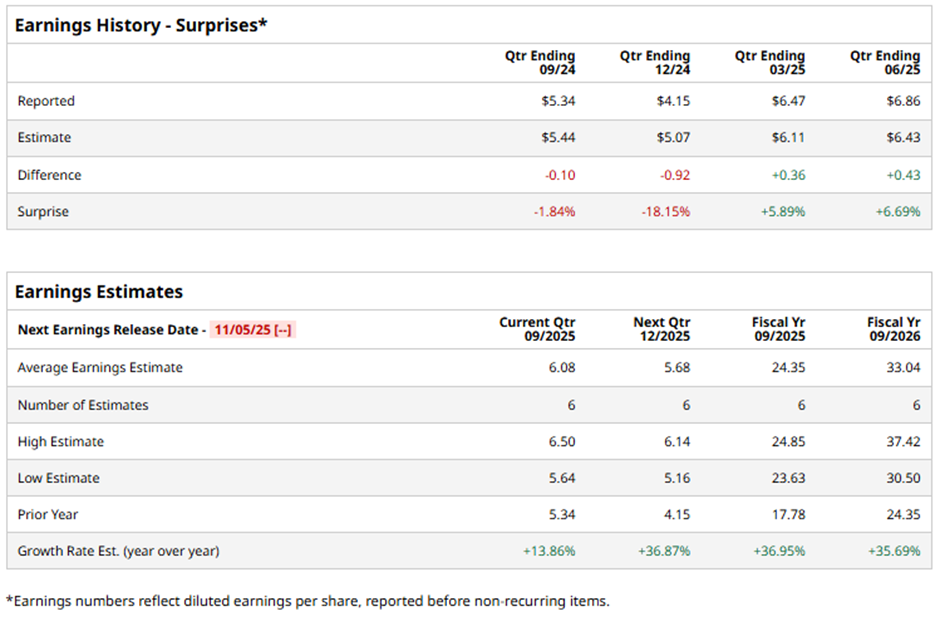

The Bozeman, Montana-based company is slated to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect FICO to report an EPS of $6.08, a 13.9% increase from $5.34 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the credit scoring giant to report EPS of $24.35, marking a growth of nearly 37% from $17.78 in fiscal 2024.

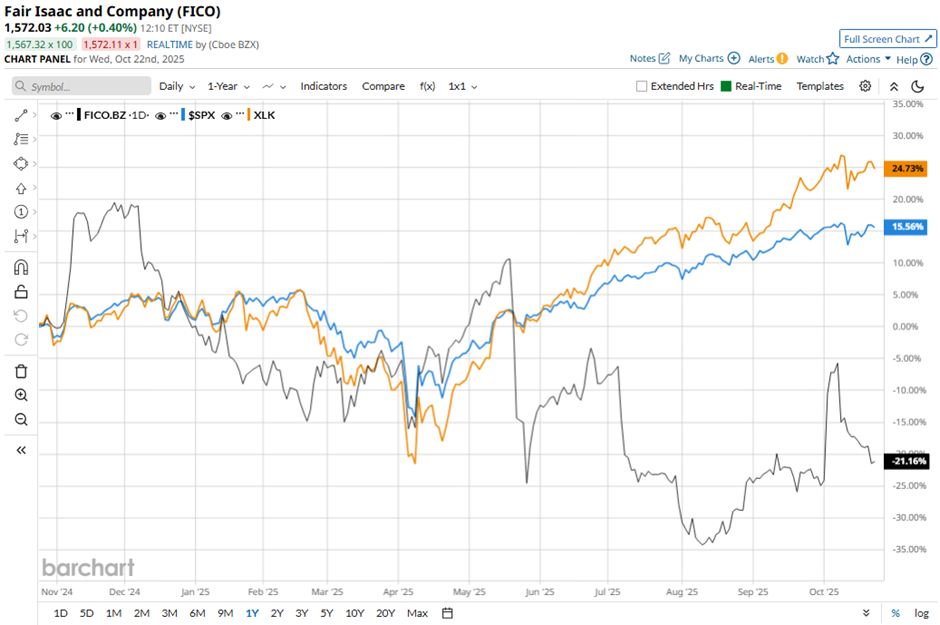

Shares of Fair Isaac have decreased 22.4% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 14.6% return and the Technology Select Sector SPDR Fund's (XLK) 22.9% rise over the same period.

Despite reporting stronger-than-expected Q3 2025 adjusted EPS of $8.57 and revenue of $536.4 million on Jul. 30, shares of FICO fell nearly 6% the next day. The Federal Housing Finance Agency’s recent decision to allow VantageScore for mortgages sold to Fannie Mae and Freddie Mac introduces direct competition to FICO’s dominant mortgage scoring business. Additionally, investor sentiment weakened as FHFA Director Bill Pulte criticized FICO’s pricing practices.

Analysts' consensus view on FICO stock remains cautiously optimistic, with an overall "Moderate Buy" rating. Out of 18 analysts covering the stock, 10 recommend a "Strong Buy," three "Moderate Buys," four "Holds," and one "Strong Sell." The average analyst price target for Fair Isaac is $2,005.75, indicating a potential upside of 27.6% from the current levels.