Meta Platforms Inc. (NASDAQ:META) has begun distributing payments from its $725 million privacy settlement, with newly filed court documents revealing that eligible Facebook users will pocket between $4.89 and $38.36, depending on how long they maintained an account during the settlement period.

Smallest And Largest Payments Confirmed

According to documents filed in a California court, the minimum payout is $4.89, the maximum is $38.36, and the average check will be $29.43, reported The Hill.

Payments are being processed by Angeion, the court-appointed administrator, and will continue over a 10-week distribution period.

The amounts are tied to a point system: users earn one point for each month they had an active Facebook account between May 2007 and December 2022.

The more points accrued, the higher the payout. A claimant with the maximum 188 points will receive the top-end $38.36 payment.

Attorneys said roughly 28 million valid claims were filed, which they believe to be the largest number ever submitted in a U.S. class action lawsuit.

The Case: Cambridge Analytica Fallout

The settlement stems from accusations that Facebook violated user privacy by sharing data with third parties, most notably Cambridge Analytica, a consulting firm that worked on Donald Trump's 2016 presidential campaign.

The company allegedly harvested the data of as many as 87 million users without consent.

While Meta agreed to the $725 million payout, it continues to deny wrongdoing. The court noted that amounts smaller than $4.89 risked going unredeemed, making that the baseline figure.

What Has Been The Financial Context

Despite ongoing regulatory scrutiny, Meta continues to post strong financial results.

The company reported second-quarter revenue of $47.52 billion in July, topping Wall Street estimates of $44.58 billion. It expects third-quarter revenue between $47.5 billion and $50.5 billion.

Meta also forecast full-year 2025 expenses of $114 billion to $118 billion, with capital expenditures between $66 billion and $72 billion, underscoring its continued heavy investment in infrastructure and artificial intelligence.

Price Action: Meta shares slipped 0.14% on Thursday and are down 4.95% over the past month, according to Benzinga Pro.

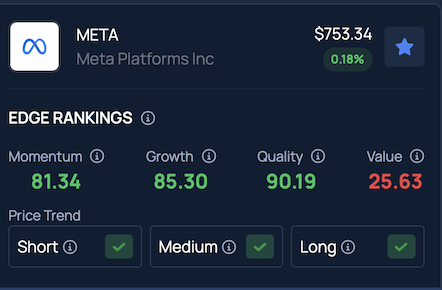

Benzinga's Edge Stock Rankings show that despite recent declines, META continues to demonstrate a strong trajectory across short, medium and long-term horizons. More detailed performance insights are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Skorzewiak on Shutterstock.com