/F5%20Inc%20HQ%20logo-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Valued at a market cap of $16.9 billion, F5, Inc. (FFIV) is a global provider of multicloud application security and delivery solutions. Headquartered in Seattle, Washington, the company offers products and services that optimize, secure, and manage applications across on-premises and cloud environments. FFIV is slated to announce its fiscal Q3 2025 earnings results after the market closes on Wednesday, Jul. 30.

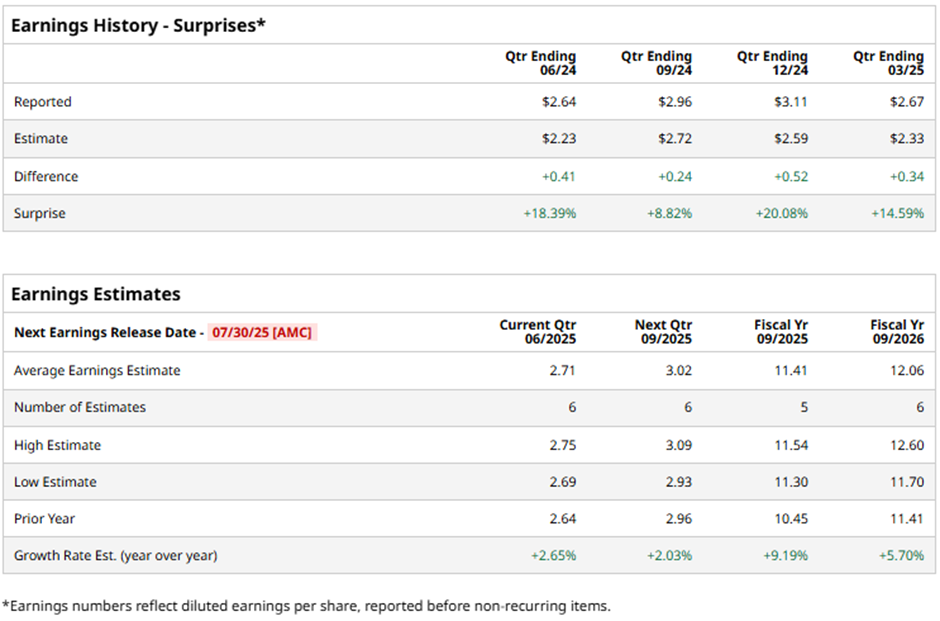

Ahead of this event, analysts expect the computer networking company to report an EPS of $2.71, a 2.7% growth from $2.64 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in the past four quarters. In Q2 2025, FFIV beat the consensus EPS estimate by 14.6%.

For fiscal 2025, analysts expect F5 to report EPS of $11.41, marking an increase of 9.2% from $10.45 in fiscal 2024.

Shares of F5 have surged 66.7% over the past 52 weeks, significantly outpacing the broader S&P 500 Index's ($SPX) 11.6% return and the Technology Select Sector SPDR Fund's (XLK) 9.3% rise over the same period.

On Apr. 28, F5 reported its fiscal Q2 2025 results, delivering adjusted EPS of $3.42, which exceeded both consensus estimates and the company's guidance midpoint of $3.08. Revenue came in at $731.1 million, reflecting a 7.3% year-over-year increase and surpassing market expectations. In light of its strong performance, F5 raised its full-year outlook, forecasting revenue growth between 6.5% and 7.5% and adjusted EPS growth of 8% to 10%. However, FFIV shares declined slightly the following day.

Analysts' consensus view on FFIV stock remains cautious, with a "Hold" rating overall. Out of 12 analysts covering the stock, one recommends a "Strong Buy," one "Moderate Buy," nine "Holds," and one has a "Moderate Sell." As of writing, the stock is trading above the average analyst price target of $292.80.