/Factset%20Research%20Systems%20Inc_%20logo%20on%20keyboard-by%20rafapress%20via%20Shutterstock.jpg)

Norwalk, Connecticut-based FactSet Research Systems Inc. (FDS) is a financial data provider. It provides integrated financial information and analytical applications to the investment community. With a market cap of $10.9 billion, FactSet operations span the Americas, Europe, the Middle East, Africa, and the Indo-Pacific.

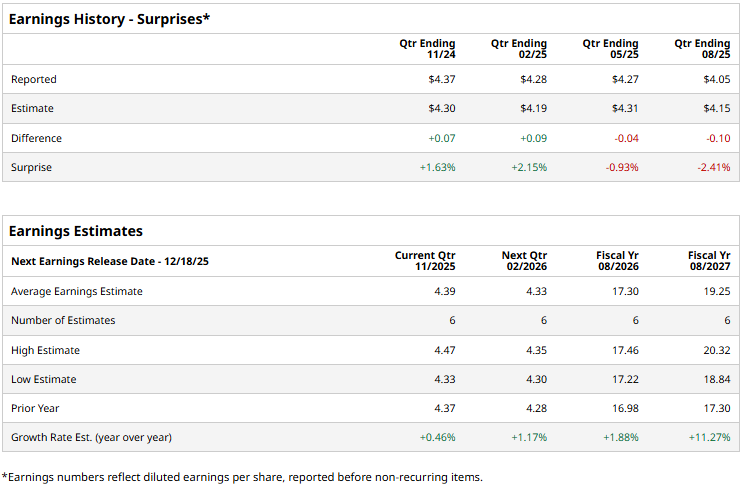

The financial data provider is expected to announce its Q1 results by mid-December. Ahead of the event, analysts expect FactSet to deliver an adjusted profit of $4.39 per share, marginally up from $4.37 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates twice over the past four quarters, it missed the projections on two other occasions.

For the full fiscal 2026, FDS is expected to deliver an adjusted EPS of $17.30, up 1.9% from $16.98 reported in 2025. While in fiscal 2027, its earnings are expected to surge 11.3% year-over-year to $19.25 per share.

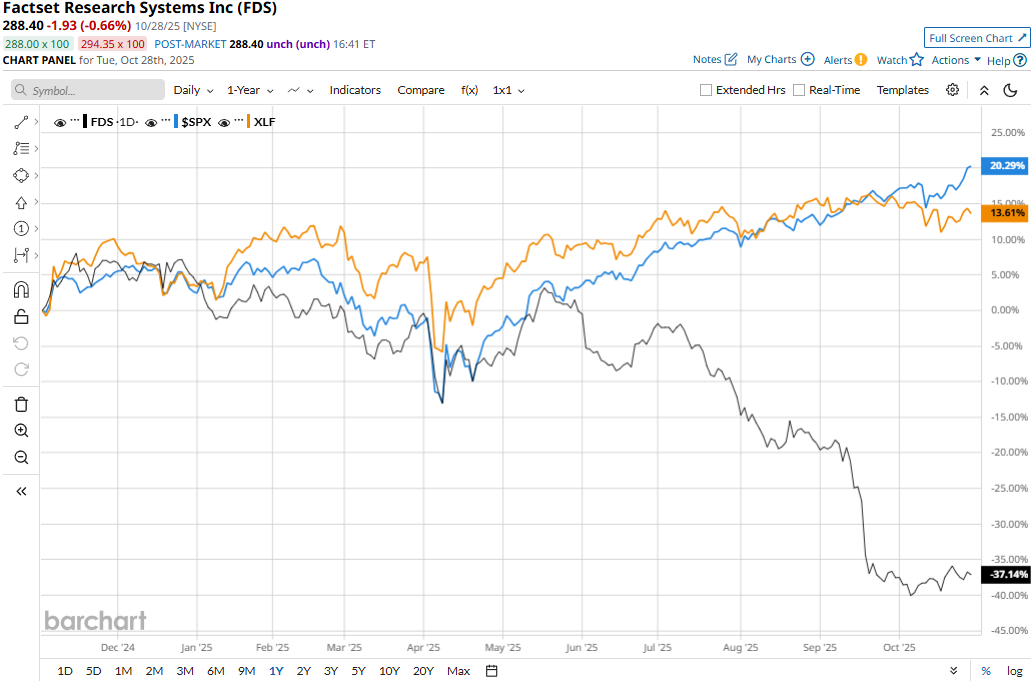

FDS stock prices have tanked 37.2% over the past 52 weeks, notably underperforming the Financial Select Sector SPDR Fund’s (XLF) 12.2% gains and the S&P 500 Index’s ($SPX) 18.3% returns during the same time frame.

FactSet Research’s stock prices plunged 10.4% in a single trading session following the release of its Q4 results on Sept. 18. At the end of August, the company’s annual subscription value (ASV) stood at $2.4 billion, up a notable 6.7% year-over-year. Meanwhile, its revenues for the quarter increased 6.2% year-over-year to $596.9 million, beating the consensus estimates by 72 bps.

However, the company’s operating margins got squeezed during the quarter, observing a 200 bps contraction year-over-year, coming in at 33.8%. While its adjusted EPS grew 8.3% year-over-year to $4.05, it fell 2.4% below the Street’s expectations. Moreover, the company’s 2026 adjusted EPS guidance of $16.90 to $17.60 fell significantly below the analyst’s projections, dampening investor confidence.

Analysts remain cautious about the stock’s prospects. FDS has a consensus “Hold” rating overall. Of the 19 analysts covering the stock, opinions include two “Strong Buys,” 10 “Holds,” and seven “Strong Sells.” Its mean price target of $335.07 suggests a 16.2% upside potential from current price levels.